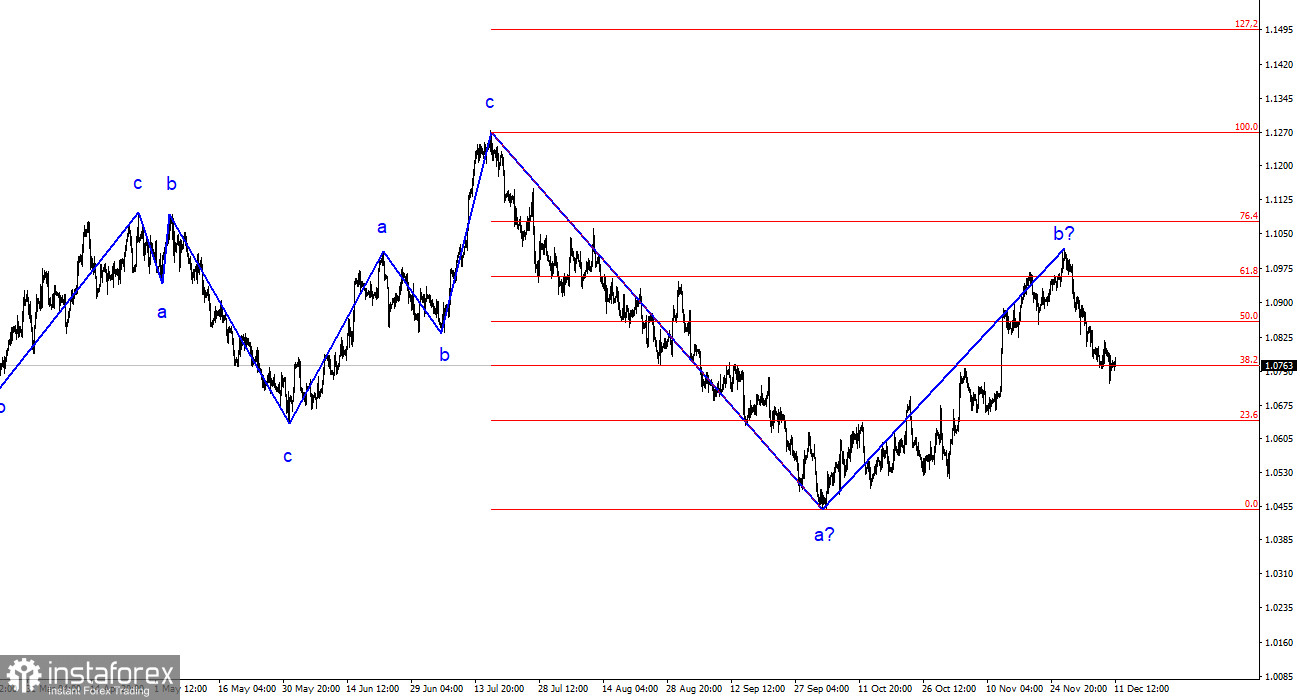

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have observed only three-wave structures that constantly alternate with each other. Throughout 2023, I regularly mentioned that I expect the pair near the 5th figure, where the construction of the last upward three-wave structure began. This target was achieved after the decline in July-October. After reaching this target, the construction of corrective wave 2 or b began, which already took on a clear five-wave but the inflation report for October in the United States led to this wave taking an even more complex form. Nevertheless, the working scenario remains the same – the construction of wave 3 or c.

Regardless of the final form of wave 2 or b (I warned that it could be much more complex), the overall decline of the European currency will not be completed, as, in any case, the construction of the third wave of the downtrend is required. Most likely, wave e in 2 or b took on a five-wave, extended form but may already be completed.

The dollar does not retreat on Monday.

The exchange rate of the euro/dollar pair remained unchanged on Monday. The pair's rate stands still since there is no news background today. Some may think that this will be the whole week, but it is not. It is even a bit strange to see an empty calendar today, knowing how many and what events will happen during the week. Tomorrow, inflation for November will be released in America. I remind you that the previous report was neither weak nor strong. Inflation came out almost as expected by the market (3.2% against 3.3%). However, this report led to a decline in demand for the dollar, which persisted for several more weeks. Now, demand for the dollar is growing, so the question arises: will tomorrow's Consumer Price Index spoil the whole picture for the dollar? Let's look at the forecasts.

In November, a decrease in the core inflation from 3.2% to 3.1% is expected. What does this mean? If inflation decreases slightly more, formally it will mean that the Fed will switch to a faster policy of lowering interest rates. There is no talk of raising rates now. If inflation rises or remains unchanged, then nothing will change in the Fed's policy, as we observed a few months ago when inflation rose to 3.7%, but the Fed gave no signals of additional tightening. Since there will be no talk of tightening in any case, this report is unlikely to provide strong support for the dollar. There is a high probability of quotes moving away from the reached lows and the construction of an upward wave.

General Conclusions.

Based on the conducted analysis, I conclude that the construction of a bearish wave set continues. Targets around the level of 1.0463 have been perfectly worked out, and the unsuccessful attempt to break this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decline in the pair. I still recommend sales with targets located below the low of wave 1 or a. At this time, wave 2 or b can be considered complete.

On the larger wave scale, it is evident that the construction of corrective wave 2 or b continues, which in length is already more than 61.8% Fibonacci of the first wave. As I have already mentioned, this is not critical, and the scenario with the construction of wave 3 or c and a decline in the pair below the 4th figure remains in force.