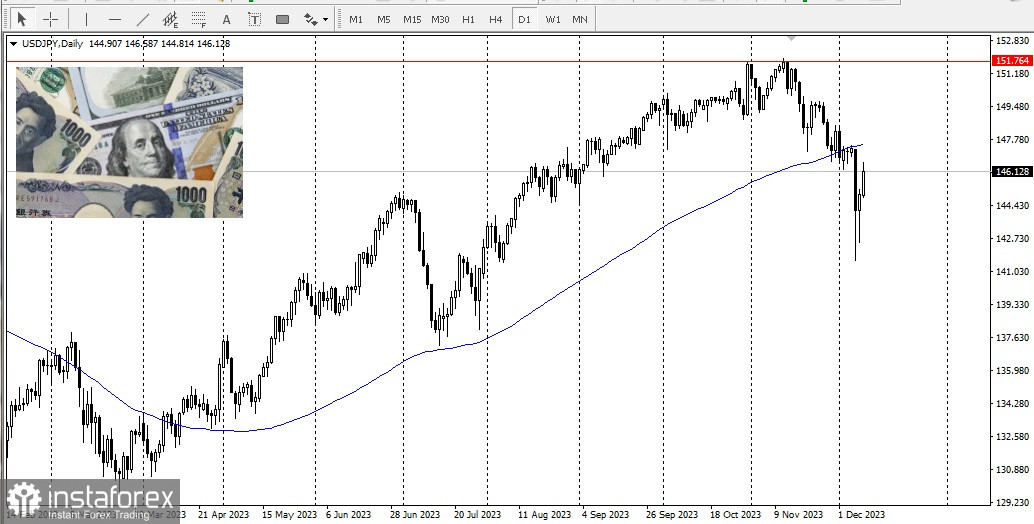

The Japanese yen has declined against the U.S. dollar for two consecutive days.

A report from Friday stated that comments from Bank of Japan Governor Kazuo Ueda were misinterpreted. Accordingly, the Central Bank will maintain the status quo as long as necessary. This addition to the weak GDP report of Japan highlights the fragility of the domestic economy, suggesting an exaggeration of expectations for an immediate interest rate hike, which, in turn, undermines the JPY.

On the other hand, relying on Friday's U.S. employment report, it is clear that job growth accelerated in November, and the unemployment rate fell to 3.7%. This indicates labor market strength, suggesting that current market prices for a rate cut in March 2024 were likely premature.

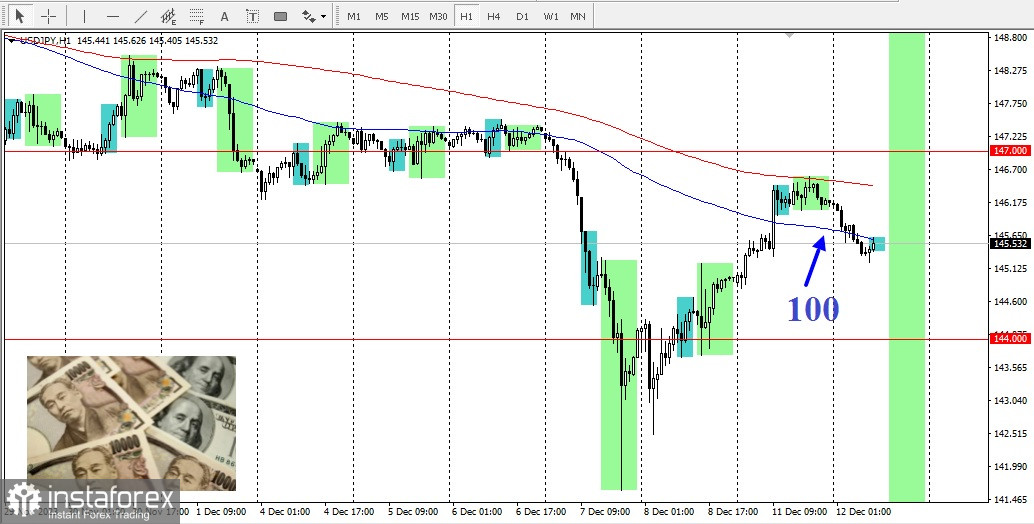

Nevertheless, yesterday's breach of the 100-hour simple moving average (SMA) can be attributed to technical purchases on sustained strength. However, concerns about a deeper global economic downturn and geopolitical risks may limit the safe-haven yen's losses and restrict further movement of this currency.

Also, ahead of key U.S. consumer inflation data on Tuesday and the crucial FOMC policy decision on Wednesday, traders should refrain from aggressive positions. However, currently, the driving force in the market is reports that downplay hopes for an imminent turn by the Bank of Japan.

From a technical perspective on the hourly chart, today, with an aggressive breakdown of the 100-hour SMA, surpassing the psychological level of 145.00, prices may head towards the 144.00 mark.

On the other hand, the round figure of 146.00, if bouncing back from the 100-hour SMA and surpassing the 200-hour SMA resistance, prices may end up around 147.00. But before positioning for further upward movement, it is necessary to wait for prices to return above the 100-hour and sustainably strengthen beyond the 200-hour SMA.

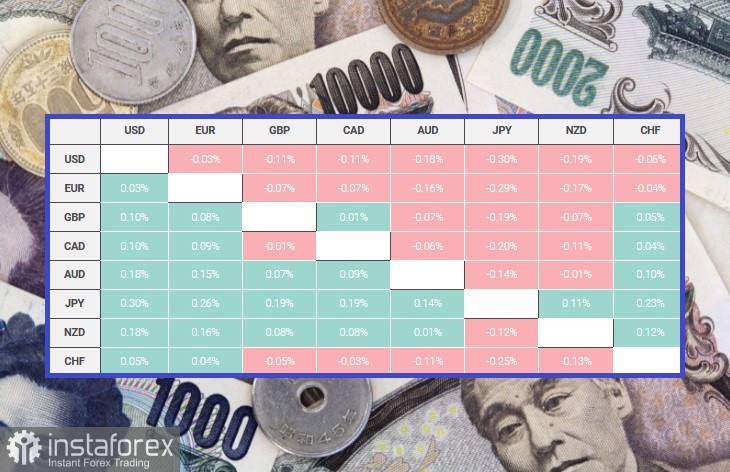

The table below shows the percentage change of the Japanese yen against major currencies.

The Japanese yen was the strongest against the U.S. dollar.