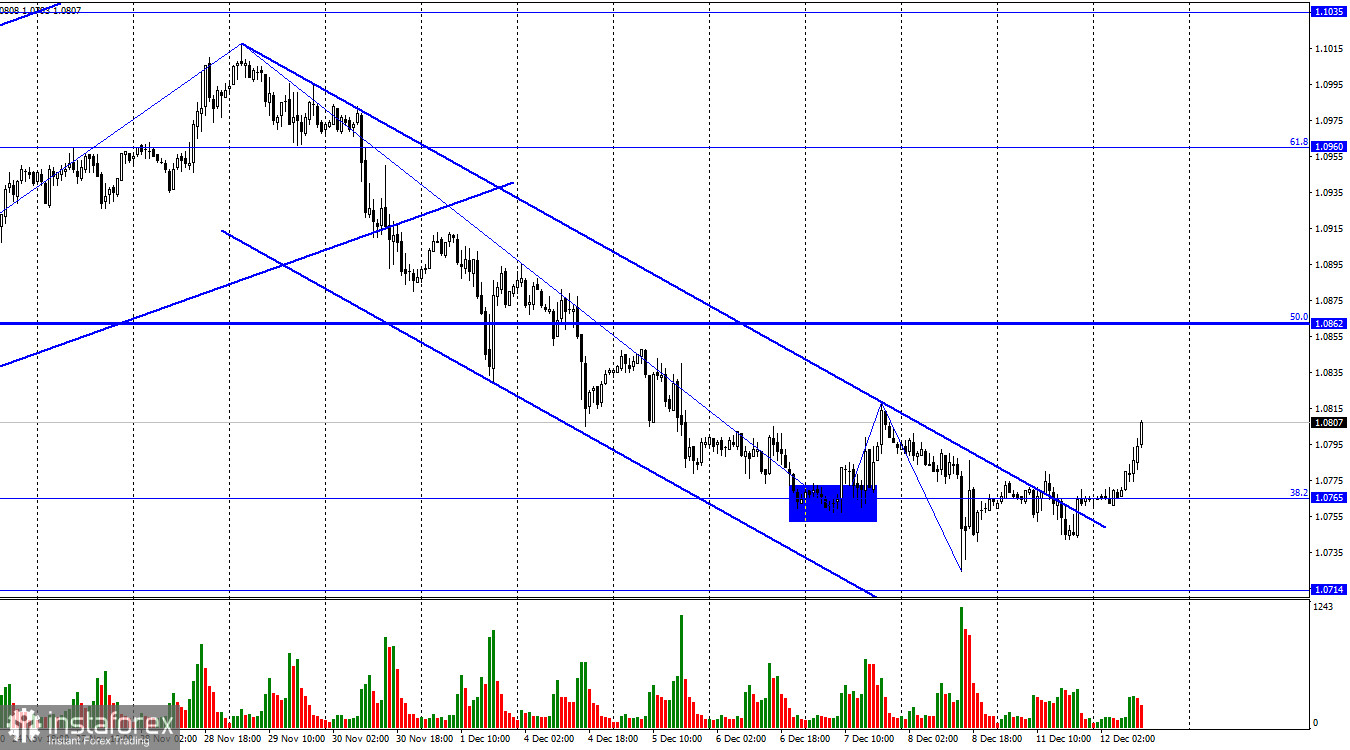

On Monday, the EUR/USD pair traded horizontally along the corrective level of 38.2% (1.0765). Today, a consolidation above the level of 1.0765 has been achieved, and a new upward movement towards the corrective level of 50.0% (1.0862) has begun. A bounce of the pair's rate from the level of 1.0818 (the peak of the last wave) will allow for expectations of a reversal in favor of the dollar and a resumption of the decline towards the level of 1.0714.

As of Tuesday, the wave situation remains simple and clear. The last downward wave broke the low of the previous wave, and the new upward wave has not even reached the last peak yet. Thus, grounds for expecting a change in the trend to "bullish" will only arise when the last peak (1.0818) is confidently broken (by more than just a few pips). Until that moment, the "bearish" trend persists, despite the quotes closing above the descending trend corridor.

