The Euro-Dollar pair has come under pressure following the release of data on rising inflation in Germany and the Eurozone. After initially marking at 1.1020, the pair made a 180-degree turn and plummeted to the area around 1.09. This sharp reversal is due to the contradictory fundamental background for EUR/USD. Both the dollar and the euro have alternately come under pressure: the greenback fell victim to the Federal Reserve's dovish stance, while the single European currency was knocked down due to a sharp slowdown in inflation in the European region.

Considering the chronological sequence of these events, the current decline in the EUR/USD price should not come as a surprise. Yesterday, on the back of the weakening dollar, the pair updated a nearly 4-month high. Today, as the euro weakens, the bears of the pair are reclaiming lost points. However, this price movement does not indicate a trend reversal. At least, such conclusions seem premature at this stage. The euro has lost an important fundamental trump card, but the pair can still resume its upward trend due to the weak position of the American currency. In this context, subsequent comments from Federal Reserve representatives will play a key role as they assess the prospects of easing monetary policy, taking into account (among other factors) the dynamics of the core PCE index, which we will discuss shortly. Therefore, it is premature to rush into selling EUR/USD, despite the powerful blow to the euro's positions.

The pair turned south yesterday when German inflation data for November was published. According to preliminary estimates, Germany's overall consumer price index in monthly terms decreased to -0.4% (the first negative value since December 2022). Year-on-year, the index fell to 3.2% (with a downward trend for the fifth consecutive month). The harmonized index of consumer prices also fell below forecasts, reaching 2.3% year-on-year (with a forecasted decline to 2.7%). The German labor market similarly did not favor the euro. It was revealed that the unemployment rate in November rose to 5.9% (the worst result since June 2021), with the number of unemployed increasing by 22,000 (against a forecasted increase of 19,000).

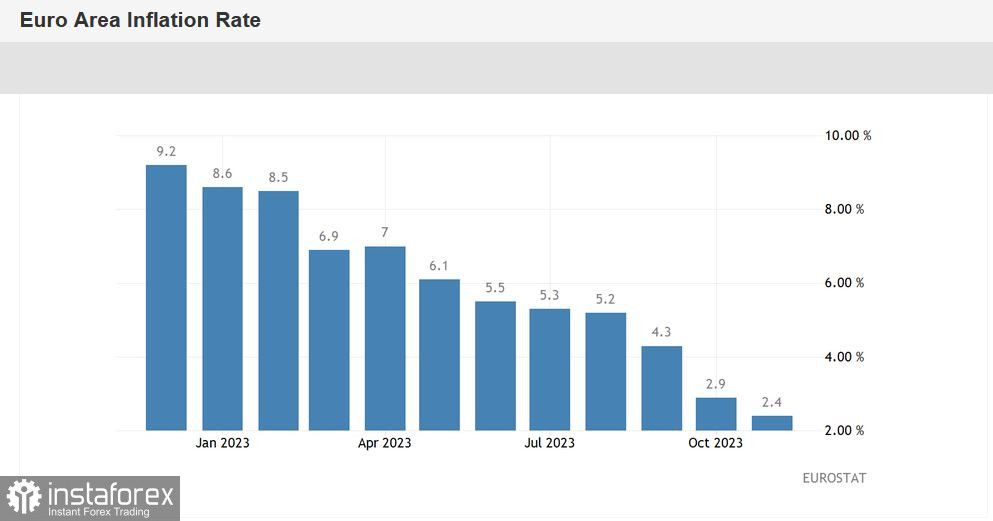

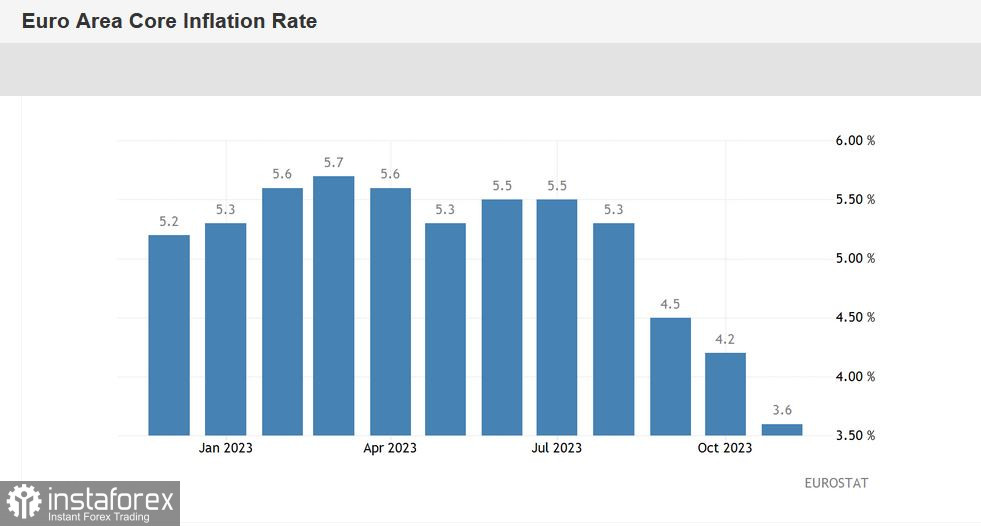

EUR/USD buyers negatively reacted to the inflation report published in Germany, as German data typically correlate with Eurozone-wide figures. Indeed, all components of today's release were in the red zone. For instance, the overall consumer price index came in at 2.4% year-on-year (the lowest value since August 2021). This indicator has been consistently declining for 7 months in a row. The core index, excluding energy and food prices, dropped to 3.6% year-on-year, the lowest since May 2022. The core CPI has also been consistently decreasing (for the fourth consecutive month), with a rapid pace: the indicator was at 5.5% in July, 5.3% in August, 4.5% in September, 4.2% in October, and finally, 3.6% in November.

The report's structure indicates a significant reduction in energy prices: in November, this component decreased by 11.5% year-on-year after falling 11.2% in the previous month. The growth of prices for food, alcohol, and tobacco products slowed down: if in October the growth was 7.4%, in November it was 6.9%. The cost of services increased by 4.0% (compared to a 4.6% increase in the previous month).

It's worth noting that lately, the EUR/USD pair has shown a combative attitude not only due to the weakening of the dollar but also due to the strengthening of the euro, which reacted to hawkish statements from some ECB representatives. However, after today's release, the chances of additional tightening of monetary policy have significantly decreased as inflation in the Eurozone is slowing down at an accelerated pace.

Interestingly, traders today virtually ignored the core PCE index, which was released at the start of the American session. The primary personal consumption expenditures index dropped to 3.5%, setting a multi-month low (the weakest growth rate since June 2021). This key inflation indicator for the Federal Reserve has been actively decreasing for the third month in a row, a significant fact considering the dovish stance of some Fed representatives.

Nevertheless, EUR/USD traders focused their attention on the slowdown of inflation in the Eurozone, allowing the pair to approach the 1.08th area.

Under these circumstances, should one consider selling? In my opinion, it's premature to rush into short positions. At least until the pair breaches the support level of 1.0850 (the middle line of the Bollinger Bands on the daily chart). After all, the dollar is also in a vulnerable position – if Waller's and Goolsby's colleagues join the discussion on the conditions for lowering the Fed's interest rate, the southward momentum of EUR/USD will dissipate. Buyers will then regain the initiative, pushing the price back to the nearest resistance level of 1.0960 (the upper line of the Bollinger Bands on the four-hour chart). Therefore, in the current circumstances, it seems most prudent to adopt a wait-and-see approach: the euro has lost a round, but the fight is not over yet.