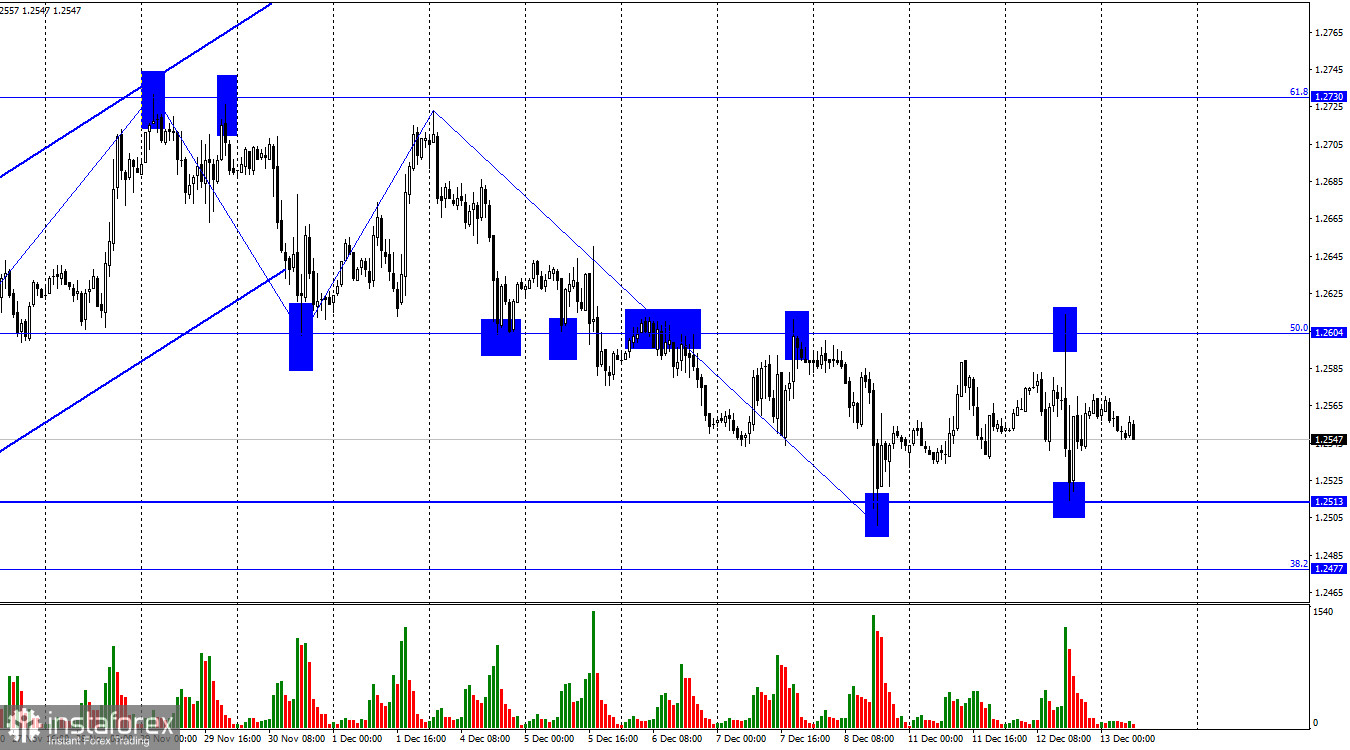

On the hourly chart, the GBP/USD pair experienced growth yesterday towards the corrective level of 50.0% (1.2604) and bounced off it. The pair then declined to the level of 1.2513 and rebounded from it. Subsequently, it returned to the middle of the horizontal channel 1.2513–1.2604, and at the moment, it is falling towards 1.2513. A new bounce from this level will favor the British pound and upward movement towards 1.2604. Fixing quotes below the zone of 1.2477–1.2513 increases the probability of further formation of a "bearish" trend.

The wave situation did not change yesterday but it showed that the pair could transition to horizontal movement. The last upward wave only slightly surpassed the peak of the previous wave by a few points, and the last downward wave (also yesterday) did not even break the previous low. Thus, the waves are approximately equal in size now, and the price is strictly between the levels of 1.2513 and 1.2604. It is necessary to wait for the quotes to exit this zone or for a wave to form that will break the previous peak or low.

