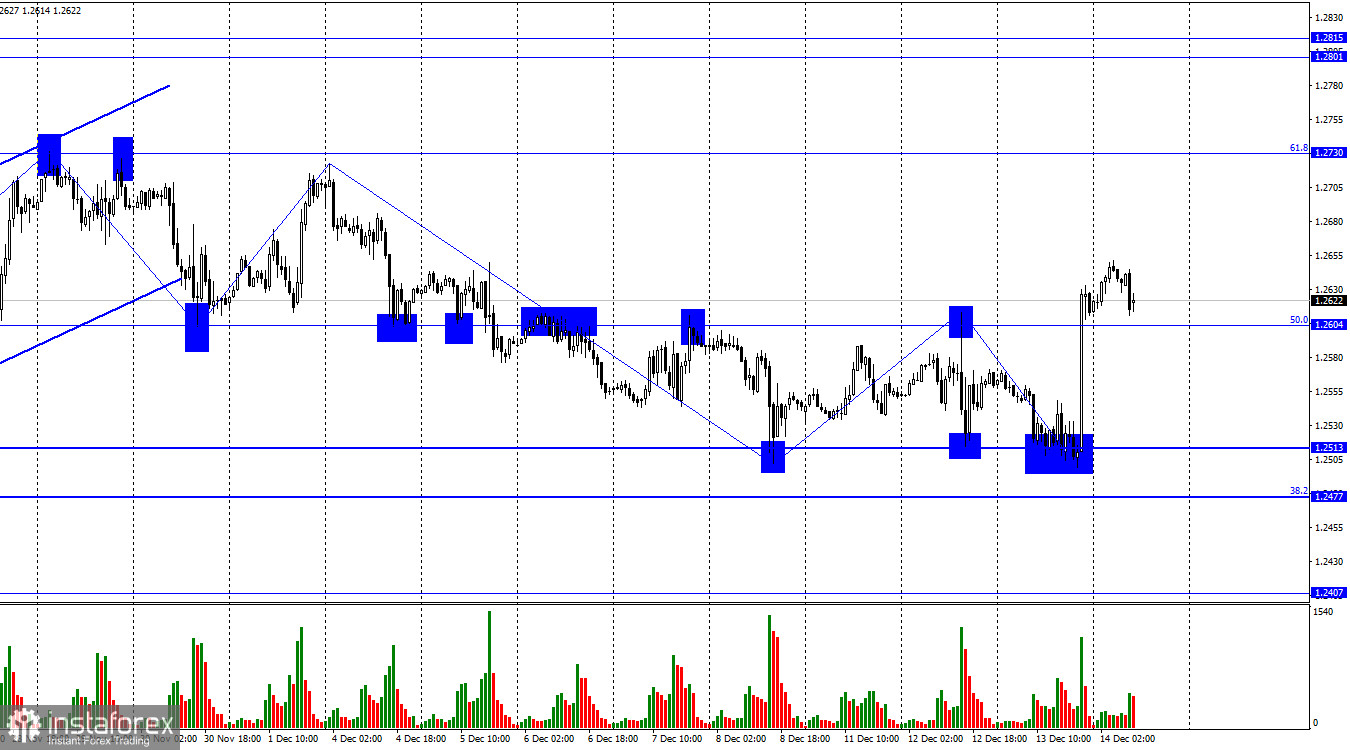

On the hourly chart, the GBP/USD pair rebounded yesterday from the level of 1.2513, reversed in favor of the British currency, and rose, consolidating above the Fibonacci level of 50.0% (1.2604). Thus, based on the chart pattern, the upward movement may continue today toward the next corrective level of 61.8% (1.2730). However, I caution traders: yesterday's growth was triggered by Powell's "dovish" statements, and today similar "dovish" information may come from the ECB or the Bank of England. The decline of the pound today cannot be ruled out. Closing the pair's rate below the level of 1.2604 will allow traders to expect a decline to the zone of 1.2477–1.2513.

