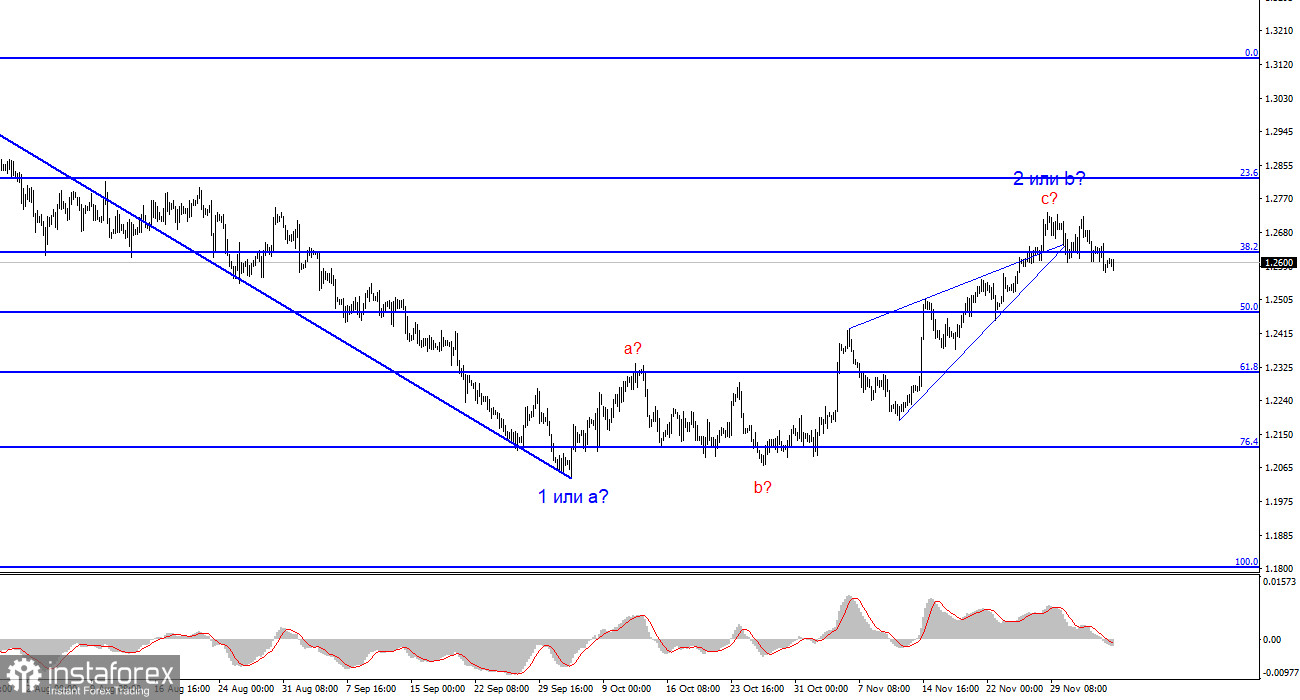

The British pound is currently showing mixed dynamics, unable to initiate a downward movement within wave 3 or C, and the market has shifted to a wait-and-see stance for the upcoming U.S. reports on Friday. An in-depth analysis of the wave layout was conducted to understand what is happening with the instrument and what to expect. It was revealed that the current size of corrective wave 2 or b is exactly 61.8%. This is the "golden" level for a correction. Subsequently, the instrument retraced down to the 50.0% Fibonacci level, which is also strong and quite important. Therefore, the British pound is stuck between these two crucial levels and cannot break through either the first or the second.

In order to understand this better, we need to look at the general picture. The market is not giving up on constructing wave 3 or C; it just lacks the strength to overcome the 50.0% level at the moment. If this is the case, the quotes will continue to fall but it will take some time. Again, take note of the important U.S. data that will be released on Friday, which can either help break the 50.0% level or lead to an unsuccessful attempt to break through with a pullback to the upside.

The Bank of England just presented its Financial Stability Report. Here, it acknowledged that the situation with the markets remains complex, but the banking system is well-capitalized and ready for any shocks. Vulnerabilities in financial markets remain relatively high, and the situation regarding inflation may worsen again due to high wage growth rates. Based on this information, I can say that the BoE has done enough to reduce inflation, but not everything in this world and the global economy depends solely on it. It has done all it can, and now all that remains is to wait and hope. Inflation will continue to decline over the next year or two. The only question is whether it will do so quickly or slowly. In any case, the British central bank will not raise rates without an urgent need.

Since the pound has risen in the past month, and now BoE Governor Andrew Bailey and the central bank itself have effectively abandoned further policy tightening, I believe the news background implies a decline in the British pound. The only thing left is to overcome the 1.2583 mark, which corresponds to 50.0% Fibonacci.

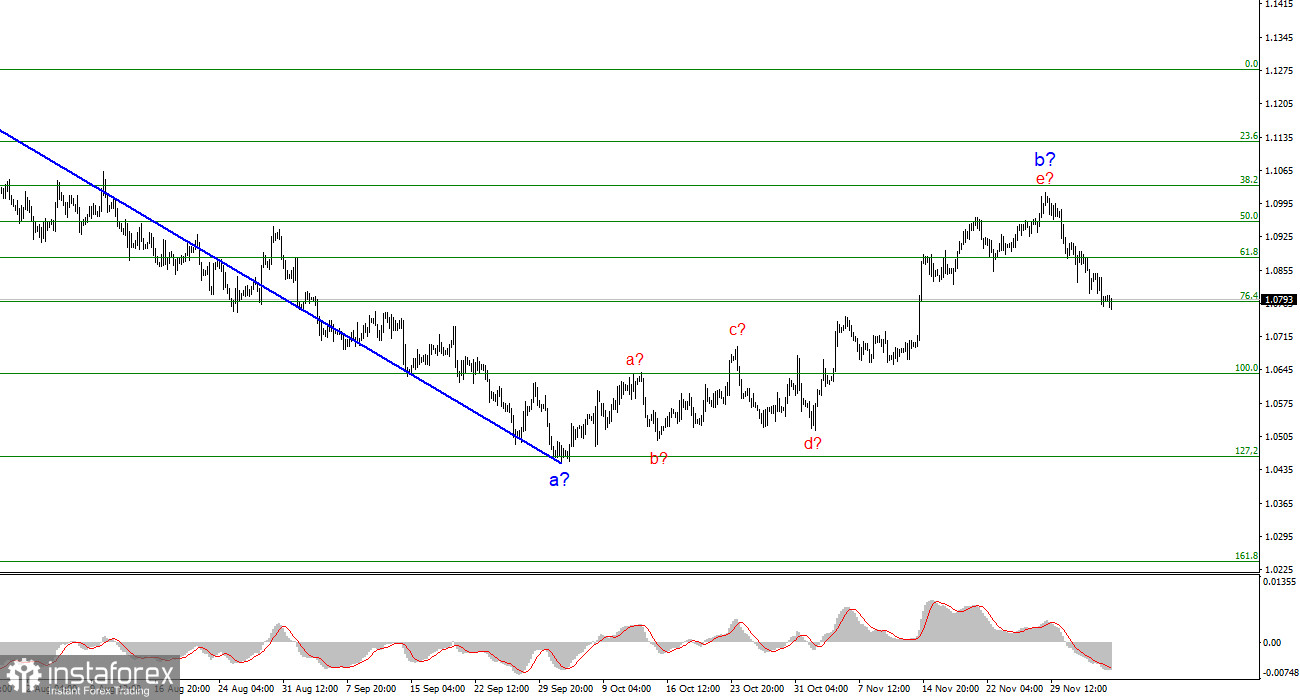

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.