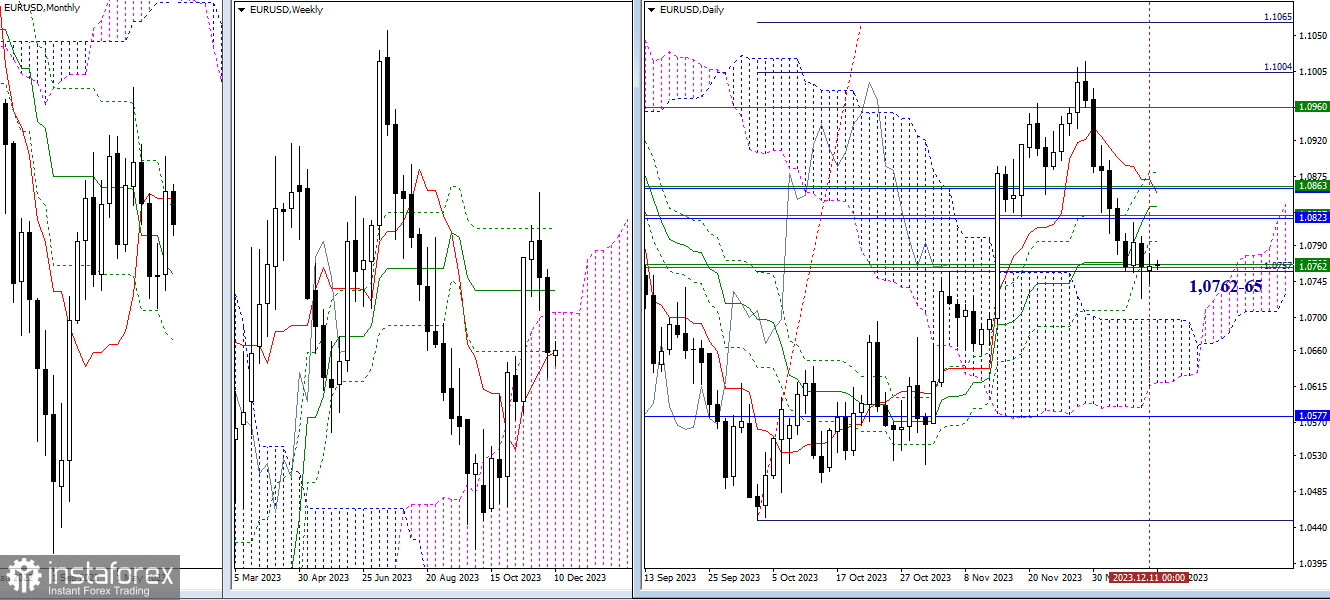

EUR/USD

Higher Timeframes

The situation has not changed significantly over the past day. The range of movement was not very large, and the pair remained within the attraction zone of the weekly levels (1.0762-65). The positions of other targets today have also practically not changed. For bearish players, in case of their activity, the supports of the daily cloud (1.0697-1.0620) and the monthly medium-term trend (1.0577) may be of interest. On the other hand, bullish players, in the event of strengthening bullish sentiments, may encounter resistance from the daily Ichimoku cross (1.0795-1.0837-1.0854-1.0880) and the areas of convergence of weekly and monthly levels (1.0823-1.0863).