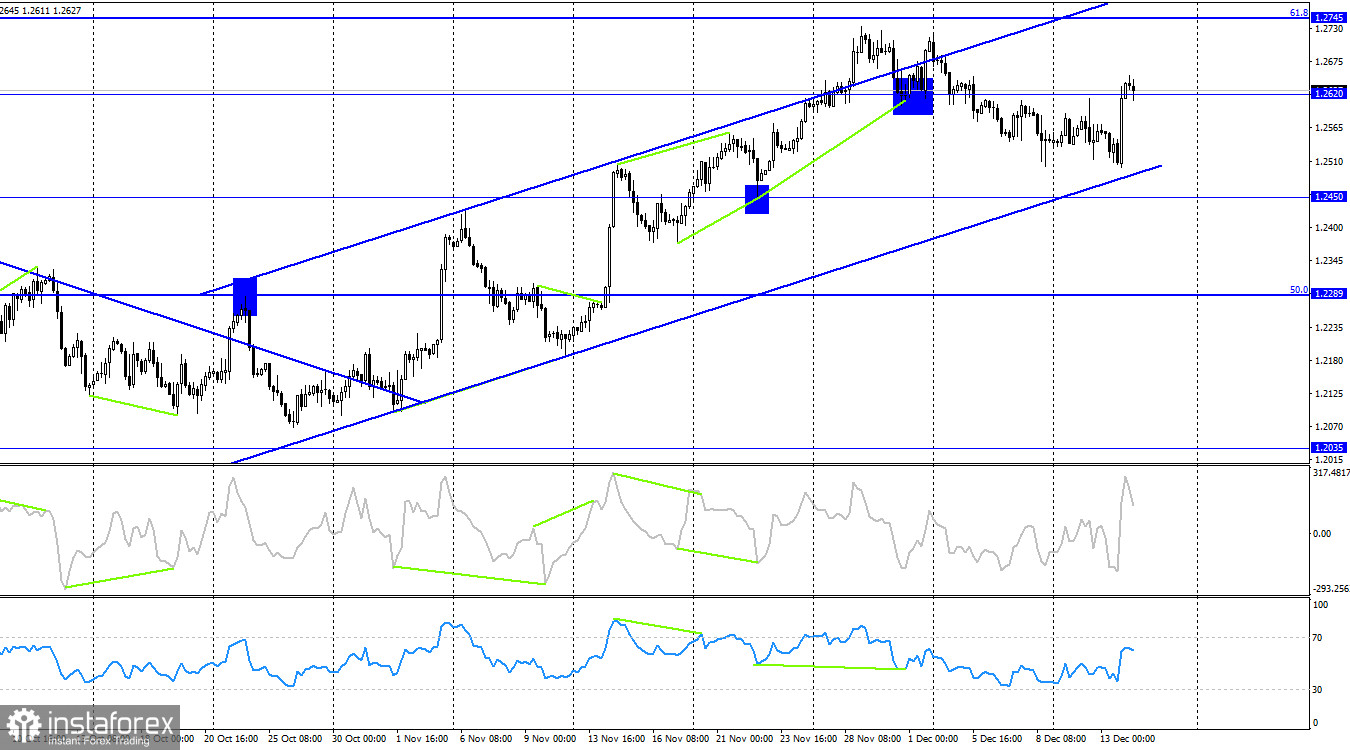

The wave situation changed slightly yesterday. The last upward wave broke the peak of the previous wave, and the last downward wave failed to break the previous low. Thus, we have two signs of a trend reversal to the "bullish" side. However, I would like to remind you once again that yesterday's growth was not the result of the bulls' long work. Today, bears can easily take the initiative back if the results of the ECB meeting are also "dovish." Today and tomorrow, pay less attention to the waves and more to the information background.

In a few hours, the ECB and the Bank of England will announce the results of their last meetings this year. Rates are expected to remain the same with a 99% probability, but accompanying statements may reflect regulators' plans for the next year. Since most traders expect interest rate cuts in 2024 from all central banks, I will not be surprised if today we hear and see a large number of "dovish" signals. The pound may fall back to 1.2513, and the euro may follow suit.

On the 4-hour chart, the pair reversed in favor of the British pound and consolidated above the level of 1.2620. I draw your attention to the fact that the reversal occurred near the lower line of the ascending trend corridor. The growth process may continue towards the Fibonacci level of 61.8%–1.2745, and there are no imminent divergences with any indicator today. I remind you that today the pair's movement will depend on the information background rather than the chart pattern.

