The GBP/USD currency pair also continued its downward movement on Friday, which was also triggered by strong American statistics. In principle, all our conclusions drawn for the EUR/USD pair apply to the GBP/USD pair as well. However, the British pound continues to fall much less eagerly than the euro. We have already mentioned that we expect a decline in both currency pairs, considering the recent upward correction as a correction against a stronger preceding fall. If this is the case, a new downward trend should now begin, with targets located at least near the $1.20 level. This scenario implies a minimum drop of 500 points from current levels. Of course, these 500 points do not have to be covered in a week. The wave could well stretch over several months. But in any case, we are only looking down.

Until recently, we could assume that the market still believed in another rate hike by the Bank of England, but last week Andrew Bailey, who "buried" hopes for a tightening of monetary policy soon, spoke out. Perhaps the market assumes that the Bank of England will hold its rate at the peak longer than the Fed. However, neither the Fed nor the BoE has provided any information about the timing of the start of the easing program. Yes, the market already anticipates five rounds of Fed rate cuts next year, but the Bank of England cannot keep its rate at its peak forever.

For a whole year, many experts have been predicting an economic downturn for America. What can be said about the UK, where the rate is only 0.25% lower, and the economy has not been growing for six quarters? In the United States, the latest GDP report showed a growth of 5.2%. The previous 3-4 quarters showed steady growth. Britain does not smell like such "financial results." This means that the British economy has much more chance of a recession next year. And the Bank of England, which is trying its best to avoid this, may well sacrifice inflation already, just to prevent negative economic growth. Therefore, we still do not believe that the pound has any fundamental advantage over the dollar.

Rate vote distribution – the most important event for the pound.

As mentioned earlier, next week will see meetings of the Bank of England and the Federal Reserve. We do not expect any important decisions from either of them. Of course, the market may react to just one phrase from Powell or Bailey, find a foothold, and start moving the currency in the desired direction. But at the moment, we don't see what markets might even hypothetically react to on Wednesday and Thursday.

In our view, the most important sub-event will be the rate vote among the members of the Bank of England's monetary committee. Recall that at the last meeting, only three officials voted for a rate hike. Since then, it has been a month and a half, and the latest inflation report showed a decline below "Bailey's forecast." Therefore, there is no reason to expect hawkish statements or decisions to tighten policy. We believe that the number of supporters for a new tightening will decrease even more, which could exert additional pressure on the British pound.

At the same time, from the Fed, we should not expect either more "dovish" or more "hawkish" rhetoric and decisions. Inflation is decreasing, but it has stabilized over the last four months. The American regulator cannot talk about a rate cut now because 2% is still very far away, but it is also not convenient to talk about tightening, as inflation is not rising. Therefore, we continue to adhere to the same strategy: the British pound should continue to fall.

