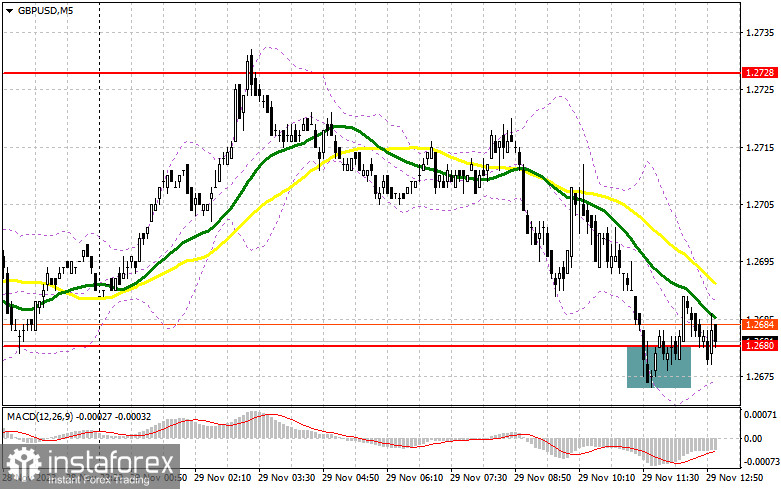

In my morning forecast, I drew attention to the level of 1.2680 and recommended making decisions on market entry based on it. Let's take a look at the 5-minute chart and analyze what happened there. The drop and the development of a false breakout near 1.2680 indicated a buying opportunity for the pound; however, as evident from the chart, there was no noteworthy engagement from buyers. For this reason, I decided to exit the market and wait for new, clearer signals. The technical picture was not revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

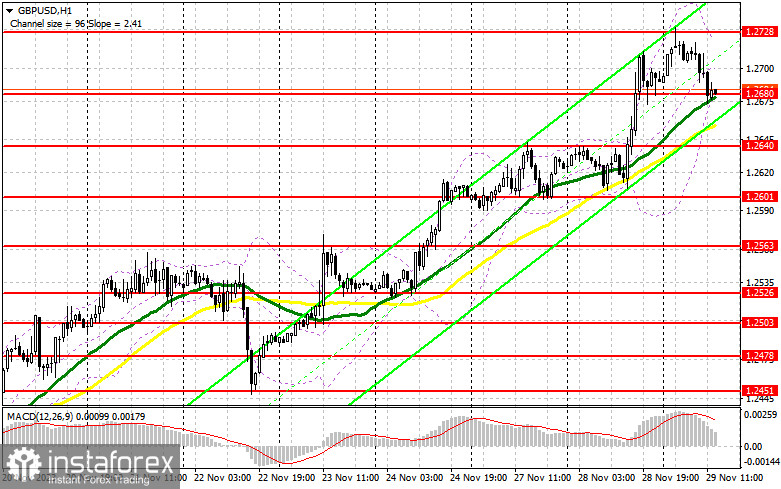

It's hard to say whether buyers will show themselves around 1.2680 in the second half of the day or not. Everything will depend on the data on changes in the US GDP for the third quarter of this year, as well as the balance of trade in goods. An upward revision of GDP will undoubtedly lead to a larger downward correction of the pound, so I'll take advantage of this moment and consider purchases around the support of 1.2640. The formation of a false breakout there will provide an excellent entry point for long positions to develop an upward trend and return to the resistance of 1.2680, around which trading is currently taking place. A breakout and consolidation above this range will lead to a new signal to open long positions with an exit to 1.2728. The ultimate target will be the area of 1.2761, where I will make profits. In the scenario of a pair's decline and the absence of buyer activity at 1.2680 and 1.2640 in the second half of the day, pressure on the pair will undoubtedly increase, leading to a larger downward correction. In this case, only a false breakout around the support of 1.2601 will signal the opening of long positions. I plan to buy GBP/USD immediately on a rebound only from 1.2563, with a target of a 30-35 point upward correction within the day.

To open short positions on GBP/USD, the following is required:

It can be said that sellers have started to act in the market, but buyers can return at any moment—especially after statements made today by FOMC member Loretta Mester, who may support her colleagues and also take a softer stance on interest rates. In the event of a pair's upward movement, the formation of a false breakout at 1.2728 will be a suitable signal for increasing short positions, quickly bringing the pair back to 1.2680. Only a breakout and a bottom-up retest of this range will deal a more serious blow to buyer positions, leading to the removal of stop orders and opening the way to 1.2640. The more distant target will be the area of 1.2601, where I will take profits. In the case of GBP/USD growth and the absence of activity at the monthly maximum of 1.2728 in the second half of the day, bears will once again lose control of the market, leading to the continuation of the upward trend. In this case, I will postpone sales until a false breakout at the level of 1.2761. In the absence of a downward trend, I will promptly sell GBP/USD upon a rebound from 1.2797, with the expectation of a pair correction downward by 30-35 points within the day.

Indicator Signals:

Moving Averages

Trading is slightly above the 30 and 50-day moving averages, indicating further pair growth.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator around 1.2680 will act as support.

Indicator Descriptions:

- Moving Average (smoothes volatility and noise, determines the current trend). Period 50. Marked in yellow on the chart.

- Moving Average (smoothes volatility and noise, determines the current trend). Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

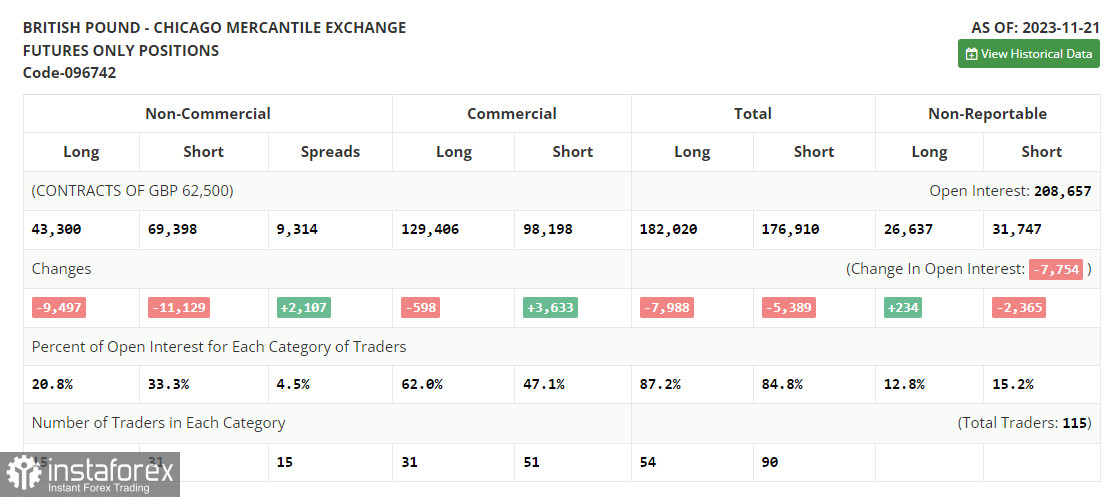

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open positions of non-commercial traders.

- Non-commercial short positions represent the total number of short open positions held by non-commercial traders.

- The total non-commercial net position is the difference between non-commercial long and short positions.