EUR/USD

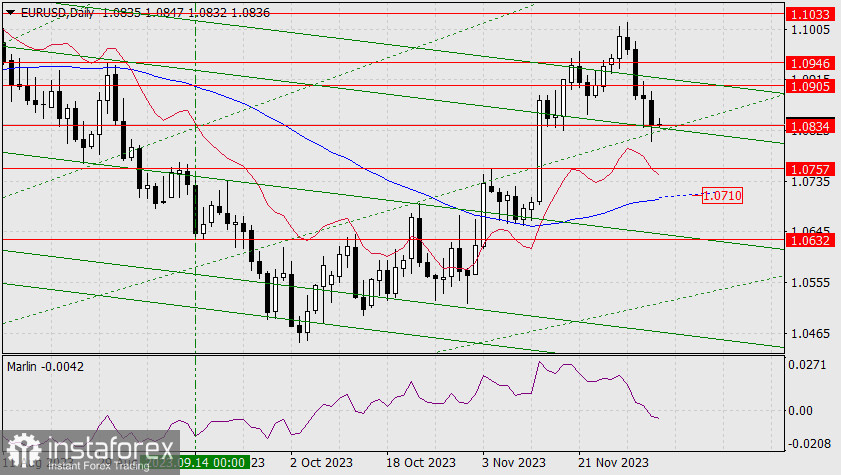

Yesterday, the euro once again attacked the strong support at 1.0834. This time, the Fibonacci ray was pierced. However, the price failed to consolidate its success, and today it opened above all supports. This is a sign of the end of the entire correction from November 29th. To confirm this sign, the signal line of the oscillator should return to the positive territory, which may happen no earlier than tomorrow. If this happens, we expect the pair to breach the nearest target level at 1.0905 and further rise towards 1.0946 and beyond to 1.1033.

If the price does manage to settle below 1.0834, we expect the pair to continue to fall to 1.0757 and further to 1.0710 – to the MACD line.

Yesterday, the dollar strengthened partly due to the decline in gold and oil prices, rising bond yields, and a dip in stock markets, and these movements occurred without clear reasons. This morning, the markets are recovering, so counter-dollar currencies may rise.

And, of course, a bearish scenario is not ruled out, as important U.S. economic data will be released starting today, and next week, the Federal Reserve meeting will take place.

On the 4-hour chart, a downtrend is in place. We need time to form any reversal signs. Today's moderate price increase or consolidation can fill this time.