As I previously mentioned, there is so little important information coming from central banks that it is not worth focusing on it. Practically all speeches by representatives of central banks are indistinguishable from each other. At best, officials talk about the possibility of further tightening of monetary policy, "as inflation may start to rise." However, in most cases, they make only general, verbose, and vague statements that do not provide any specificity to the market.

Furthermore, the market would be ready to react to information that would allow it to anticipate future events. But even such conclusions cannot be drawn based on the current speeches of central bank officials. For instance, is there a clear answer to the question of which central bank is really ready to raise the rate again? Certainly, if inflation starts to rise again and stops moving towards the target, then new tightening is possible, whether in England or the United States. But no one knows if inflation will rise. In the European Union, it has already fallen to 2.4%, so why would the European Central Bank raise the rate or even talk about it?

It is a different story in the UK. Inflation there is much higher than in America or the European Union, and the pace of its decline has pleased many in recent months. One of the members of the Bank of England's Board, Catherine Mann, said last week that the prospects for stable inflation are pushing the central bank toward stronger policy tightening. Mann believes that the BoE's policy has only recently become restrictive, and it cannot be called "too restrictive." In other words, the current interest rate level cannot guarantee a further 2.6% drop in inflation. Core inflation in the UK is even higher and is falling much more slowly than the headline figure.

I believe that the BoE is the closest central bank to raise interest rates again. The probability of this is still not high, but it exists. Perhaps that's why demand for the British currency is not decreasing, although wave 2 or b should have been completed long ago.

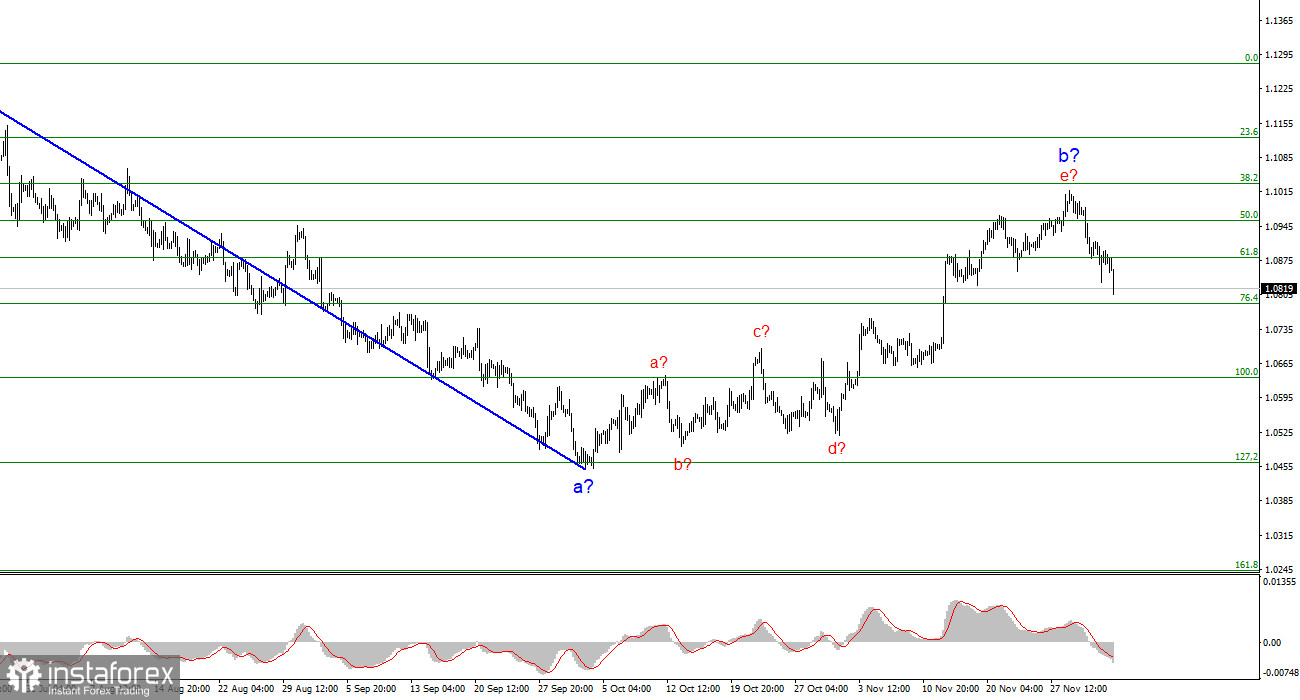

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form. A successful attempt to break the 1.0851 level could signal a decline in the instrument.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end and at any time, and it could happen at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.