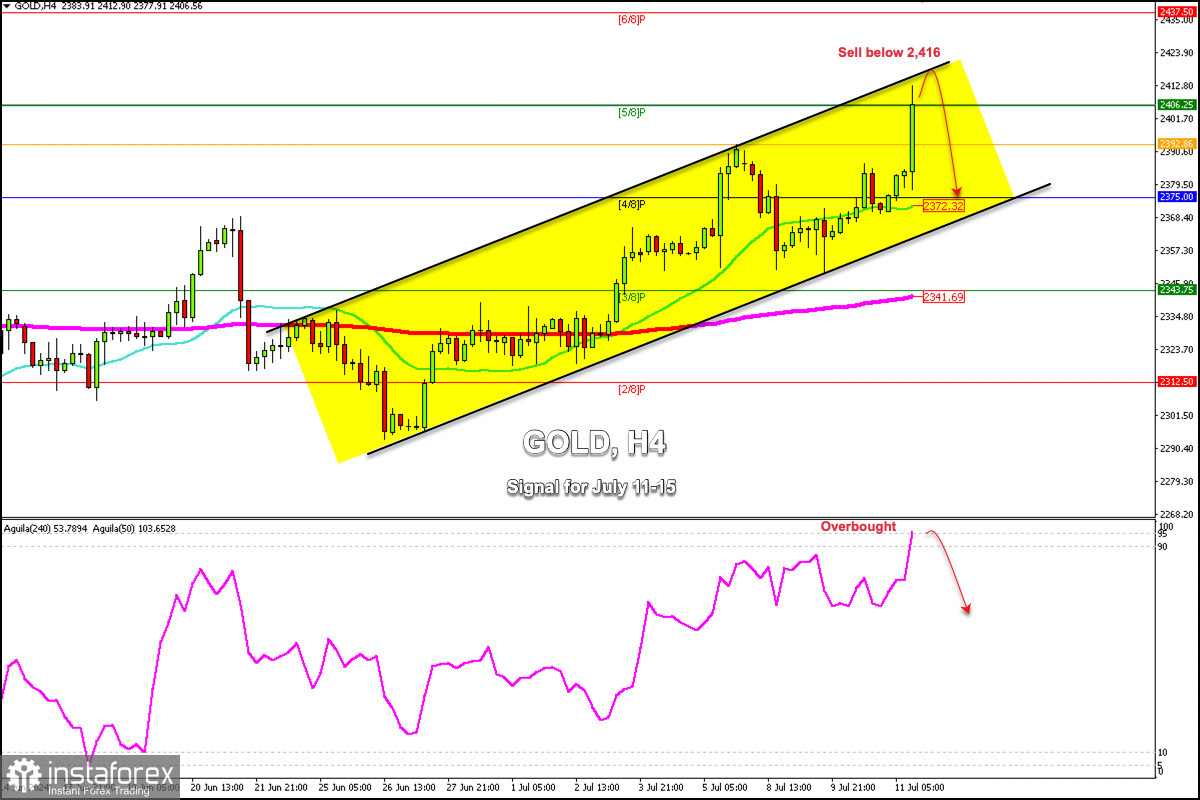

Early in the American session, gold is trading around the 2,405 level that coincides with the 5/8 Murray and within the uptrend channel forming since June 25.

Gold could make a technical correction in the next few hours since the eagle indicator reached the overbought zone. The metal also reached the top of the bullish trend channel which means strong bearish pressure below 2,317. So, we could expect a technical correction towards the psychological level of 2,400 which could even push the price up to 4/8 Murray at 2,475.

Yesterday in our analysis, we pointed out that gold had left the GAP at 2,391. Today after the inflation data from the United States, gold covered this GAP and surpassed that barrier reaching a high of 2,413. Therefore, we believe that a technical correction could occur only if the Gold settles below the top of the uptrend channel.

If gold consolidates below 2,417 – 2,422 in the next few hours, the outlook will be a technical correction and we could look for opportunities to sell below the top of the bullish trend channel or even below Murray's 6/8 with targets at 2,392 and 2,375.

On the other hand, if gold consolidates above 2,315, it is expected to reach 2,437 (6/8 Murray) in the next few days. This area means strong resistance and it is most likely that below that area, gold will have difficulties to continue rising.

Our trading plan for the next few hours is to sell gold at the current price levels with a target at 2,375. The eagle indicator is giving overbought signals which means a technical correction is imminent in the next few hours.