Tonight, the results of the last FOMC meeting of the current year will be announced. It can be said right away that this meeting does not claim the title of "most interesting" or "important." It does not even claim the title of simply "interesting." The market almost does not doubt that interest rates will not change, and all the interesting details can be gleaned from Jerome Powell's speech. What are the possible scenarios, and how can they affect the dollar exchange rate?

The first scenario assumes the maintenance of "hawkish" rhetoric by Powell. This scenario suggests that the Fed President will announce the high risks of new inflation hikes, forcing the regulator to keep rates at peak levels for a longer period than previously forecast. There should also be words about the readiness to raise rates again if the situation requires it. Analysts do not believe too much in this scenario.

The second scenario assumes maintaining the rate but without words about possible tightening in the future. Most FOMC members will abandon the idea of the need to raise the rate at least once more. The "dot-plot" chart will show three rate cuts next year.

The third scenario assumes that inflation is confidently decreasing, reducing the likelihood of new policy tightening and increasing the likelihood of rate cuts in the first half of next year. The "dot-plot" chart will show no fewer than four rate cuts next year.

As we can see, everything tonight will depend on the "dot-plot" chart, which (if anyone does not remember) reflects forecasts for rates over the next few years made by FOMC members. In simpler terms, based on this chart, we can find out how many times the rate is planned to be changed next year, according to the current opinion of the FOMC committee. This is quite important information. At present, the market expects five rate cuts, so almost any value on the "dot-plot" chart will be lower, and the market may perceive this as a reason to increase demand for the dollar.

Jerome Powell's speech will also be of significant importance. He may say about his readiness to raise the rate again, or he may not. He may talk about the high risks of inflation acceleration, or he may report on suitable rates of its slowdown. Depending on the rhetoric voiced, the market will make decisions tonight and in the near future. No one can predict Powell's speech, so all that remains is to wait for his speech and official information from the FOMC.

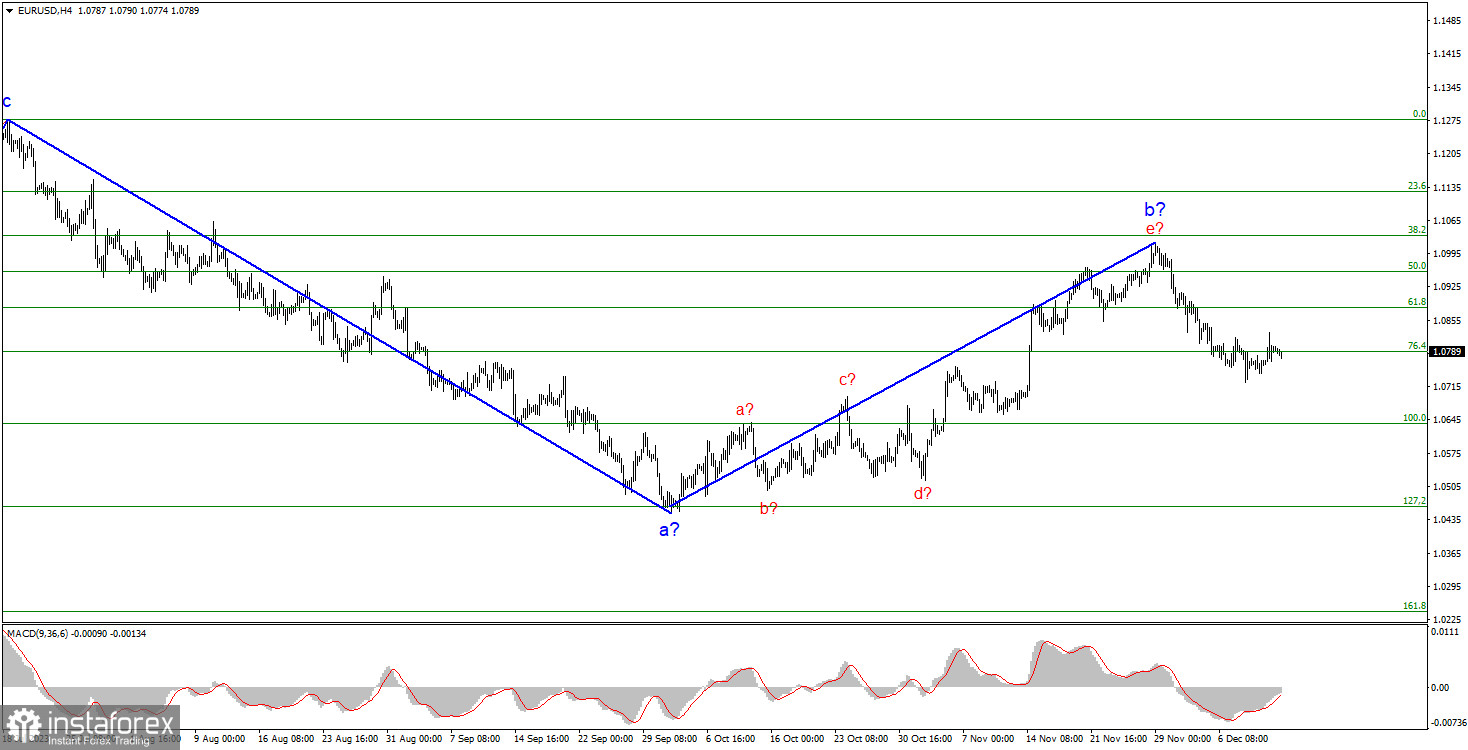

Based on the analysis conducted, I conclude that the construction of a bearish wave set continues. Targets around the 1.0463 level have been perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of a descending impulse wave 3 or c with a significant drop in the instrument. I still recommend selling with targets located below the low of wave 1 or a. At present, wave 2 or b can be considered complete.

The wave pattern of the pound/dollar pair implies a decrease within the descending trend section. The maximum the British pound can count on is a correction. At present, I can recommend selling the pair with targets below the 1.2068 level, because wave 2 or b must eventually end and can end at any moment. And the longer it lasts, the stronger the decline of the British will be. The narrowing triangle is a harbinger of the completion of the movement.