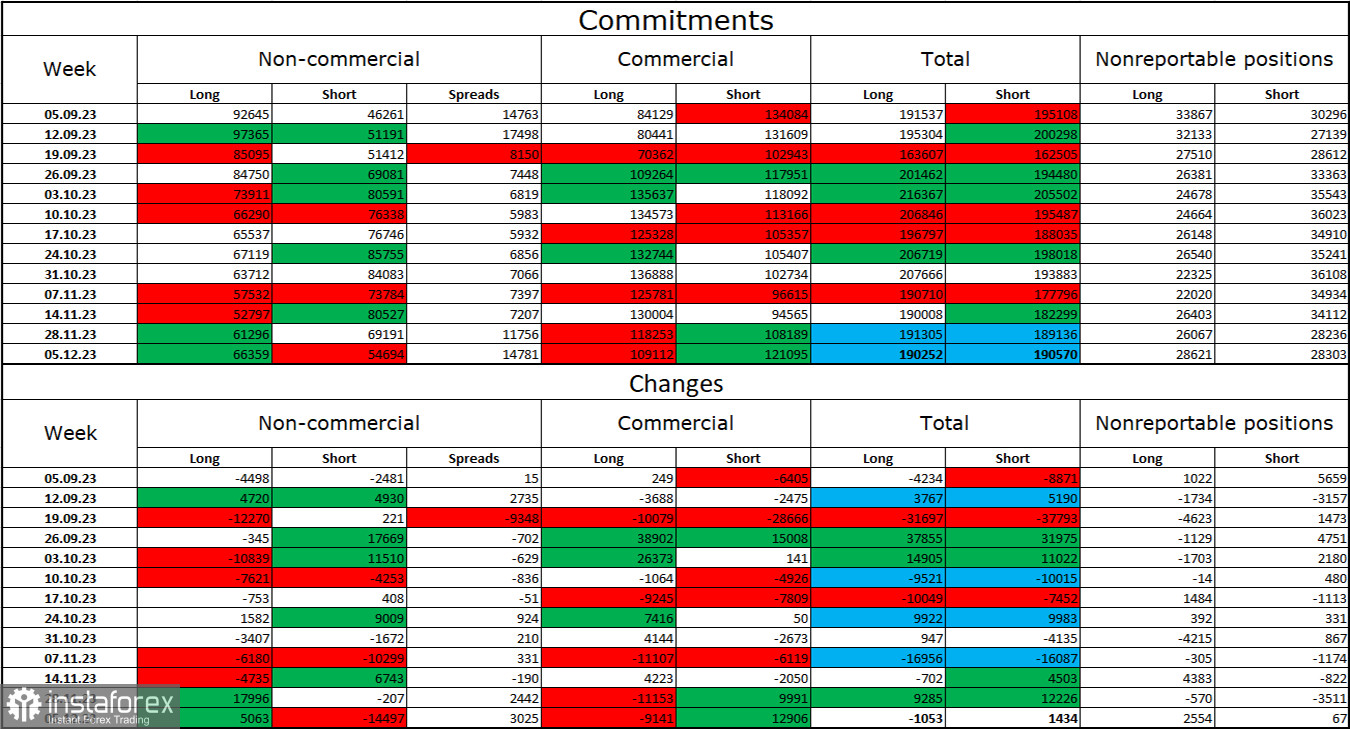

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become more "bullish." The number of long contracts in speculators' hands increased by 5063 units, while the number of short contracts decreased by 14497 units. The overall mood of large players changed to "bearish" a few months ago, but at the moment, bulls are attacking again. The gap between the number of long and short contracts is now increasing in favor of the bulls: 66 thousand versus 55 thousand. In my opinion, excellent prospects for further decline remain for the pound. I still do not expect a strong rise in the pound soon. I believe that over time, bulls will continue to get rid of Buy positions since the information background is currently playing in favor of the dollar. The growth we have seen in the last month and a half, in my opinion, is corrective.

Economic Calendar for the US and the UK:

UK – Bank of England Rate Decision (12:00 UTC).

UK – MPC Official Bank Rate Votes (12:00 UTC).

UK – Bank of England Press Conference (12:00 UTC).

US – Retail Sales MoM (13:30 UTC).

US – Initial Jobless Claims (13:30 UTC).

On Thursday, the economic calendar contains many important entries, with the Bank of England meeting and everything related to it standing out. The impact of the information background on market sentiment today can be strong again.

Forecast for GBP/USD and trader's recommendations:

I advised selling the pound on consolidation below the level of 1.2604 with a target of 1.2513. This level has been worked out. Sales today can be considered close below the level of 1.2604 with a target of 1.2513. Buying was possible on a rebound from the level of 1.2513 with a target of 1.2604. This target has also been worked out. Buy positions can be held with a stop loss below 1.2604 and a target of 1.2730.