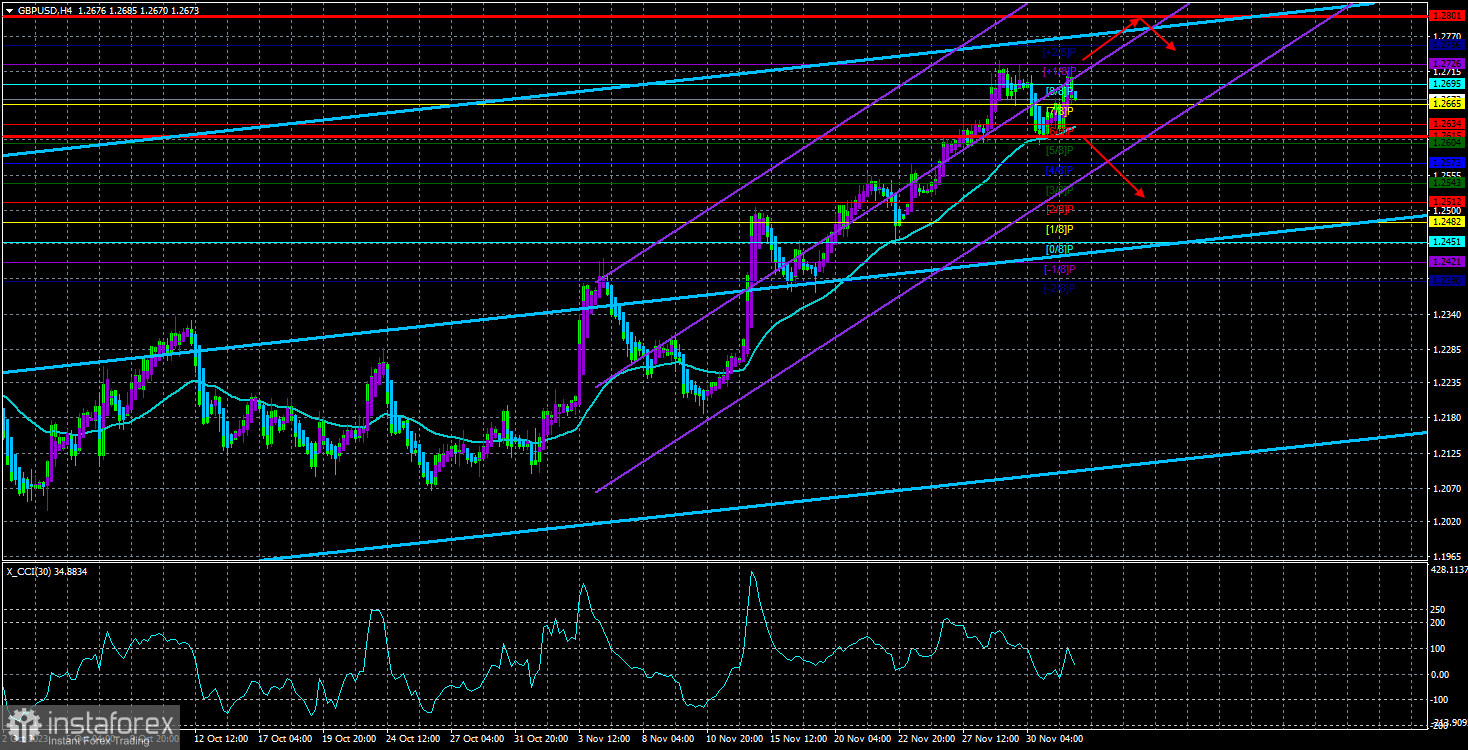

On Friday, the GBP/USD currency pair made an unconvincing attempt to settle below the moving average, which could change the current upward trend to a downward one. Recall that we have long been awaiting a resumption of the decline in the British currency, considering the entire rise of recent weeks unfounded. Similar to the EUR/USD pair, there were valid reasons for the dollar to decline in the last month. However, this decline wasn't consistent throughout the entire month. Pay attention to the recent upward movement between November 17th and 29th. During this time, the pound did not correct downward even once. Weak reports from across the ocean come 1-2 times a week, if at all. And this is not to mention British statistics, which also rarely please traders.

Therefore, our conclusion remains the same. The decline of the pair is still the most logical and natural scenario. Even the euro has already started to correct, but the pound seems to ignore its overbought condition or act as the world's number one reserve currency. The triple overbought condition of the CCI indicator has yet to be worked out. We have yet to see a consolidation below the moving average. In general, the current movement remains illogical and unfounded. Moreover, the continuation of this movement will be equally illogical and unfounded.

In the current situation, traders can be advised of two strategies. Either adhere only to technical analysis or continue trading the trend, which raises no doubts. Or wait until the market remembers the fundamental and macroeconomic background and stops buying the pound in any unclear situation.

