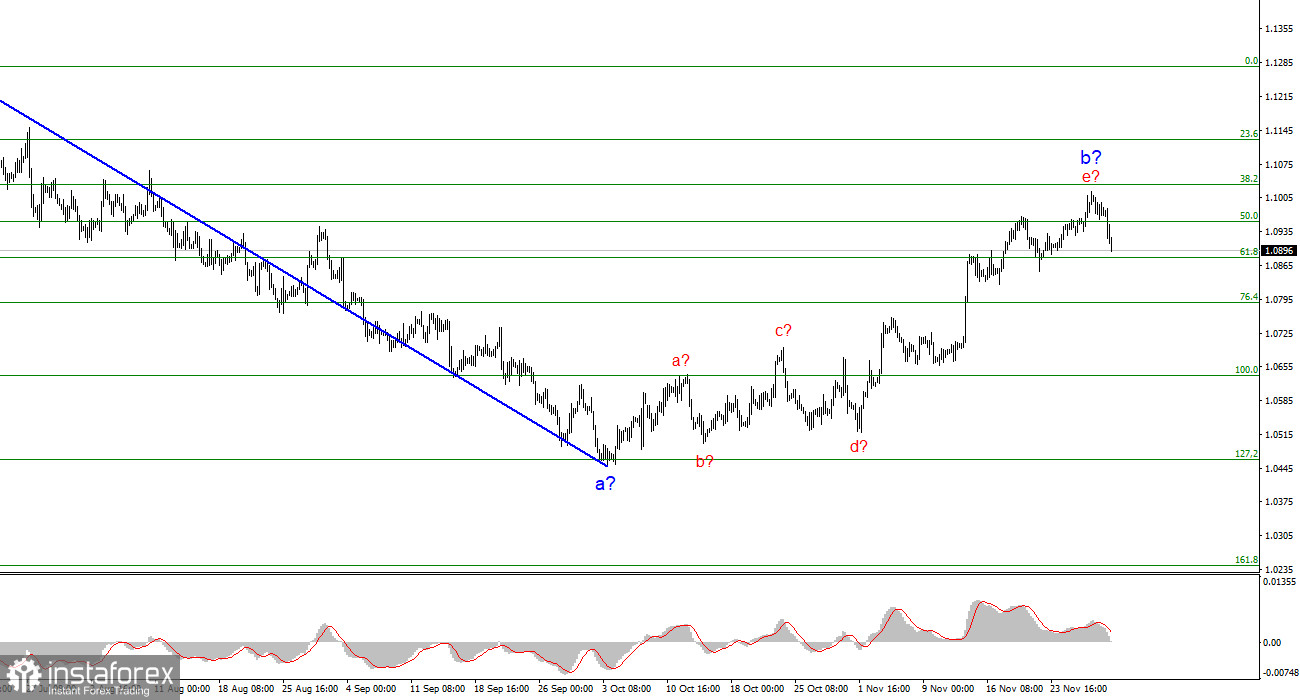

Demand for the European and British currencies noticeably decreased on Thursday. It is too early to declare the end of the waves 2 or b for both instruments, but both currencies have made a decent step towards transitioning to forming waves 3 or c. I would like to remind you that the current wave layout does not suggest an uptrend. If this is the case, then a new downward wave could start forming at any moment.

In recent weeks, the market has not particularly pondered why it is selling the dollar. The latest GDP report showed strong growth in the U.S. economy, the Federal Reserve is not planning to lower rates in the near future, and inflation in the eurozone is much lower than in the U.S. The eurozone just released another inflation report on Thursday, showing a slowdown to 2.4% year-on-year. Obviously, with such a level, the European Central Bank will not even think about tightening monetary policy further.

At the same time, inflation in the U.S. is at 3.2%, and if it stops slowing down, the Fed may need another interest rate hike. Michelle Bowman mentioned this on Wednesday, and several other FOMC members as well. Accordingly, at this time, the Fed is much closer to considering another rate hike than the ECB. As a result, at this time, the Fed is much further from starting to ease policy than the ECB. Therefore, demand should be increasing for the U.S. currency and decreasing for the euro.

On Thursday, we witnessed the long-awaited decline of both instruments. The decline could be the starting point for waves 3 or c. However, I want to remind you that in recent weeks, the market has often made decisions to sell the U.S. currency even when there were no reasons for it and even the opposite. For instance, on Wednesday, the U.S. GDP report did not support the dollar. Therefore, waves 2 or b may still take on a more extended form.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form. A successful attempt to break the 1.0851 level could signal a decline in the instrument.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end and at any time. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.