The US inflation data was published at the start of Tuesday's US session. Nearly all components of the report matched forecasts, which means that inflation is slowing, but only gradually. On the one hand, this scenario works in favor of the EUR/USD bulls, especially ahead of the announcement of the results of the Federal Reserve's December meeting. On the other hand, this time the CPI did not land in the "red zone" (as it did last month), so there are no special reasons to increase "dovish expectations."

This is why the market's reaction is quite contradictory. The EUR/USD pair initially surged, rising more than 70 pips, and then it swiftly plunged back down, returning to previous levels. All of this happened within an hour after the report was published. It's worth noting that in such cases, it's difficult to trust either the bears or the bulls. Traders seem discouraged by this unipolar and simultaneously expected outcome. The fundamental puzzle has become more complicated: traders are left guessing how the Federal Reserve will react to the latest report on the US labor market (a decrease in unemployment, a decrease in average wages) and the latest inflation report. Both releases occurred during the blackout period when Fed members are not allowed to express their views publicly.

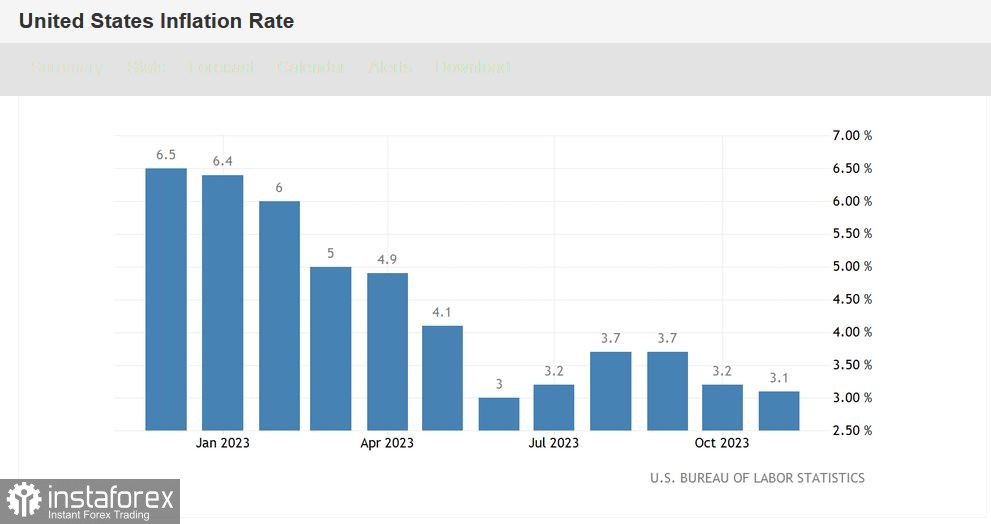

Now, let's return to the latest report. The Consumer Price Index (CPI) increased by 0.1% in monthly terms (with a forecast of zero growth). In annual terms, the indicator decreased to 3.1% (the slowest growth rate since June of this year).

The structure of the report indicates a significant decrease in energy prices (down to 5.4% on an annual basis), particularly a nearly 9% drop in gasoline prices. The cost of food increased by 2.9% in November (compared to a 3.3% increase in October), and clothing prices rose by 1.1% (compared to a 2.6% increase in October). New vehicles became 1.3% more expensive, while prices for used cars decreased by 3.8%. It is worth noting a significant increase in the cost of transportation services, which rose to 10.1% in November (compared to a 9.2% increase in October).

The core CPI, excluding food and energy prices, decreased to 4.0% on an annual basis. This is the same level as in October, marking the slowest growth rate since September 2022.

Unlike the October data, where all components were in the "red zone," almost all of the CPI indicators were in line with forecasts in November. Inflation continues to gradually slow down but not at an accelerated pace. This suggests that the Fed may maintain a "moderately hawkish" stance, refuting rumors that the central bank is ready to discuss easing monetary policy conditions.

At the same time, the Fed may leave the door open for further interest rate hikes. At the end of the previous meeting, Fed Chair Jerome Powell noted that the U.S. economy turned out to be "surprisingly robust," as evidenced by preliminary GDP data for the third quarter. In this context, he mentioned that if additional evidence of high inflation and economic growth emerges (and/or if the labor market significantly accelerates), the central bank may need another interest rate hike. In other words, in November, Powell "tied" the prospects of monetary tightening to key macroeconomic indicators. It can be assumed that in December, the central bank will again voice similar rhetoric, providing support to the greenback, considering the rise in dovish expectations.

However, an alternative dovish scenario cannot be ruled out, which would be reflected primarily in a reduction in the dot plot's point forecast. In fact, all inflation indicators in October (CPI, wages, Producer Price Index, core PCE index, import price index) demonstrated a downward trend, reflecting a slowdown in inflation in the United States. These reports were published after the November meeting. We just learned the November value of the CPI, the trajectory of which indicates further slowdown. Other indicators for November will be disclosed after the December meeting.

That's why traders are not rushing to conclusions: after a sharp surge to the 1.0830 level, the pair fell to 1.0760 but then rose again to the boundaries of the 1.08 figure. The latest economic data allows the Fed to point to a "half-empty" glass or declare that the glass is still half full. Amid such uncertainty, it would be better to maintain a wait-and-see position on the pair, as the latest report left more questions than answers.