If you look at the chart, it might seem that the Federal Reserve lowered the key rate yesterday. And although this is not the case, to some extent, it is not that far from the truth. Firstly, the Fed lowered the inflation forecast for 2024, while simultaneously raising the forecast for the pace of economic growth. Secondly, Fed Chair Jerome Powell explicitly said that Federal Open Market Committee members are discussing the timing of the start of interest rate cuts. And although no specific timelines were mentioned, we can still arrive at the conclusion that the US central bank will no longer raise the key interest rate, and the first cut is likely to take place early next year. This was enough for the dollar to show broad weakness.

However, it is still too early to say that the dollar will continue to lose its positions. Now it's the Bank of England's turn, and its results may be exactly the same. Most likely, the British central bank will also announce the gradual start of an interest rate cut cycle. This, in turn, will introduce some corrections and exert pressure on the pound. Of course, the BoE's impact is not as significant as that of the Fed, so we shouldn't outright expect the pair to return to the values it was at before the FOMC meeting. Rather, it will resemble a fairly substantial pullback.

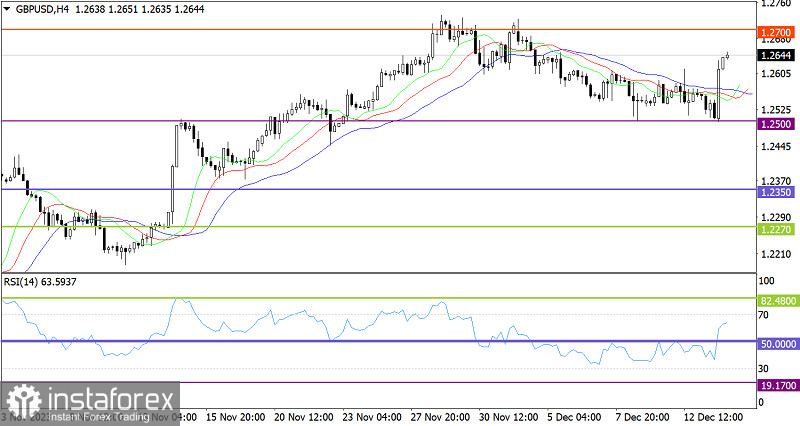

Amid the US dollar's broad weakness, the GBP/USD pair has shifted to rapid growth. The level of 1.2500 serves as support, and we observed that long positions have increased in relation to this level.

On the 4-hour chart, the RSI upwardly crossed the 50 middle line, indicating an increase in the volume of long positions.

On the same timeframe, the Alligator's MAs have changed direction from that of descending to ascending. This technical signal suggests a possible end of the corrective cycle from the level of 1.2700.

Outlook

In case the pound climbs further, the price could move towards the resistance level of 1.2700, and the British currency may completely recover its value compared to the recent corrective movement. It is worth noting that a sharp price change over a short period can lead to a local overbought condition in the short-term timeframes.

The complex indicator analysis points to the recovery process in the pound in the short-term, medium-term and intraday periods.