On Monday, the information background was absent, which explains the traders' zero activity throughout the day. Today, the situation is already more interesting, and it will become even more intriguing after lunch. At the moment, two reports have been released, which, with a high degree of probability, triggered the rise of the European currency. The ZEW Economic Expectations Index in Germany in December stood at 12.8, compared to 9.8 in November, and a similar index in the European Union showed a value of 23.0, compared to 13.8 in November. Both indices significantly exceeded traders' expectations. Thus, the activation of the bulls is explainable.

However, in the second half of the day, the report on US inflation will be released, which may bring bears back to the market. I fully admit that this month the Consumer Price Index may decrease minimally or not decrease at all, which could trigger dollar purchases in the market since the probability of additional tightening of the Fed's monetary policy may increase slightly.

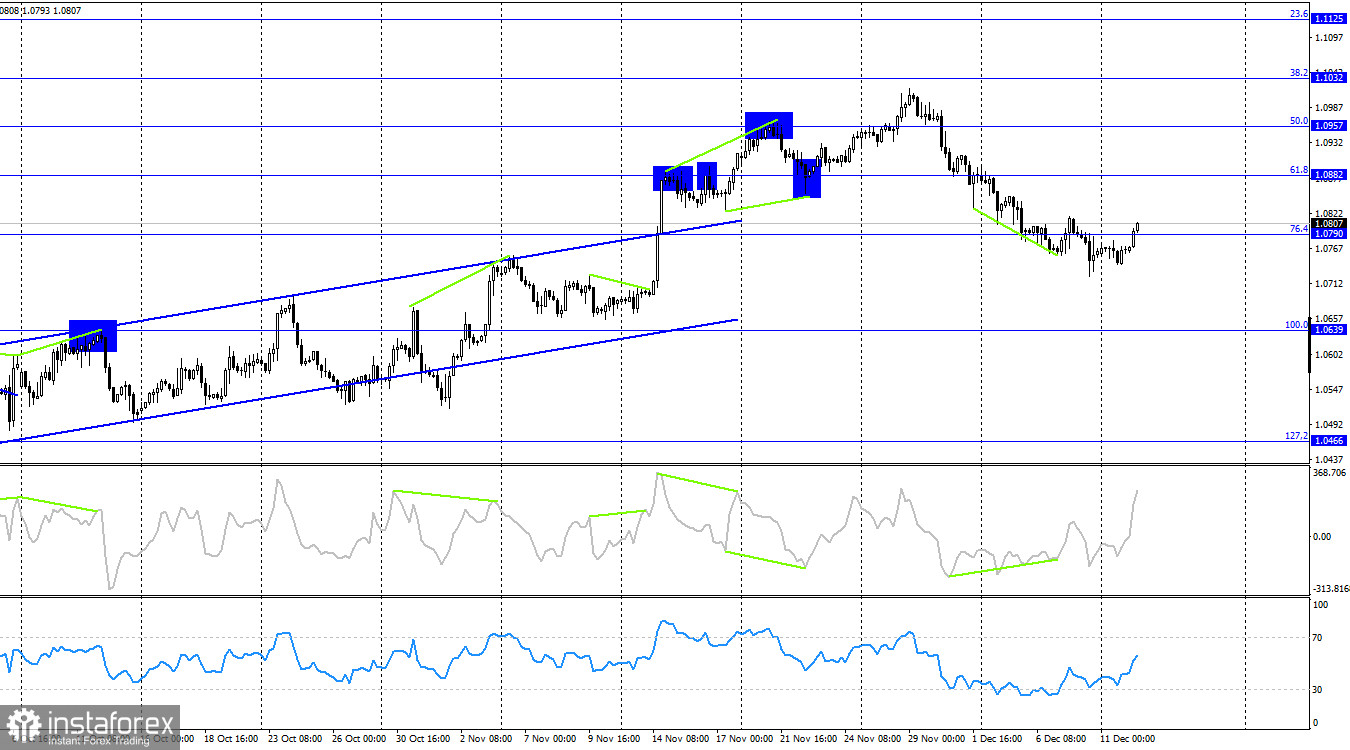

On the 4-hour chart, the pair has reversed in favor of the European currency and consolidated above the corrective level of 76.4% (1.0790), allowing for expectations of continued growth towards the next Fibonacci level at 61.8% (1.0882). The reverse consolidation of quotes below the level of 1.0790 will again work in favor of the US currency and the resumption of the decline towards the corrective level of 100.0% (1.0639). No impending divergences are observed in any of the indicators today.

