The Federal Reserve kept the key interest rate unchanged in the range of 5.25%-5.50% and hinted at a potential rate cut as early as next year. It also published its forecasts for macroeconomic indicators for the next three years, the most interesting of which should be the one for inflation because it will directly influence the central bank's decisions on interest rates. According to the report, the Fed expects inflation to fall to 2.4% in 2024, slightly lower than the previous forecast of 2.5%. The figure should decrease to 2.2% by 2025.

Although Fed Chairman Jerome Powell stated that interest rates seem to have hit the peaks, he mentioned that it could be raised if necessary. However, by next year, taking into account the forecast of rising unemployment to 4.1%, there may be a 0.75% decrease. Risk appetite surged because of this news.

Undoubtedly, easing inflation and a noticeable decline in the number of new jobs, economic activity and business activity will convince the Fed to start reducing interest rates in the new year to avoid a recession. In such a case, a rally in the stock markets will take place, while Treasury yields will decrease with interest rate cuts still at attractive levels. Dollar will also come under pressure.

Futures on major stock indices in Europe and the US have already begun to rise. And although dollar started to decline, the ICE dollar index remains slightly above 102.00. However, it may fall to 100.00 by the end of the week.

Forecasts for today:

EUR/USD:

The pair rose in price due to expectations that the Fed will begin easing rates early next year. Even if it falls to 1.0875 today, it will resume its upward movement and head towards 1.1000.

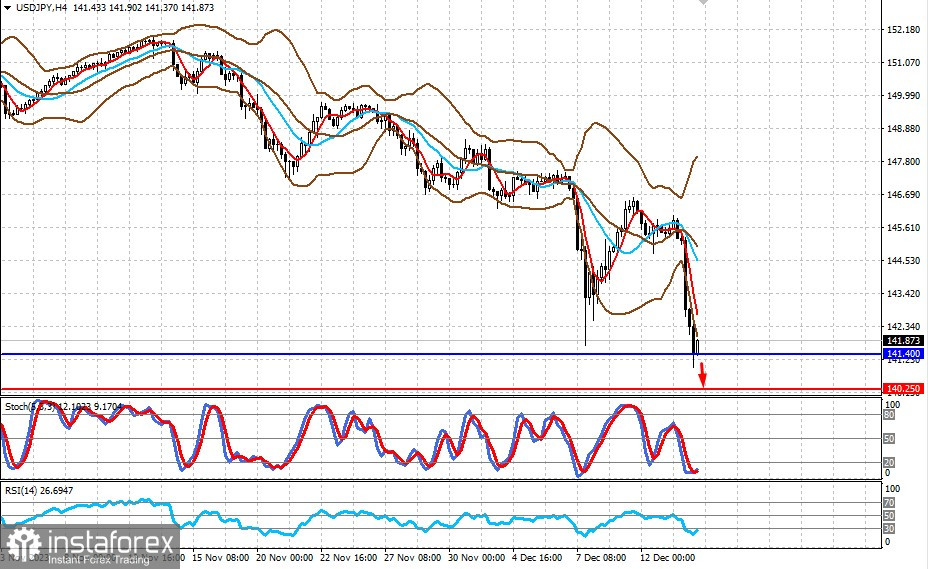

USD/JPY:

The pair, after a slight upward move, will resume its decline towards 140.25 after surpassing 141.40.