The EUR/USD currency pair continued its downward movement on Monday. Let's remind ourselves of the thought we have repeatedly voiced in recent weeks: the dollar is significantly oversold, the euro is significantly overbought, and there are simply no factors for the further growth of the European currency. Thus, the recent decline in the European currency is logical and inevitable. It should be understood that the foreign exchange market involves many major players who cannot constantly push the pair in the same direction. After all, we are talking about the most stable currencies on planet Earth. Naturally, the euro can only fall by 700–1000 points for serious reasons, just as the US dollar cannot fall at a cruising pace.

Therefore, the downward correction has been brewing in the last few weeks, and now we are witnessing it. The market did not even require weighty reasons for this correction to begin. It is foolish to think that statements from Powell or Lagarde provoked the fall or rise of the dollar. Powell, Lagarde, and their colleagues from the ECB and the Fed have been limited to general phrases for several months. The likelihood of a new tightening of monetary policy in the United States is zero, no matter what the head of the Fed says. This is evidenced by the FedWatch tool. And this tool precisely reflects the market's expectations. So, the market does not believe in a rate hike, but the dollar is strengthening on hawkish comments from the head of the Fed? This is impossible.

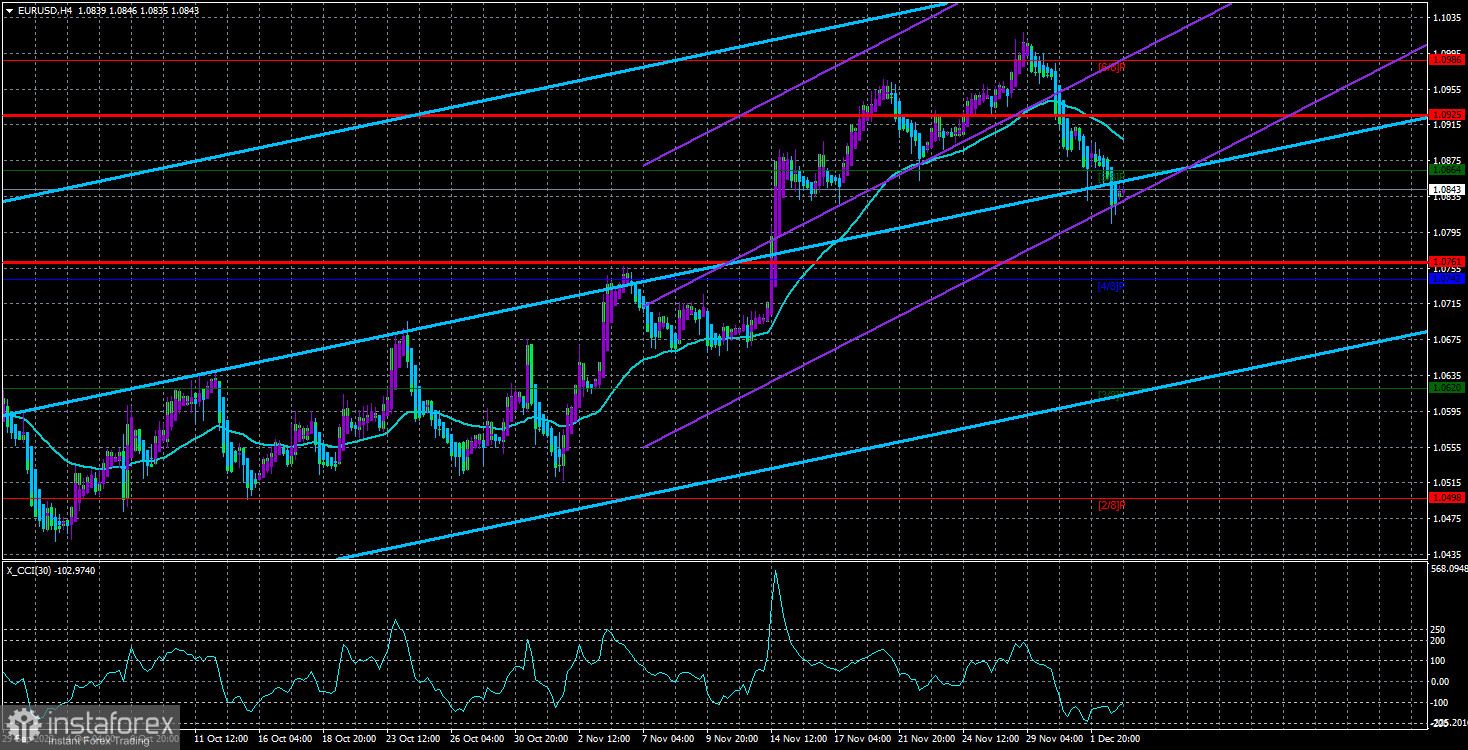

The same applies to Powell's dovish rhetoric. If Powell covertly hints at the inexpediency of further tightening, then why is the dollar rising? We are currently witnessing a simple correction. Recall that the CCI indicator entered the overbought zone three times, signaling an excessively high exchange rate for the pair. Therefore, the European currency could fall to the level of $1.02. It has no grounds for growth; it has risen too sharply in recent weeks. The only support for the euro currency is the American reports, but it cannot be constantly negative either.

