The EUR/USD currency pair sharply surged on Wednesday after Powell uttered the words "further rate hikes are unlikely." This phrase alone led to a 100-point drop in the dollar, and now the current technical picture is becoming very interesting. Some may argue that the market has shown its commitment to the upward direction, and now we should only expect the pair to rise. However, we consider yesterday's surge to be another illogical market reaction.

Let's be honest; everyone understood that the Fed would eventually end the tightening cycle. Even if, theoretically, the American regulator could raise the rate one more time, it would not change much. The market already believes that the Fed will cut the rate 4-5 times next year. Powell yesterday spoke of three rounds of easing in 2024. This means that the market is pricing in a more "dovish" scenario, and theoretically, the dollar could have even shown growth yesterday since Powell does not support the scenario of five rate cuts. However, as is often the case, the market reacted impulsively, panically, and emotionally. Powell stated for the first time that the monetary policy tightening cycle is effectively complete, and based on this, the dollar plummeted like a stone.

However, we want to remind you that the Fed's rate has not changed; it is 1% higher than the ECB's rate, and the ECB currently has many more reasons and grounds to move towards easing monetary policy. In the European Union, economic growth has been absent for several quarters, and inflation has fallen to 2.4%. In the United States, the economy is growing rapidly, and inflation is at 3.1%. In the current circumstances, who needs a rate cut more? Therefore, we believe that Christine Lagarde may echo Powell's words about the start of policy easing next year. If the market does not start selling the euro, it means we are entering another period of illogical euro growth, during which it can rise to any level without any macroeconomic or fundamental support.

The ECB must follow in the footsteps of the Fed.

In principle, everything has already been said about the upcoming ECB meeting. We still believe that the economy of the European Union is in a much less favorable position than the US economy. Inflation in the EU is lower, so Lagarde has no reason to talk about possible additional tightening. At the same time, she has every reason to announce that the rate will start to decrease next year. How should the market react to this "dovish" rhetoric? Only by selling the euro.