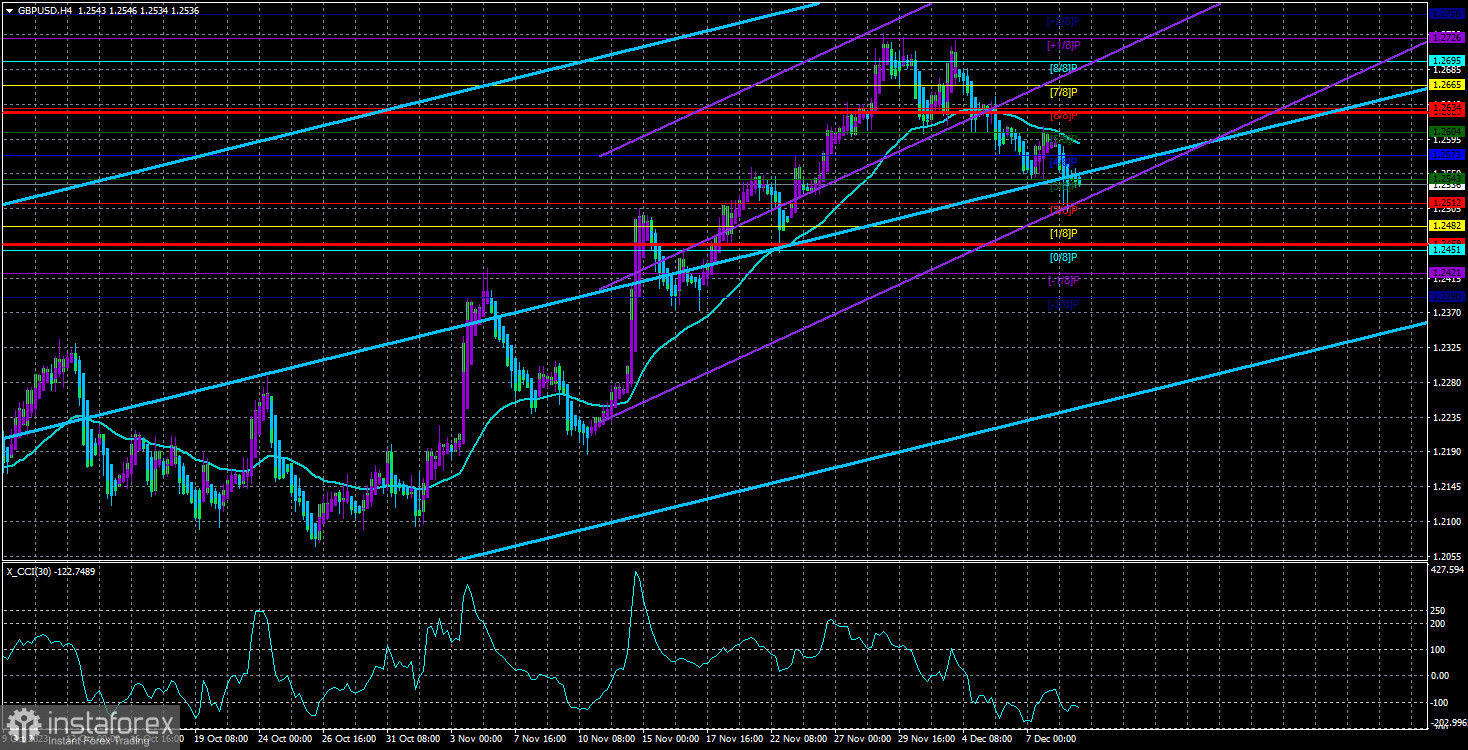

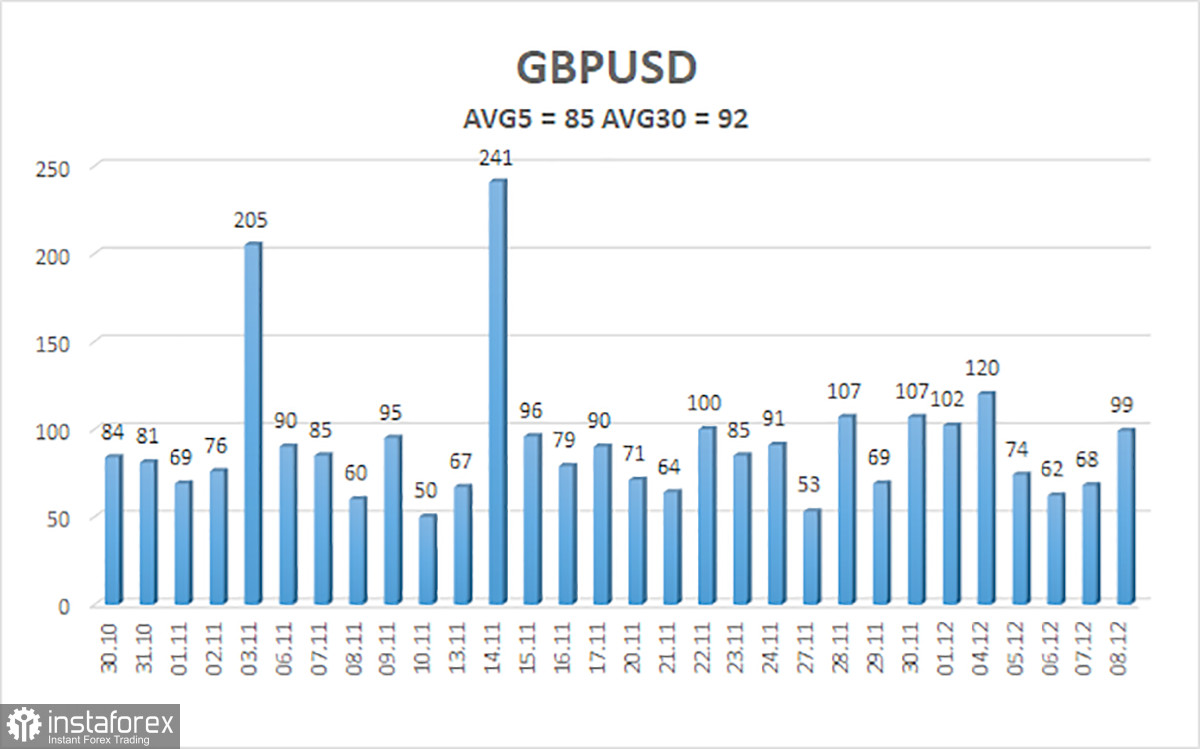

The average volatility of the GBP/USD pair for the last 5 trading days is 85 points. For the pound/dollar pair, this value is considered "average." On Monday, December 11th, we expect movements within the range limited by the levels of 1.2459 and 1.2629. A reversal of the Heiken Ashi indicator upward will indicate a new phase of corrective movement.

Nearest support levels:

S1 – 1.2543

S2 – 1.2512

S3 – 1.2482

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2604

R3 – 1.2634

Trading recommendations:

The GBP/USD currency pair remains below the moving average line. Thus, we can advise traders to continue holding short positions with targets at 1.2482 and 1.2459. Despite the large number of publications and events this week, we continue to expect only declines from the pound. Opening long positions would be advisable upon consolidation above the moving average with targets at 1.2665 and 1.2695.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and direction in which to trade now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.