Jerome Powell closed a rather dull week with his speech on Friday, which turned out to be quite dull as well. What did the head of the Federal Reserve say? Once again, we heard that the regulator "did not close the doors" to tightening monetary policy, and the current interest rate may not be enough to return inflation to the target level. We heard that the Fed will raise rates again if necessary, but we have yet to find out at what level of inflation such a need will arise. Powell reminded us that the Fed makes decisions on rates from meeting to meeting, but, as we saw quite recently, inflation of 3.7% did not become a reason for new tightening.

Thus, we can already draw a whole series of conclusions. First, the Fed is ready to raise the key rate only if inflation rises sharply or exceeds 4%. We are likely to see something like this soon. Second, lowering the key rate will also not happen now, as inflation still needs improvement. The American regulator has taken the same position as the ECB and the Bank of England and is ready to intervene if something terrible happens with inflation. If this does not happen, then the central bank is ready to wait the whole next year and 2025 for the consumer price index to fall on its own to 2%.

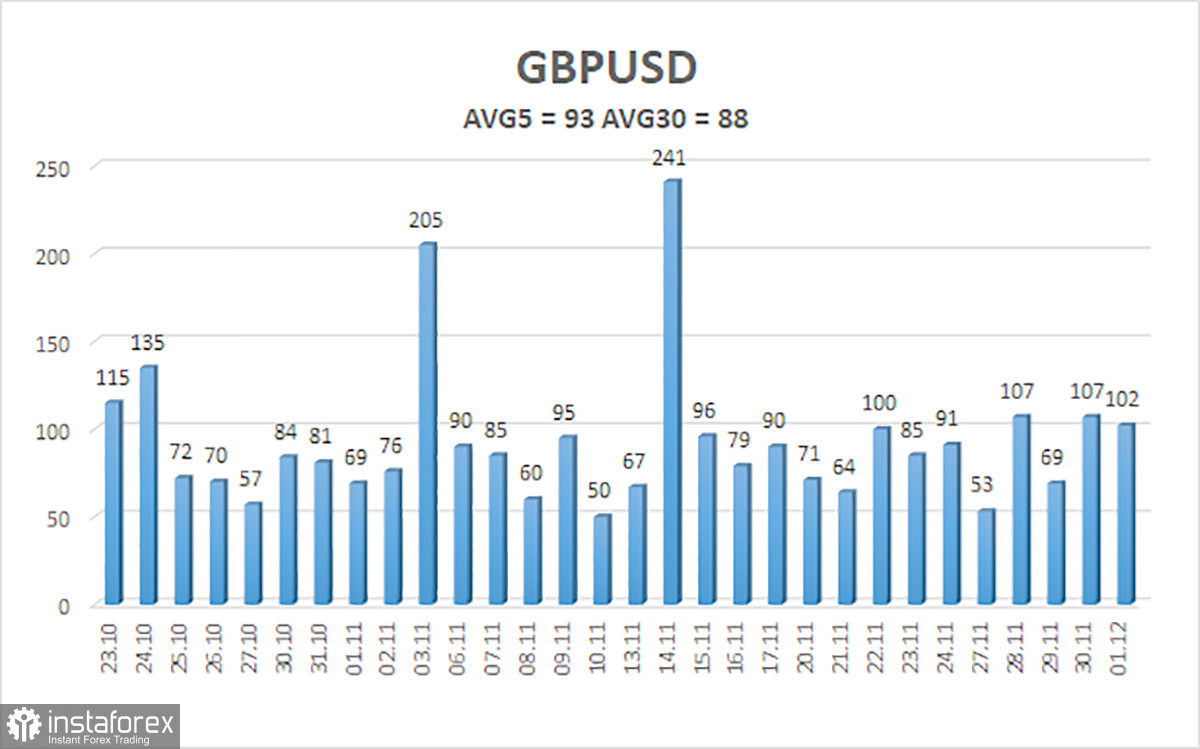

The average volatility of the GBP/USD pair over the past five trading days is 93 points. For the pound/dollar pair, this value is considered "average." On Monday, December 4th, we expect movement within the range limited by the levels of 1.2615 and 1.2801. A reversal of the Heiken Ashi indicator back down will indicate a new attempt to start forming a downward trend.

Nearest support levels:

S1 - 1.2665

S2 - 1.2634

S3 - 1.2604

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2726

R3 - 1.2756

Trading recommendations:

The GBP/USD currency pair continues to stay above the moving average. Thus, today, we can advise traders to stay in long positions with targets at 1.2756 and 1.2801. It should be remembered that today is Monday, and the calendars of the United States and the United Kingdom are empty. Thus, it isn't easy to expect a strong movement in any direction today. Opening purchases after consolidating below the moving average with targets at 1.2543 and 1.2512 will be reasonable. In the future, we expect a much more significant decline in the pound.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.