On Tuesday, the demand for the European currency declined, while the British pound remained unchanged. I need clarification on the pound's resilience, which lacks strong supportive news. The pound sterling should also be losing if the European currency loses ground. However, one factor may influence market participants' attitudes toward the euro and the pound, which we will discuss in this review.

The latest inflation report in the European Union recorded a decrease to 2.4%. Back then, I wrote that now the ECB has no reason not only to raise the interest rate but even to talk about it. The core inflation remains high, but if the headline inflation falls, the core will also fall. It is slowing down, so the need to tighten monetary policy again is diminishing.

Nevertheless, almost all recent statements by ECB Board members have indicated that the regulator has not completed the tightening process and is ready to return to the stage in case of inflation acceleration. However, Isabel Schnabel stated today that "further rate hikes are unlikely," as the latest inflation report is encouraging. Based on this, the European currency is under more pressure than the pound.

In the UK, inflation is almost twice as high as in the European Union, so the British regulator cannot afford to talk about the end of tightening yet. Meanwhile, British officials only talk about the need to continue holding the rate at its current level. However, market participants can see that it can still start rising with the current values of the Consumer Price Index in Britain. In this case, the Bank of England will have to at least consider the scenario with a new fifteenth interest rate hike, and the number of voting members of the Managing Board may increase from the current three.

From all the above, it follows that the Bank of England can still tighten hypothetically, and the ECB is unlikely to. This is the difference between the euro and the pound at the moment.

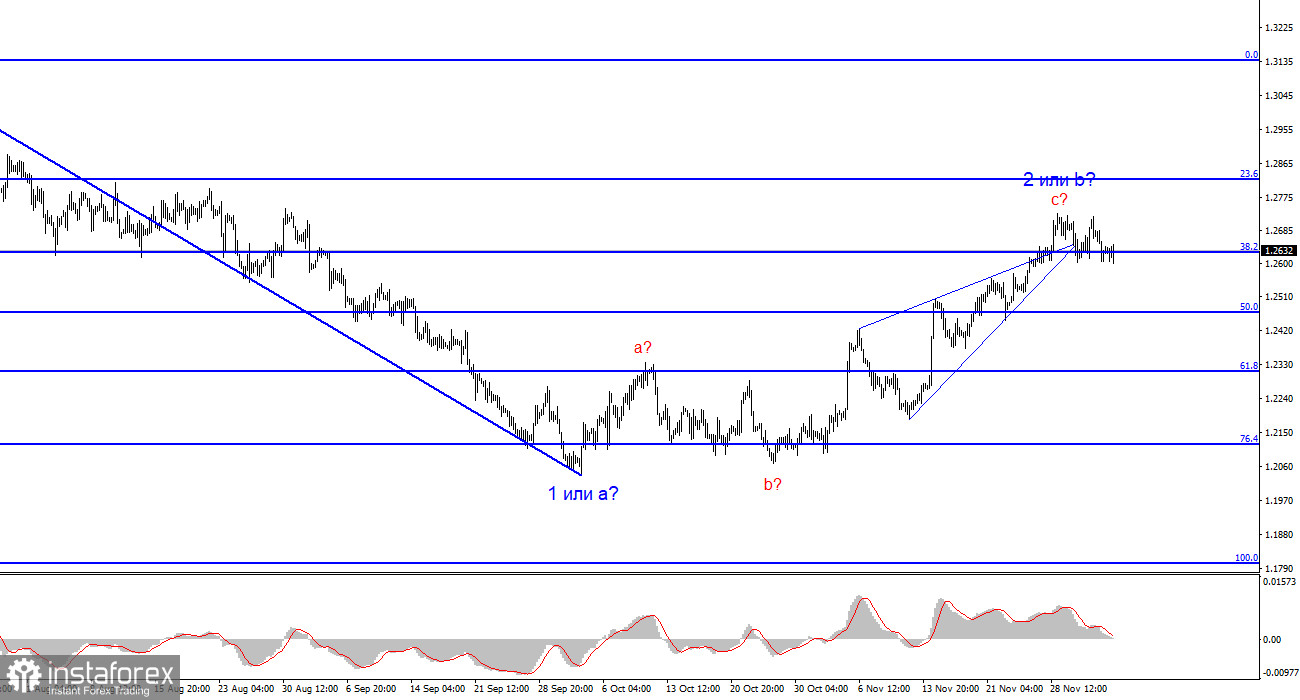

Based on the analysis conducted, the formation of a bearish wave set continues. Targets around the 1.0463 mark have been perfectly worked out, and the unsuccessful attempt to break through this mark indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decline in the pair. I still recommend selling with targets below the wave 1 or a low. At the moment, the wave 2 or b can be considered complete.

The wave pattern of the pound/dollar pair suggests a decline within the descending trend segment. The maximum the British pound can count on is a correction. I recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b should ultimately end and can end at any time. The longer it takes, the stronger the decline of the pound will be. The narrowing triangle is a harbinger of the completion of the movement.