The information background for the British pound was interesting yesterday and remains so today. I would like to remind you that yesterday, unemployment and wage reports were released in the UK. Although they minimally affected traders' sentiment, the reports themselves cannot be called secondary. This morning, the GDP and industrial production reports were released. The former showed a contraction in October of 0.3%, which traders were not prepared for, and the latter showed a decrease of 0.8%, although the market expected a decline of no more than 0.1%. Both reports failed, prompting the activation of bears, who started to get rid of the British pound again. However, a strong zone of 1.2477–1.2513 is located below, and it will not be easy to overcome it. I think the decline of the British pound will not last long. In the evening, the FOMC meeting results will be announced.

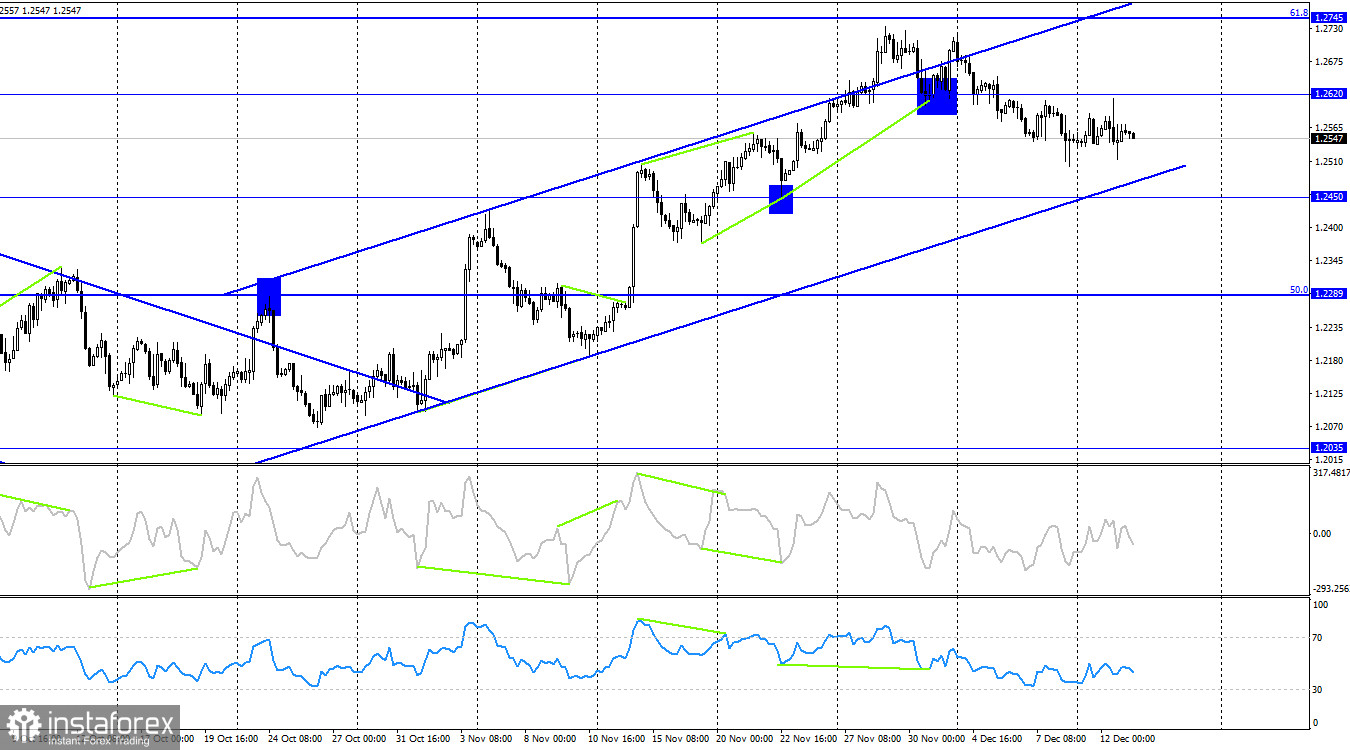

On the 4-hour chart, the pair consolidated below the level of 1.2620, allowing it to count on a continuation of the decline towards the next level of 1.2450. Earlier, I mentioned that a drop to the lower line of the ascending corridor would be quite logical. A rebound of the pair's rate from this line or the level of 1.2450 will allow the British pound to start the growth process, but I am currently more inclined to consider the option of closing below the corridor and continuing the pound's decline.

