Wednesday night will mark the conclusion of the first of three central bank meetings this week. This refers to the Federal Reserve (FOMC) meeting, which is rightfully considered the most important among them all. Investors were awaiting the US inflation data for November to try to understand whether there will be any changes in Fed Chair Jerome Powell's rhetoric. However, the report turned out to be almost neutral, showing neither a significant decline nor an increase in inflation. Therefore, we cannot draw any significant conclusions at this time.

On Tuesday, quotes initially rose by 25 pips and then fell by 50. In other words, we can consider it a weak reaction. Not as strong as last month when we saw a movement of 100 pips. This suggests that this time the market reacted more thoughtfully, and since there were no significant changes in the indicators, there is no reason to actively play out this report.

The same scenario will likely unfold on Wednesday night. The FOMC is highly unlikely to make any significant decisions, and Powell is unlikely to make statements during the press conference that would shock or even surprise the market. Most likely, there will be statements about the ongoing fight against high inflation, the need for more time for the impact of high rates to manifest, and the question of policy easing is not even on the agenda.

However, we expect an updated forecast for interest rates for 2024. Each voting member of the FOMC will present their vision of the trajectory of interest rates. Analysts expect these projections to be lowered by 50 basis points. In other words, FOMC members may reduce the average interest rate projection for the next year. This would signal that the results of the fight against inflation are being positively evaluated, and next year the central bank will move towards rate cuts. However, I want to remind you that the European Central Bank and the Bank of England will also be lowering rates next year.

Based on all of the above, it appears that the market's reaction to the results of the FOMC meeting may be similar to their reaction to the inflation report—fairly weak and not likely to have a significant impact on the wave analysis.

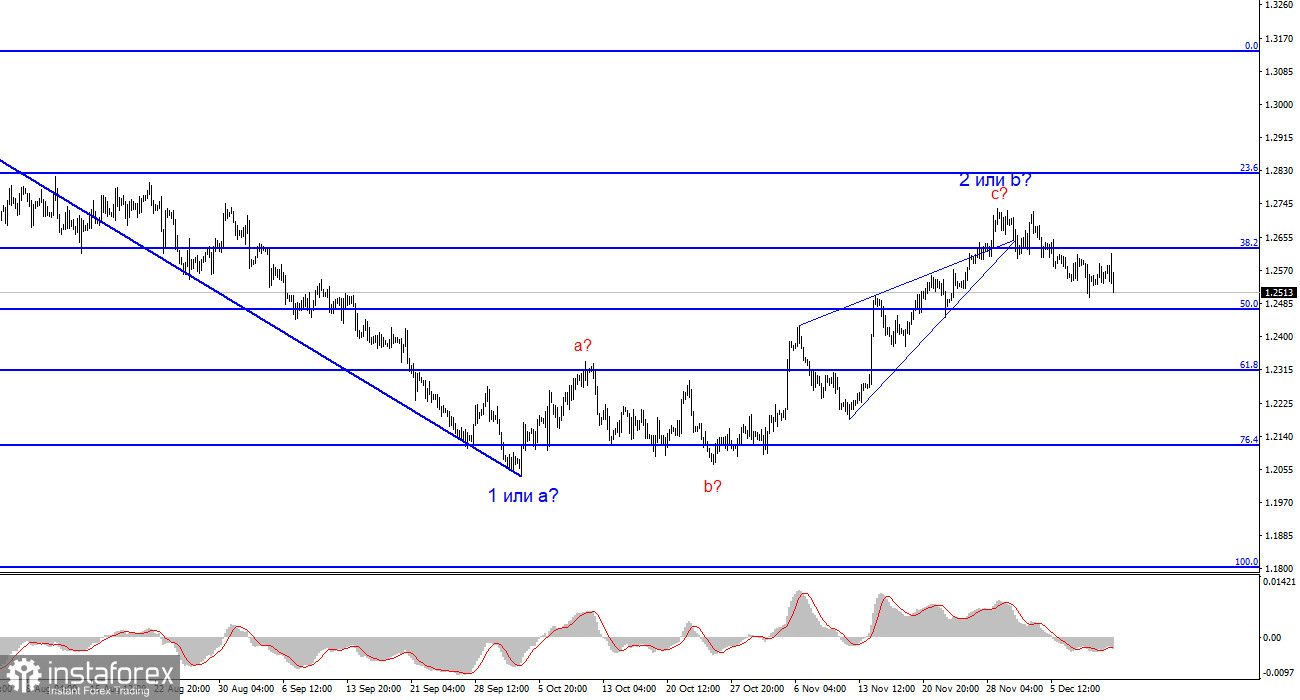

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.