Over the last seven days, the value of Bitcoin has increased by 13.5%, reaching a new yearly record above the $42 level. The attention of crypto investors is squarely focused on Bitcoin, as evidenced by its record-high dominance in the market. Investor enthusiasm remains unabated and is consistently fueled by fundamental and local news, which continues to push prices higher.

The period of active accumulation continues, and BTC reserves on exchanges have already dropped to 3%, an absolute record. The crypto market is in a state of euphoria, anticipating the approval of a spot BTC ETF and the easing of the Federal Reserve's monetary policy. The current situation leaves no room for sellers and local corrections, which could pose a threat to the long-term bull trend. There is currently no reason to believe that the situation will change dramatically in the near future.

Fundamental Factors

Fear of a recession from the Federal Reserve makes predictions of easing monetary policy even sweeter for financial markets. The overwhelming majority of investors and traders believe in a rate cut in the first half of 2024. This positive expectation significantly strengthens the correlation between BTC, gold, and the SPX stock index. As a result, the cryptocurrency has hit a local high, while gold has reached a historical high and is expected to remain above the $2,000 mark.

The correlation with the SPX stock index also supports the Bitcoin bull rally due to the start of the "Santa Claus rally." Typically, this period before the holidays is accompanied by a sharp influx of liquidity into the U.S. stock market, as retail investors are forced to buy shares of American corporations to reduce tax liability. Indirectly, the "holiday rally" positively impacts Bitcoin quotes and strengthens overall optimism in the market.

In addition, investors are eagerly awaiting approval for a spot BTC ETF by the regulatory body SEC. The head of Franklin Templeton stated that BTC ETFs will be approved in the United States, once again fueling market interest. Institutional investors also continue to show increased interest in the crypto industry. According to CoinShares data, the influx of funds into crypto products last week amounted to $176 million, reaching a record +$1.76 billion over 10 weeks.

Is Bitcoin Overheated?

Despite all the optimism and confident upward movement, skepticism about the bullish trend that began with the fake news of BTC ETF approval is not subsiding. BBG analysts have stated that, according to technical metrics, Bitcoin has entered the "overbought" zone. Being in such a zone can last quite a while and is characteristic of a bullish trend. However, in any case, the overbought condition of an asset is an important signal of an approaching correction

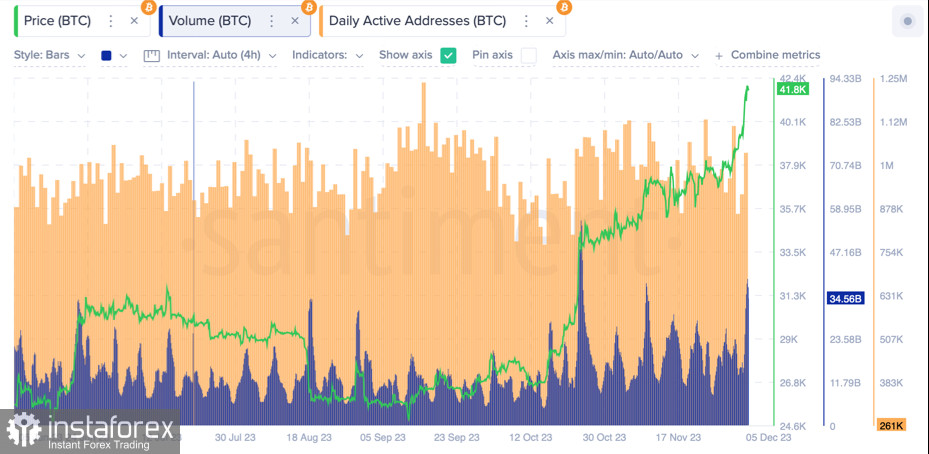

As of December 5th, there is a capital redistribution in the Bitcoin market and a shakeout of "weak hands" through impulsive price movements. It is reported that over the past day, positions worth over $210 million were liquidated in the crypto market. At the same time, the number of addresses with non-zero balances has exceeded 50 million, indicating high interest in Bitcoin.

Bitcoin is trading near the $42k level, with daily trading volumes around $35 billion. Enthusiasm around the cryptocurrency remains strong, and reaching another historical high hash rate above the 500 EH/s mark is direct confirmation of this. In recent days, there has been no significant profit-taking, indicating investors' confidence in further upward movement for BTC. Considering this, the main short-term target for BTC in the next few weeks will be the $45k level, with the local support zone at the $40k–$40.3k mark.

Conclusion

Macroeconomic positivity and internal positivity in the crypto market leave Bitcoin with no chance of entering a correction in the coming days. Next week, inflation data and the Federal Reserve meeting are expected, which will once again bring positivity to the cryptocurrency market. The first signal of an approaching correction was Bitcoin entering the "overbought" zone. The next step will be the gradual flow of liquidity into altcoins, and only after that will the probability of correction reach a significant level.