EUR/USD

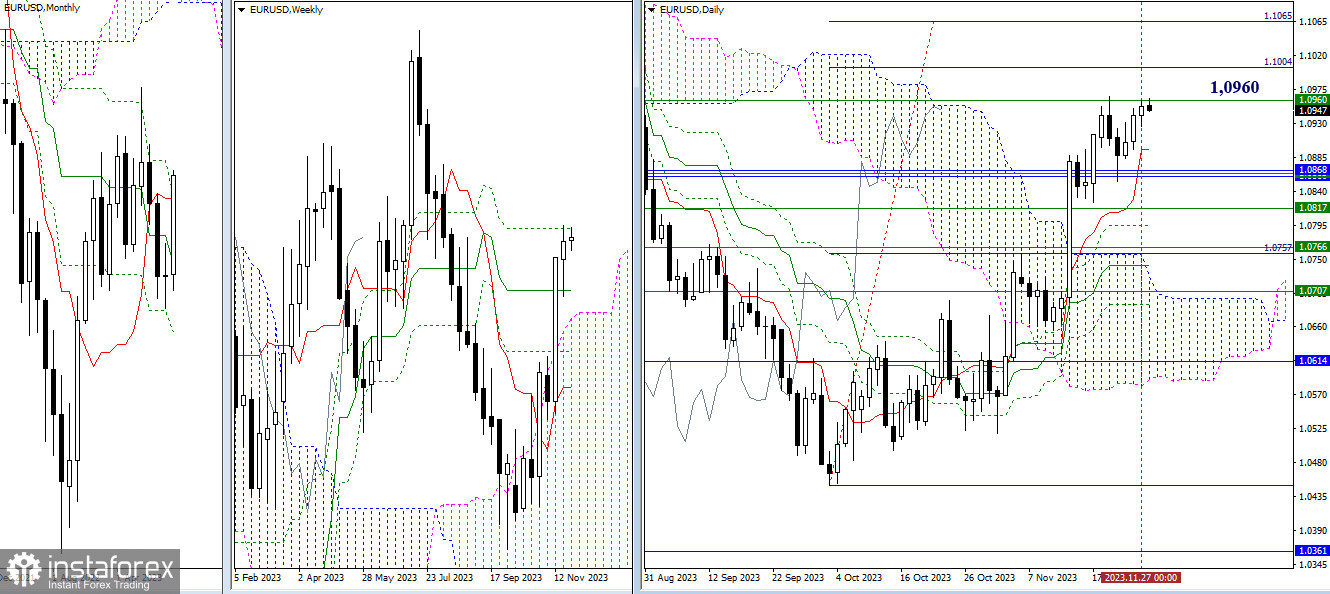

Higher Timeframes

Interaction with the final level of the weekly death cross (1.0960) continues. The outcome of this interaction will determine the possibilities for further development. The location and significance of the key reference points over the past day have not changed. For bullish players, the daily target is the breakout of the Ichimoku cloud (1.1004 – 1.1065), while for the bearish players, the most crucial value is the cluster of monthly and weekly levels in the range of 1.0862–68, with additional support possibly provided by the daily short-term trend (1.0896).