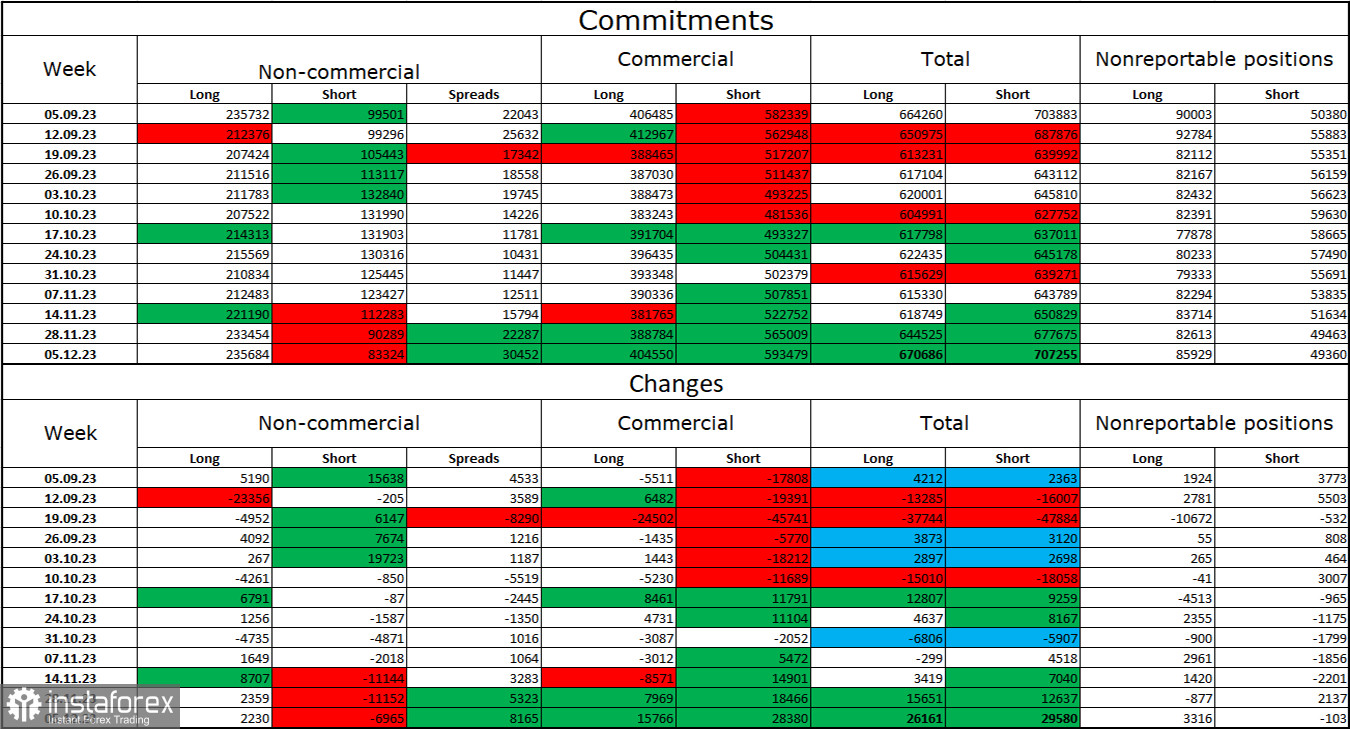

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2230 long contracts and closed 6965 short contracts. The sentiment of large traders remains "bullish" and is strengthening again. The total number of long contracts concentrated in the hands of speculators now stands at 235 thousand, while short contracts amount to only 83 thousand. The difference is again threefold. However, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background now, although the situation may change after the Fed and ECB meetings. Professional traders may resume closing Long positions soon. I believe that the current figures allow for the resumption of the euro decline in the coming months.

Economic Calendar for the US and the European Union:

EU - Economic Expectations Index (10:00 UTC).

EU - Germany's Economic Expectations Index (10:00 UTC).

US - Consumer Price Index (13:30 UTC).

On December 12th, the economic calendar contains three important entries, two of which are already available. The impact of the information background on traders' sentiment today can be quite strong.

Forecast for EUR/USD and Trader's Recommendations:

I recommended buying the pair yesterday when the quotes were consolidated on the hourly chart above the descending corridor with targets at 1.0818 and 1.0862. These trades can now be kept open. Sales today will be possible on a rebound from the levels of 1.0818 and 1.0862 with targets at 1.0765 and 1.0714.