The EUR/USD currency pair continued its upward movement on Tuesday, as seen in the illustration. The ascent has been ongoing for several weeks. It is worth recalling that we expected the completion of the upward correction (and the current upward movement should be classified as a correction) around the time of the release of the US inflation report. Also, it is noteworthy that inflation in the US was not resonant and, for the most part, should not have triggered such a sharp decline in the American currency. However, the market has its logic, and since November 1, it has been consistently selling the dollar.

If there were specific reasons and grounds for the almost daily decline in the American currency, there would be no questions about the current movement. However, the current situation is as follows. Occasionally, not very positive news comes from America, mostly related to macroeconomic statistics. But they come only from time to time, not every day. Yet the dollar is falling practically every day. Therefore, we consider the current rise of the pair to be illogical and unjustified.

Nevertheless, the rise continues, and there's nothing to be done about it. We remind you that the market is not only comprised of traders aiming to profit but also large market makers who conduct currency transactions for their business purposes. In other words, if a large bank or corporation urgently needs billions of euros, they enter the market and buy them. They do not consider fundamental or macroeconomic background; they do not follow the principle of "buy cheap, sell high." They simply execute the transaction they need.

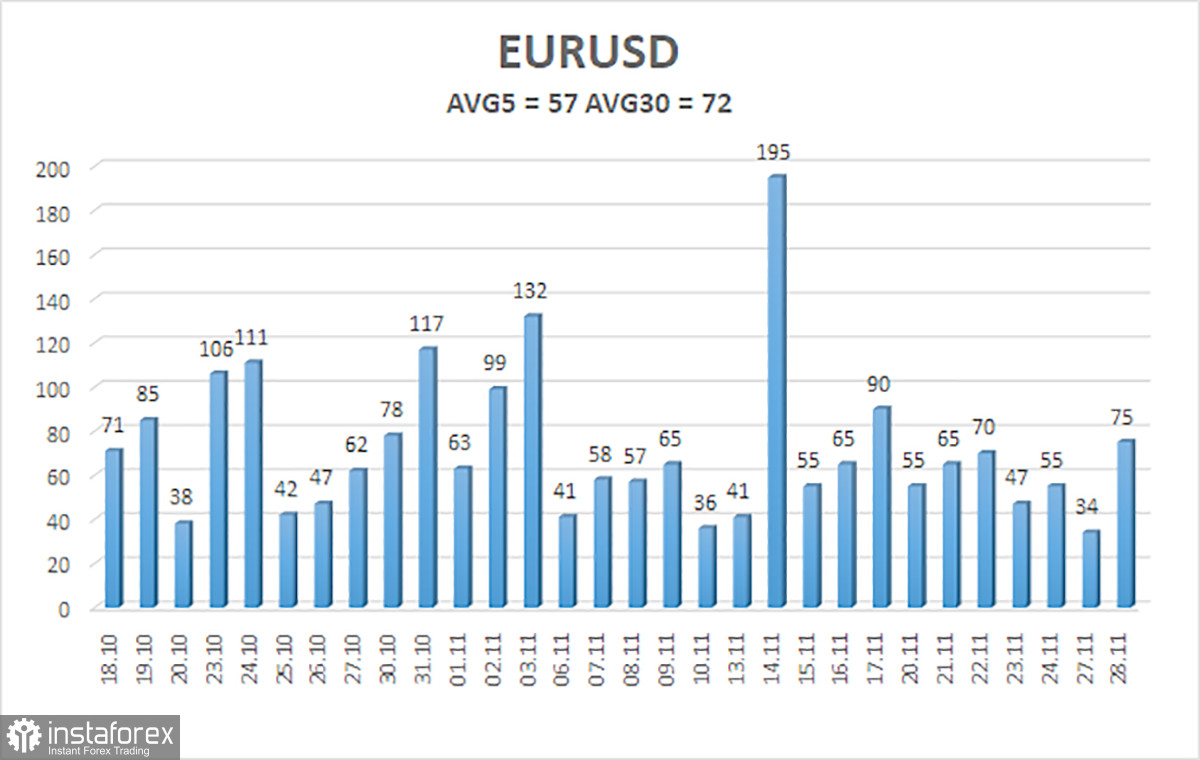

As ordinary traders, we observe during such periods illogical movements when there seems to be no reason for the pair to rise, but it still does. Meanwhile, volatility continues to decrease and is now only 57 points.

The ECB again speaks about the incompleteness of the tightening cycle.

On Tuesday, the head of the Bundesbank, Joachim Nagel, informed the market that the European regulator has not yet "closed the door" on the issue of tightening monetary policy. He noted that the decisions of the regulator, as before, will depend on economic data, particularly inflation. If the consumer price index starts accelerating again, it will mean that the regulator may resort to another rate hike. Nagel explained that the ECB fears making a mistake towards too-weak tightening, which will keep inflation above the target for many years. He also noted that the prospects for inflation have improved recently, but it is still too early to speak of a complete victory over high inflation rates.

Thus, the only assumption that can be made now is that purchases of the European currency are associated with the strengthening of the hawkish position of the ECB. However, we want to remind you that the thesis "In case of need, the rate will be raised" has been known for a long time.

Representatives of the ECB, like representatives of the Fed, occasionally voice this phrase, fearing a new acceleration of inflation. It turns out that in both cases, the regulator is ready to intervene if the consumer price index starts moving not towards 2% but away from 2%. Therefore, from our point of view, the euro has no advantage over the dollar.

Also, let's recall that the CCI indicator entered the overbought zone three times. If each entry into such a zone ended with a significant correction, there would be no questions again. However, after the last and most powerful visit to the extreme zone, the price did not show any correction at all. For us, there is too much illogicality and strangeness in the current upward movement. Nevertheless, the price continues to stay above the moving average line, so we do not recommend selling the pair.

The average volatility of the euro/dollar currency pair for the last 5 trading days as of November 29 is 57 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0945 and 1.1059 on Wednesday. A reversal of the Heiken Ashi indicator downward will indicate a possible downturn in the corrective movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues its new upward movement and is above the moving average. At this time, it is advisable to consider buying, but we still believe that the current rise is illogical and may end in a collapse of the pair. Based on "naked" technical analysis, it is reasonable to remain in long positions with targets at 1.1059 and 1.1108 until the price consolidates below the moving average. Selling the euro will become relevant after the price consolidates below the moving average with a target of 1.0864.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an approaching trend reversal in the opposite direction.