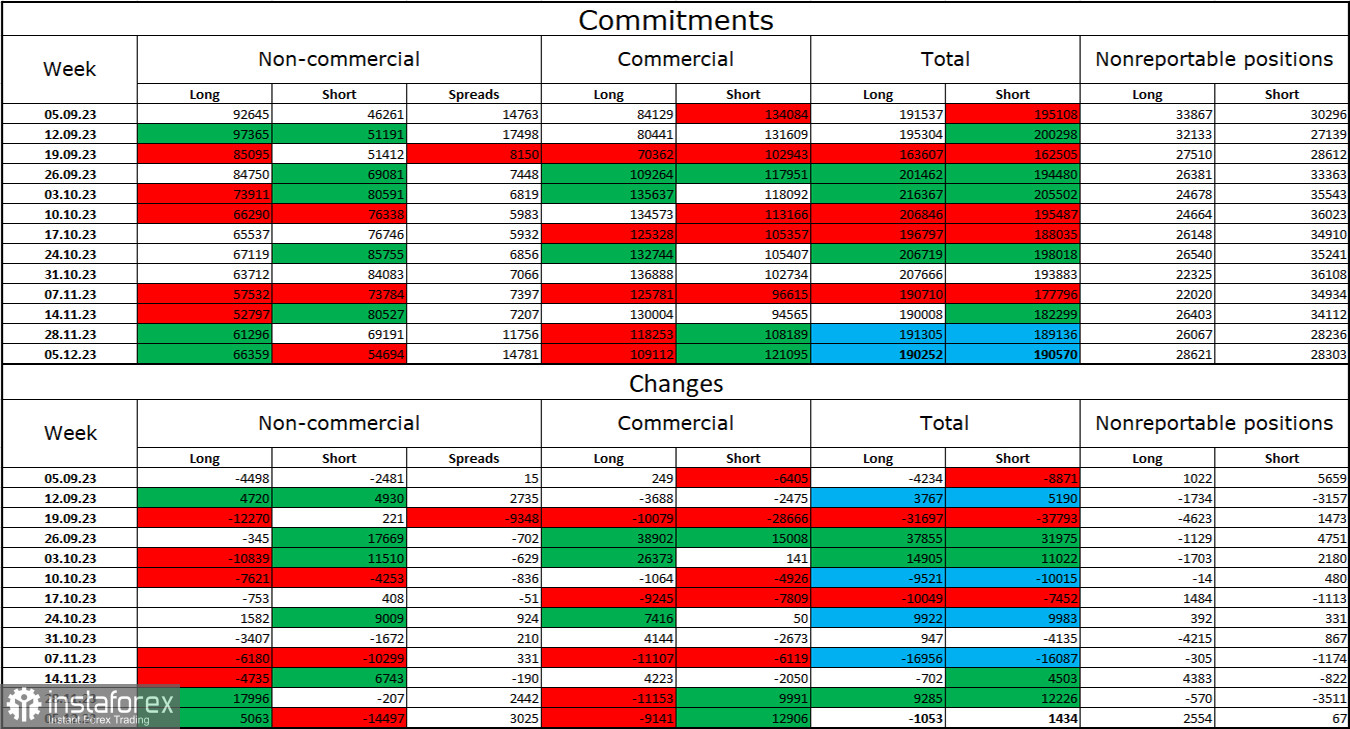

Commitments of Traders (COT) Report:

The sentiment of the "non-commercial" trader category over the last reporting week has become more "bullish." The number of long contracts held by speculators increased by 5063 units, while the number of short contracts decreased by 14497 units. The overall sentiment of major players changed to "bearish" several months ago, but at present, bulls are attacking again. The gap between the number of long and short contracts is now widening in favor of the bulls: 66 thousand versus 55 thousand. In my opinion, excellent prospects for the continuation of the decline persist for the British pound. I still do not expect a significant rise in the pound sterling soon. I believe that the growth we have seen in the last one and a half months is corrective.

News Calendar for the US and the UK:

UK – Change in GDP volume in October (07:00 UTC).

UK – Industrial Production (07:00 UTC).

US – Producer Price Index (13:30 UTC).

US – FOMC Rate Decision (19:00 UTC).

US – FOMC Statement (19:00 UTC).

US – FOMC Press Conference (19:30 UTC).

Wednesday's economic events calendar includes quite important entries, with the FOMC meeting and everything related to it being particularly highlighted. The impact of the information background on market sentiment today can be strong.

GBP/USD Forecast and Trader's Recommendations:

I advised selling the British pound when it consolidated below the level of 1.2604, with a target of 1.2513. This level has been worked out. Sales could also be made on the rebound from the level of 1.2604. New sales are possible when closing below the zone of 1.2477–1.2513 with a target of 1.2407. Purchases are possible on today's rebound from the level of 1.2513, with a target of 1.2604.