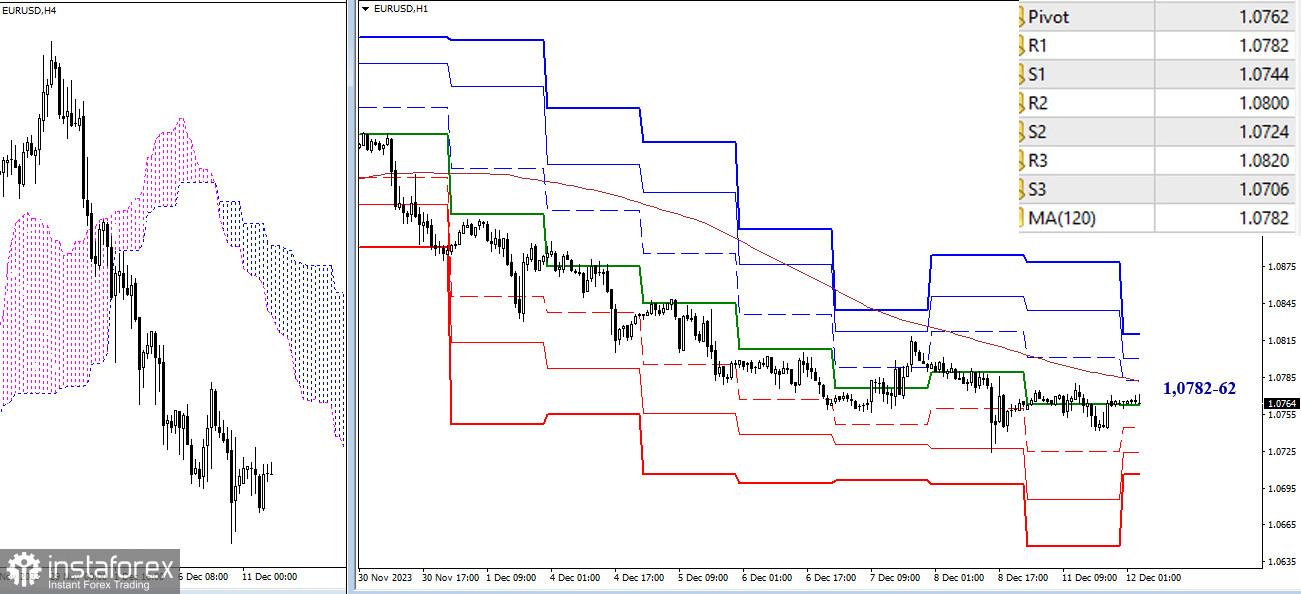

H4 – H1

On lower timeframes, corrective movement, instead of rising to new upward targets, is forming in a sideways, horizontal direction. Key levels today are in a small range of 1.0782-62 (central pivot point + weekly long-term trend). Breaking these boundaries and a reversal of the movement can change the current balance of power and shift attention to new targets, such as 1.0800-1.0820 (resistances of classic pivot points). In the case of bearish strengthening, levels within the day that may matter are 1.0744-1.0724-1.0706 (supports of classic pivot points). In this scenario, it is important for bearish players to exit the current correction zone at 1.0724 (low) and continue the decline.