The market is focused on upcoming US statistics.

Thus, we rely on global factors when making forecasts. Remember that in the last month, practically all the most important US reports turned out to be weaker than forecasts. But at the same time, those stronger reports did not support the dollar, and European statistics were actively ignored. Because if we take the most important inflation reports, it has already dropped to 2.4% in the EU. If the probability of a new increase in the key rate is zero in the United States, it is negative in the European Union. Therefore, regarding the monetary policy factor, the European currency is again in a less advantageous position than the dollar: the Fed's rate is higher, and the probability of a rate cut is higher at the ECB.

So, let's reiterate the obvious fact: the European currency has no grounds to continue rising. Of course, it is possible because transactions on the foreign exchange market are made not only for profit. However, we are trying to understand how the pair will move based on fundamentals, macroeconomics, and technical analysis. If major market participants keep buying the euro, fundamentals and macroeconomics will contradict this movement. Therefore, making the right conclusion and the right forecast will be impossible.

We advise traders to base their expectations on further pair decline, but remember that movement in the foreign exchange market can be almost anything. The speeches of Powell, Lagarde, and their colleagues are unimportant. This week, important reports will be published in the United States, which is paramount for the dollar's prospects.

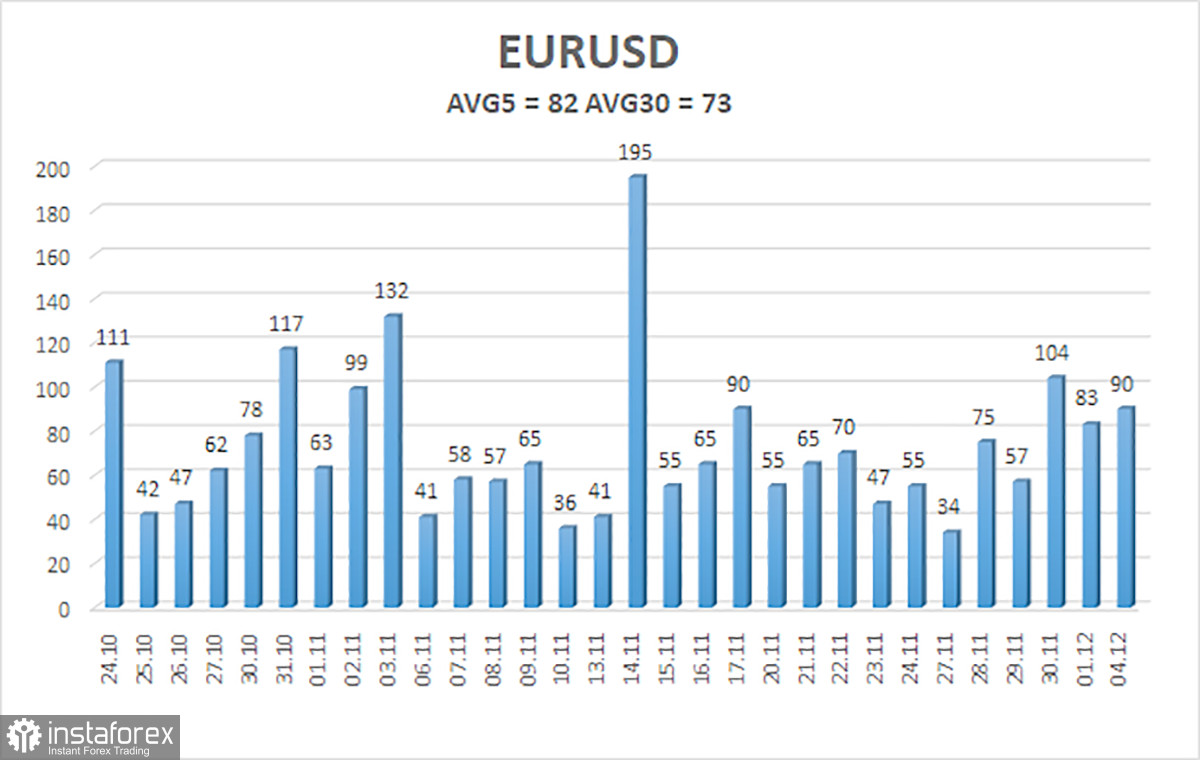

The average volatility of the EUR/USD currency pair for the last five trading days as of December 5th is 82 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0761 and 1.0925 on Tuesday. The upward reversal of the Heiken Ashi indicator will indicate a possible resumption of the uptrend.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair has consolidated below the moving average, allowing traders to open short positions. It is possible to stay in shorts with targets at 1.0761 and 1.0742. Even if the current downward movement is a correction, the price must decline by at least a hundred points before resuming its rise. As for purchases, they can be considered when the price is fixed above the moving average or when strong signals are formed on the 24-hour TF. Targets are 1.0986 and above.

Explanations for illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel for the pair to spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the oversold area (above +250) indicates that a trend reversal towards the opposite direction is approaching.