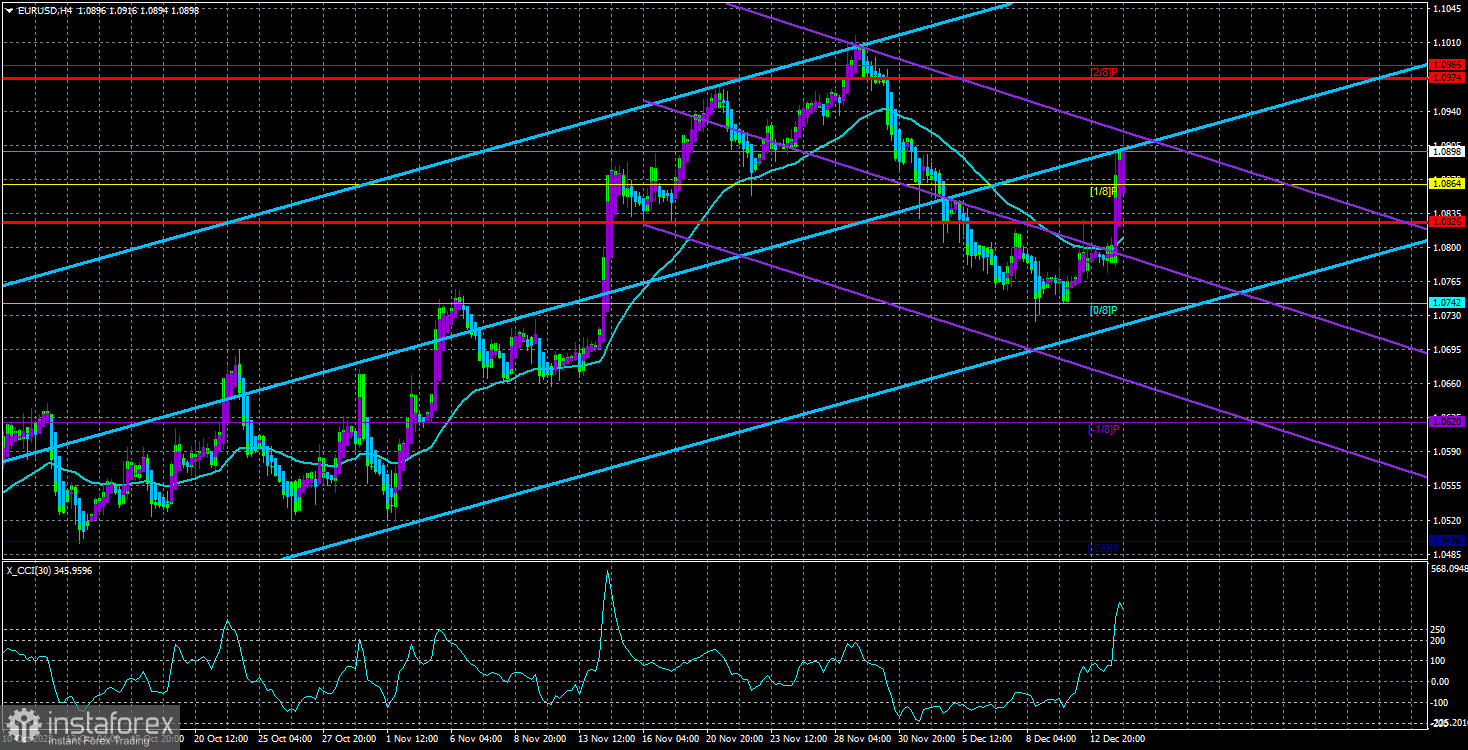

Let's take a closer look at the technical picture. After yesterday's 100-point surge in the pair, the CCI indicator, for the fourth time recently, entered the overbought zone. The previous three times were barely worked out during the period from November 29 to December 8. But now we see a new entry into the extreme zone. What does this indicate? A new drop in the pair is looming. And it may happen today since the ECB and the BoA meetings will surely provoke a market reaction. The entire last surge can be interpreted only as a correction. In the 24-hour timeframe, the entire last surge can also be interpreted only as a correction. That is, on all timeframes, we are currently witnessing a correctional pullback in quotes upward. If so, then the descending trend should resume soon.

Is there a basis for the euro to grow in the long term? From our point of view, no. If the ECB starts cutting rates next year, demand for the euro cannot grow. Both central banks and both currencies are currently in roughly equal conditions. Perhaps the market will manage to keep the pair in the current range, but the growth of the European currency over the next 6–12 months is possible only with complete disregard for fundamentals and macroeconomics.

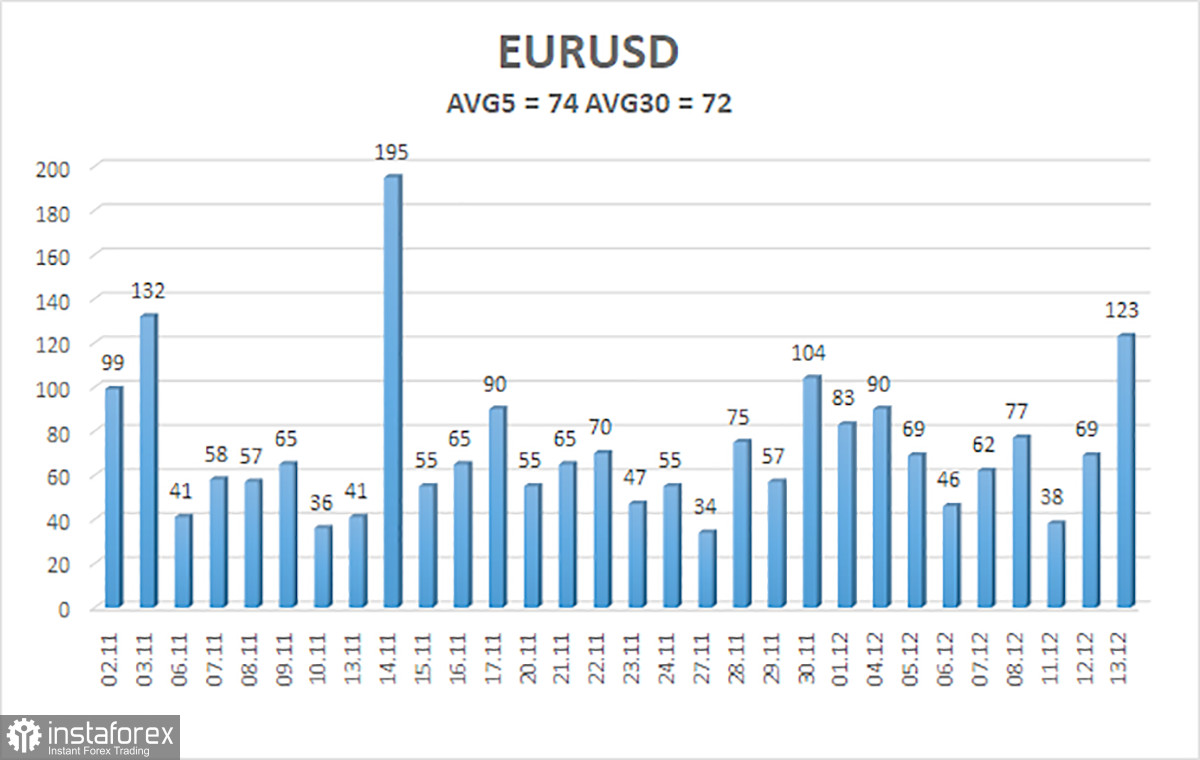

The average volatility of the euro/dollar currency pair over the last 5 trading days as of December 14 is 74 points and is characterized as "average." Thus, we expect movement in the pair between the levels of 1.0826 and 1.0974 on Thursday. A reversal of the Heiken Ashi indicator back down will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair settled above the moving average line yesterday, but we do not believe that the rise can continue. Formally, you can remain in long positions with targets at 1.0974 and 1.0986 until the Heiken Ashi indicator reverses down. However, the new overbought condition of the CCI indicator suggests a more likely fall. Short positions can be considered with a reverse fixation below the moving average, with a target at 1.0620. Today, the ECB meeting could well provoke a fall in the European currency.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.