Transaction analysis and trading tips for the British pound

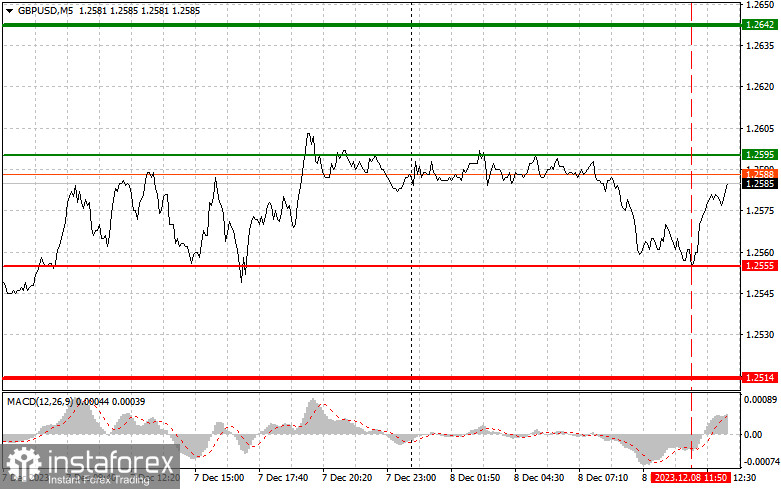

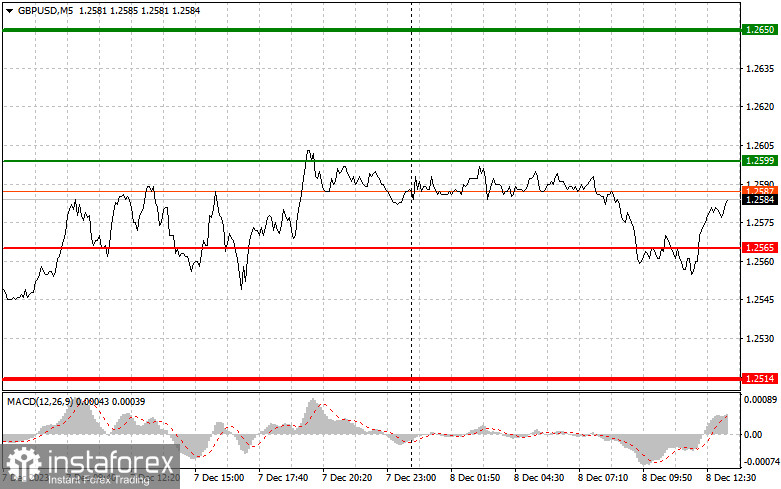

The test of the 1.2555 price level occurred when the MACD indicator had dropped significantly below the zero mark, which limited the further downward potential of the pair. I have never witnessed a retest of this level. The absence of statistics from the United Kingdom constrained pressure on the pair, but ahead of us lies a crucial report on the US labor market. The direction of the dollar's future movement depends on whether we see an increase in new jobs. A rise above economists' forecasts will strengthen the dollar and lead to a decline in the pound. However, if the indicator falls below expectations, the pound may continue its upward trend. Regarding the intraday strategy, I will rely more on implementing scenario #1 after the data release, paying less attention to the MACD indicator.

Buy Signal

Scenario #1: Buying the pound today is possible when the entry point reaches around 1.2599 (green line on the chart) to reach the level of 1.2650 (thicker green line on the chart). At the 1.2650 level, it is recommended to exit long positions and open short positions in the opposite direction (anticipating a movement of 30-35 points in the opposite direction from the entry-level). A pound rally can be expected only after weak US labor market statistics, prompting the Federal Reserve to consider rate cuts soon seriously. Important! Before buying, ensure that the MACD indicator is above the zero mark and only just beginning its rise.

Scenario #2: Buying the pound today is also possible in the case of two consecutive tests of the 1.2565 price when the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a reverse market turnaround. Expect growth towards the opposite levels of 1.2599 and 1.2650.

Sell Signal

Scenario #1: Selling the pound today is possible only after updating the 1.2565 level (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be the 1.2514 level, where it is recommended to exit sales and immediately open buys in the opposite direction (anticipating a movement of 20-25 points in the opposite direction from the level). Sellers will show their presence only in the case of strong US data. Important! Before selling, make sure that the MACD indicator is below the zero mark and is only beginning its decline.

Scenario #2: Selling the pound today is also possible in the case of two consecutive tests of the 1.2599 price when the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a reverse market turnaround downwards. Expect a decline towards the opposite levels of 1.2565 and 1.2514.

Chart Key Points:

Thin green line – entry price for buying the trading instrument;

Thick green line – the anticipated price where Take Profit can be set, or profits can be independently fixed, as further growth above this level is unlikely;

Thin red line – entry price for selling the trading instrument;

Thick red line – the anticipated price where Take Profit can be set, or profits can be independently fixed, as further decline below this level is unlikely;

MACD indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important. Novice traders in the Forex market should be cautious when making entry decisions. Before significant fundamental reports are released, staying out of the market is best to avoid being caught in sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You must set stop orders to avoid losing your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, successful trading requires a clear trading plan like the one presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.