***

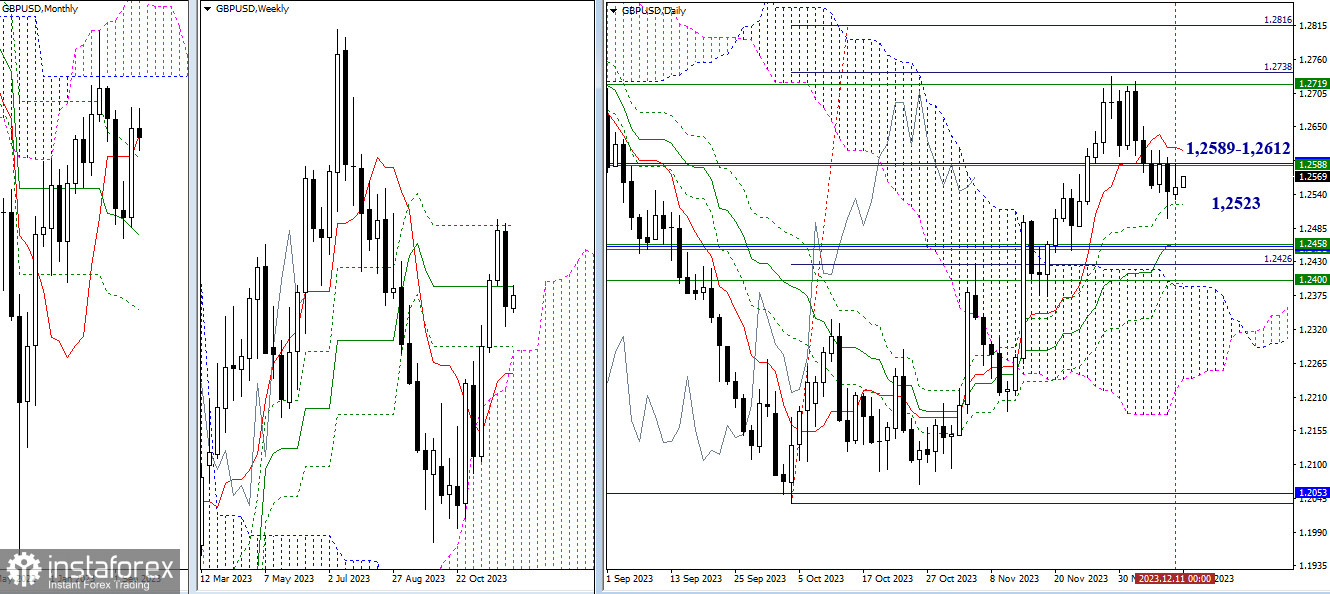

GBP/USD

Higher Timeframes

The past day did not bring any significant developments. The pair remains undecided between the daily support (1.2523) and the convergence of the weekly medium-term trend (1.2589) and the monthly short-term trend (1.2588). Just above is the daily short-term trend (1.2612). A breakout of these resistances will allow bullish players to refocus attention on the task of eliminating the weekly death cross, the final level of which is currently at 1.2719. If the bearish scenario materializes, the interests of bearish players will be directed towards overcoming the nearest support zone (1.2458-1.2390), where resistance levels of all higher timeframes are currently concentrated.

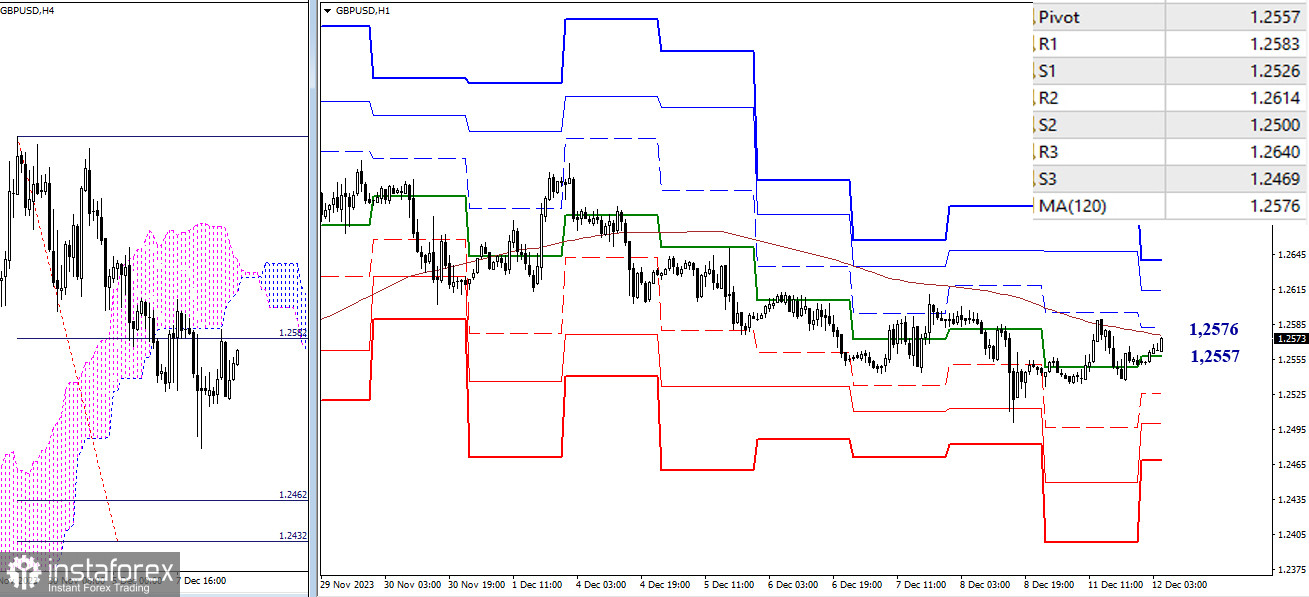

H4 – H1

On lower timeframes, the ongoing upward correction is currently testing the weekly long-term trend (1.2576). It is responsible for the current distribution of forces. Working below the moving average leaves the main advantage in favor of bearish players. Strengthening bearish sentiments today is possible through the overcoming of 1.2526-1.2500-1.2469 (supports of classic pivot points), updating 1.2501 (correction low), and achieving a breakout of the H4 cloud (1.2462-1.2432). In case of a trend breakout (1.2576) and working above the moving average, the main advantage will be gained by bullish players. Their targets within the day today may be the resistances of classic pivot points (1.2583-1.2614-1.2640).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)