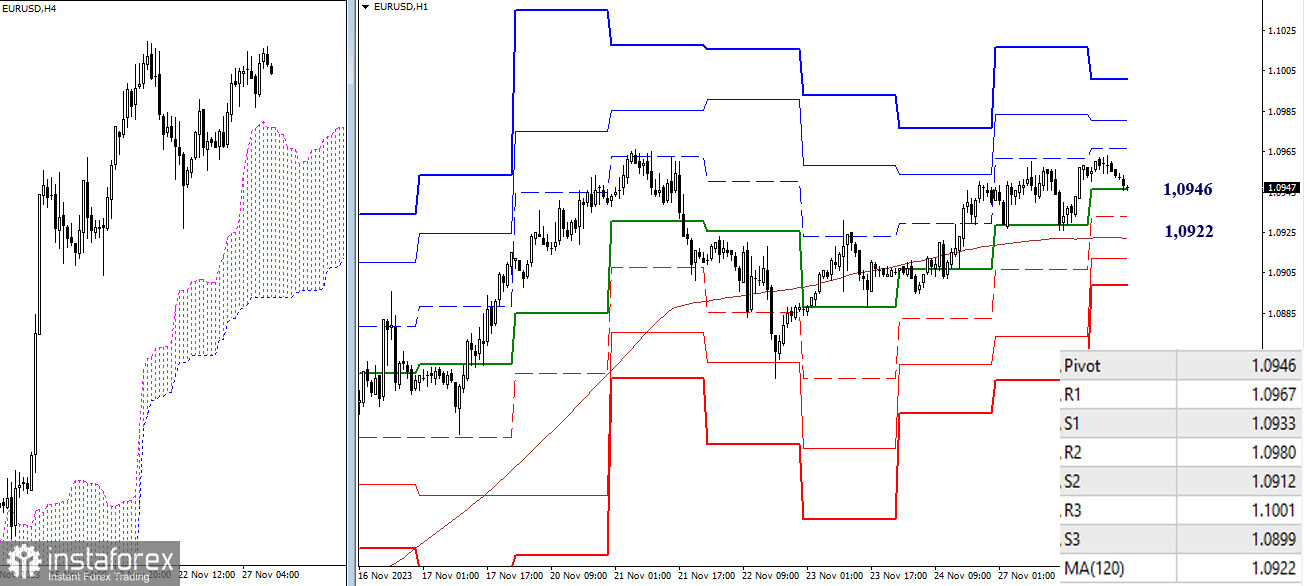

H4 – H1

On lower timeframes, the main advantage belongs to bullish players. However, it should be noted that they have currently paused, and the opponent is developing a corrective decline. Reference points for intraday correction today are located at 1.0946 (central pivot point) and 1.0922 (weekly long-term trend). Consolidation below and a reversal of the movement will change the current balance of power. Other classic pivot points today are situated at 1.0933 – 1.0912 – 1.0899 (supports) and 1.0967 – 1.0980 – 1.1001 (resistances).

