GOLD

Higher Timeframes

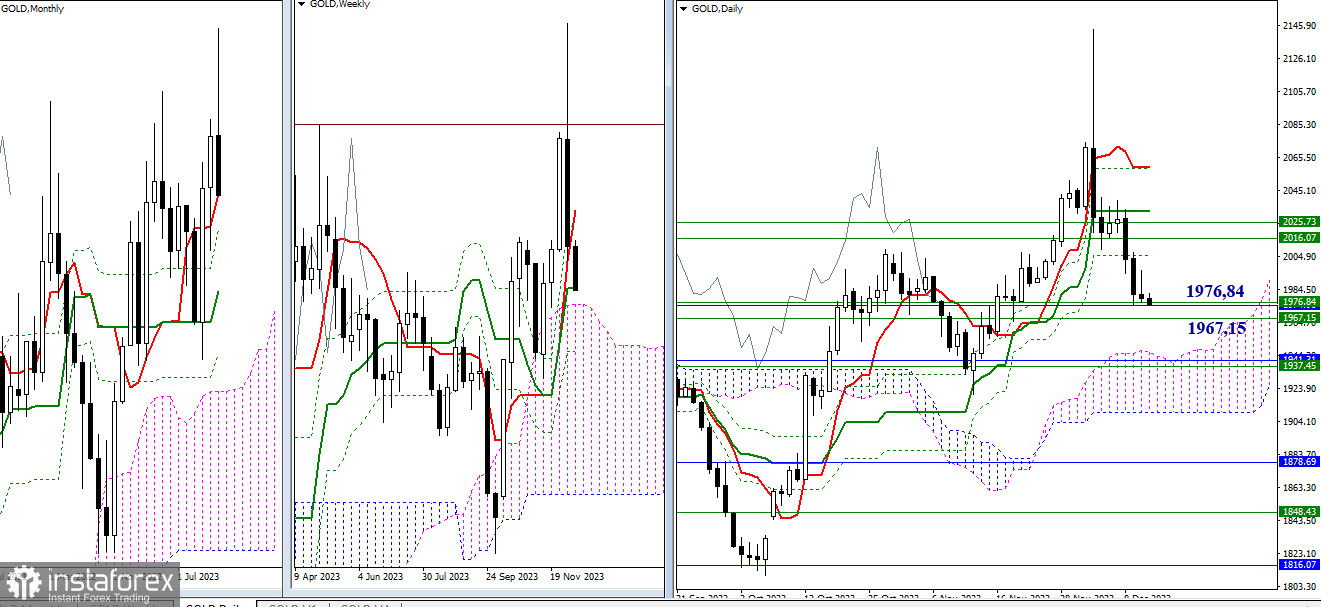

Gold in early December updated its high, forming a new historical high (2,143.74). However, it was not possible to maintain the height and consolidate at the achieved level. As a result, even the monthly corrective decline has already been fulfilled according to the first target orientation—the monthly short-term trend (1,976.84) has been tested. The current interaction with the encountered support zone of 1,967.15 – 1,976.84 (weekly medium-term trend + upper boundary of the weekly cloud + monthly short-term trend) will determine the possibilities for further development of the situation.

A rebound and a return to the bullish side of recently lost levels, forming a currently wide resistance zone led by weekly thresholds (2,016.07 – 2,025.73) and daily short-term trend (2,059.59), will allow considering prospects for restoring the situation above previous highs (2,080.15 – 2,143.74) through further strengthening of bullish positions. In this case, the prospects for bullish players can only be new historical highs.

The breakdown of 1,967.15 – 1,976.84 and the continuation of the decline will open up a series of supports for bears, varying in strength and significance. The nearest ones today are located around 1,941.51 – 1,937.45 (monthly and weekly Fibonacci Kijuns + upper boundary of the daily cloud).

H4 – H1

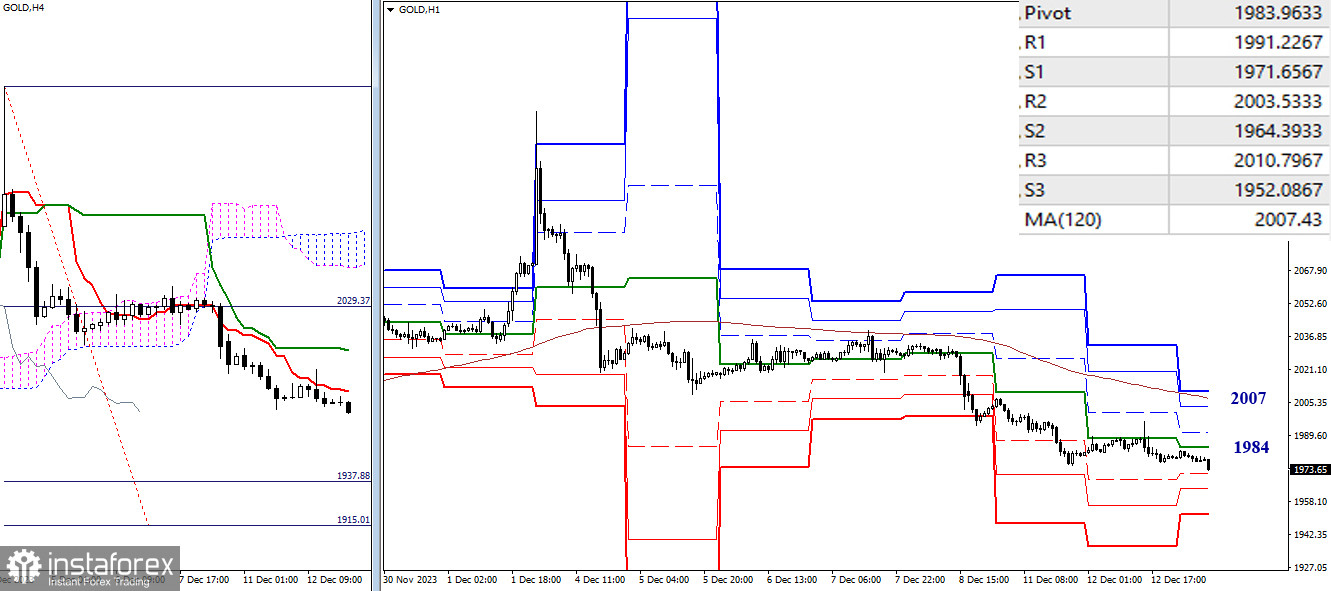

The main advantage on lower timeframes now belongs to the bears. They have completed another correction, updated the low, and continue to decline. Among the bearish intraday targets, the first to be tested will be the supports of classic pivot points (1,971.66 – 1,964.39 – 1,952.09), and then bears are waiting for targets for breaking through the H4 cloud (1,915.01 – 1,937.88).

If sentiments and priorities change, and bullish players return to activity, the development of the upward correction today will go through the testing and overcoming the resistance of pivot points (1983.96 – 1991.23 – 2003.53). The main and most important level for bulls, in this case, is the weekly long-term trend (2,007.43), which is responsible for the current balance of power. The breakout and reversal of the long-term trend may change the current balance of power in the market.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)