***

GBP/USD

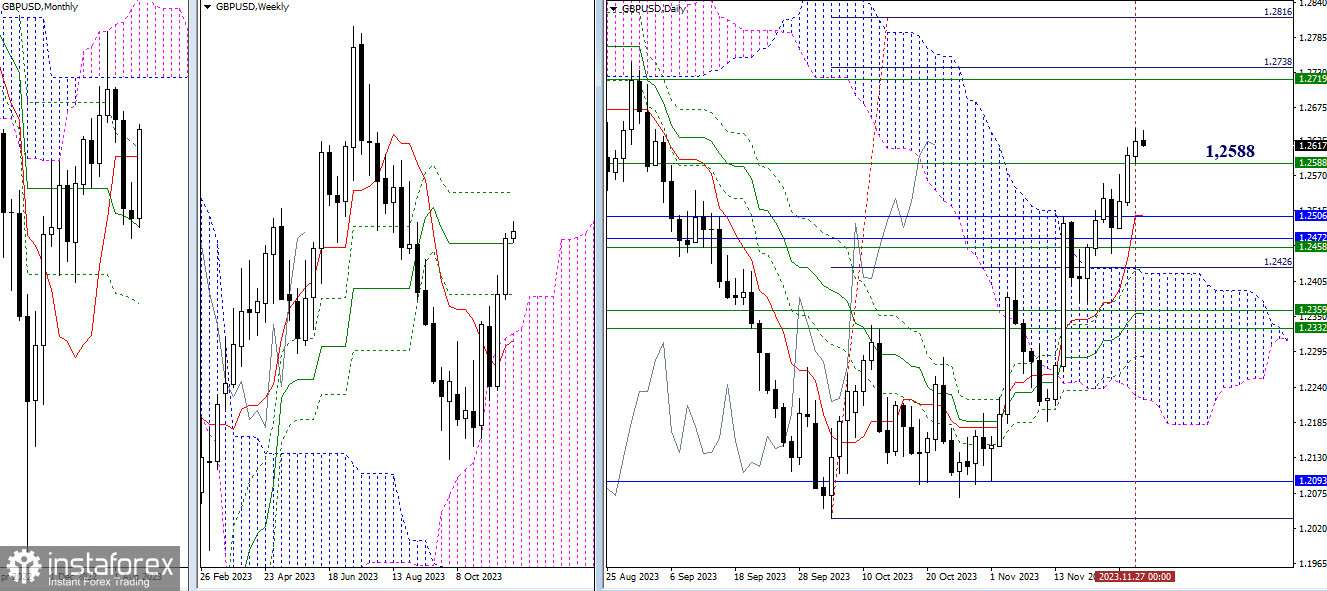

Higher Timeframes

Yesterday's rise was not particularly effective, but bullish players maintained the advantage and updated the daily high. Further recovery of bullish positions could lead to resistance at the final level of the death cross of the weekly Ichimoku cloud (1.2719) and the daily target for breaking through the cloud (1.2738 – 1.2816). Failure and a decline below the weekly medium-term trend (1.2588) would shift the focus to a broad support zone, combining levels of various timeframes, where the first supports today are the daily short-term trend (1.2508) and the monthly Fibonacci Kijun (1.2506).

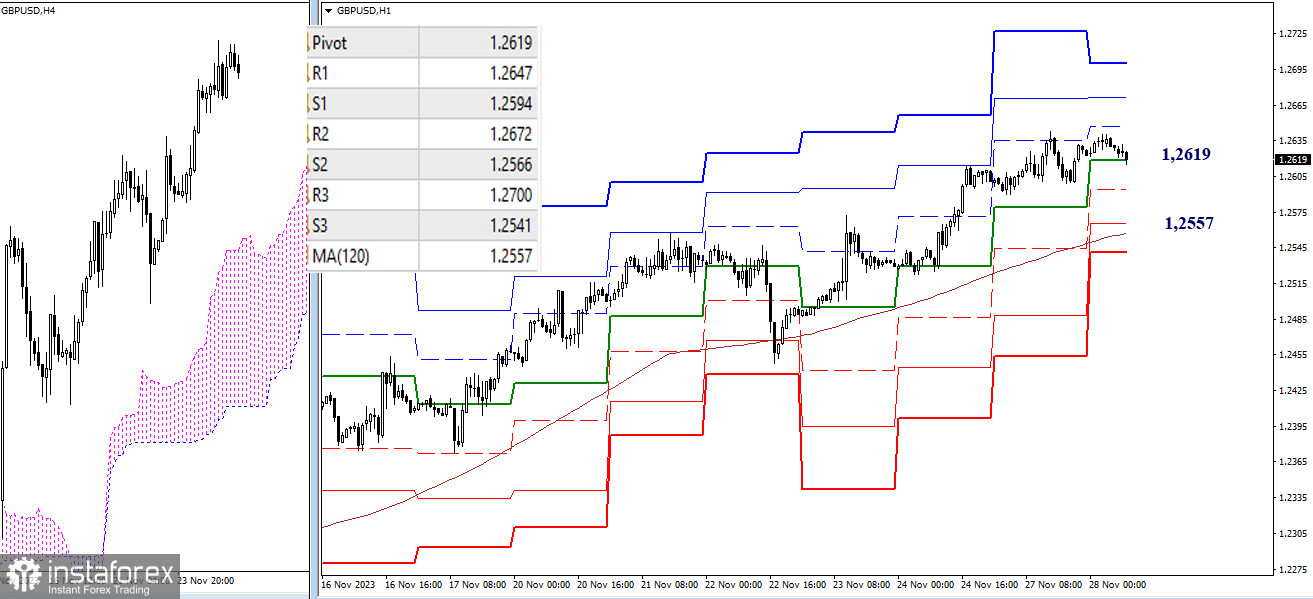

H4 – H1

Currently, the pair is in a correction zone. After breaking the central pivot point (1.2619), the decline may develop through supports S1 (1.2594) and S2 (1.2566), but the most crucial value will be the breakout and reversal of the weekly long-term trend (1.2557). This level is responsible for changing the current balance of power. If the decline concludes and bullish players continue the rise, then intraday market interests will focus on the resistances of classic pivot points (1.2647 – 1.2672 – 1.2700).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)