In the previous overview, I drew your attention to two of the most important phrases that Federal Reserve Chair Jerome Powell voiced on Wednesday evening. These two phrases became the starting point for the dollar's "journey to the bottom." However, the troubles of the US currency did not end there. While the European Central Bank, for the most part, did not make any important decisions, the Bank of England surprised the market by maintaining its hawkish stance. With inflation at 4.6% annually, such an outcome could be expected, but many analysts still expected the BoE to somewhat loosen its stance.

BoE Governor Andrew Bailey became the second culprit in the decline in demand for the US currency. During his speech, he announced that the monetary committee is not currently discussing a rate cut, and its current level may be raised. The fact that the BoE is still the only central bank among the "big three" that allows for further tightening certainly boosted the pound. And the pound pulled the euro up with it. Bailey also stated that there is still much work to be done to bring inflation down to the target level. "Markets form their own view. But we are more cautious than markets", Bailey said.

"I see that inflation is decreasing, and this is very good, but wages are still rising too fast, and global geopolitical instability can cause an increase in energy prices, which will also affect prices," the BoE head believes.

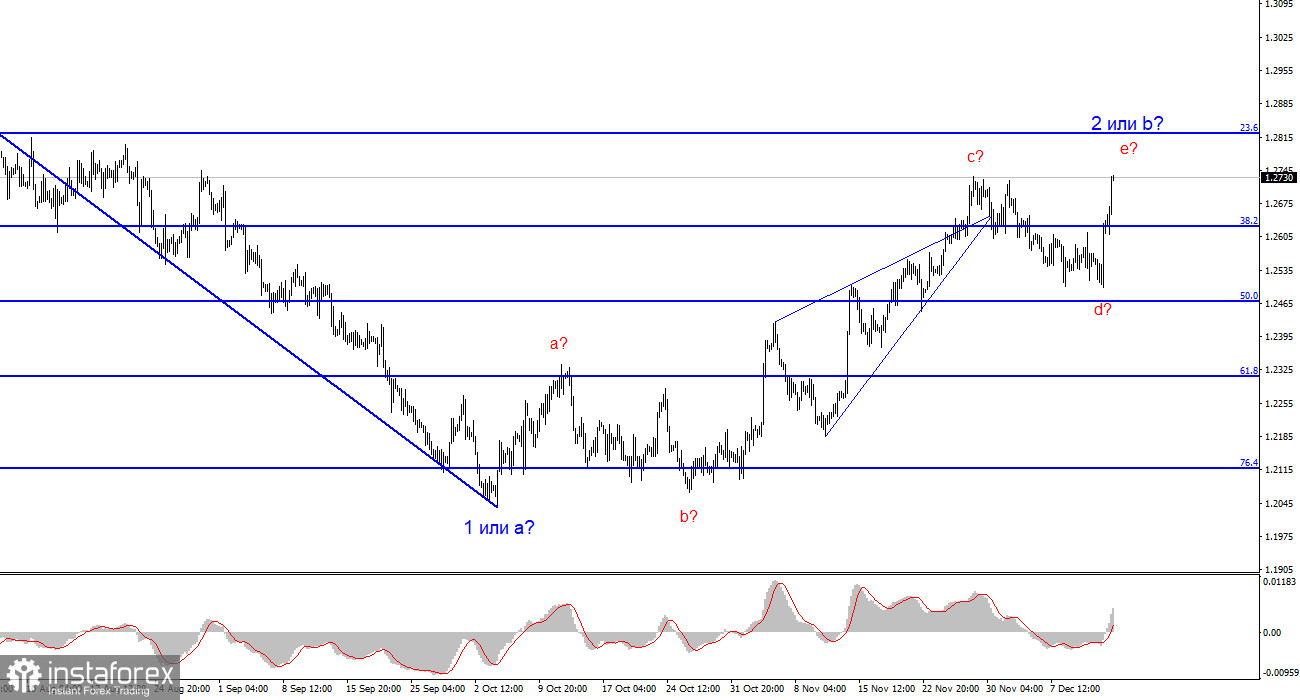

Based on everything mentioned, we can conclude that the BoE remains the only hawkish bank. Even if it no longer raises interest rates, the pound may continue to enjoy high demand. Overall, there is currently little support for the pound, but the "central bank factor" may be enough for it to rise for some time. The wave analysis for the pound is currently complicated, and there are no entry points for selling. It certainly looks appealing to buy right now, but I want to remind you that trying to predict such growth is not only impossible but also impractical. At the moment, wave 2 or b has already taken a five-wave form, so it could be completed at any time.

What should traders do? Wait for good signals, wait for MACD divergences, wait for positive news from the United States, wait for new UK inflation data. If inflation continues to decline, the likelihood of further tightening automatically drops to zero. And this will reduce demand for the British pound.

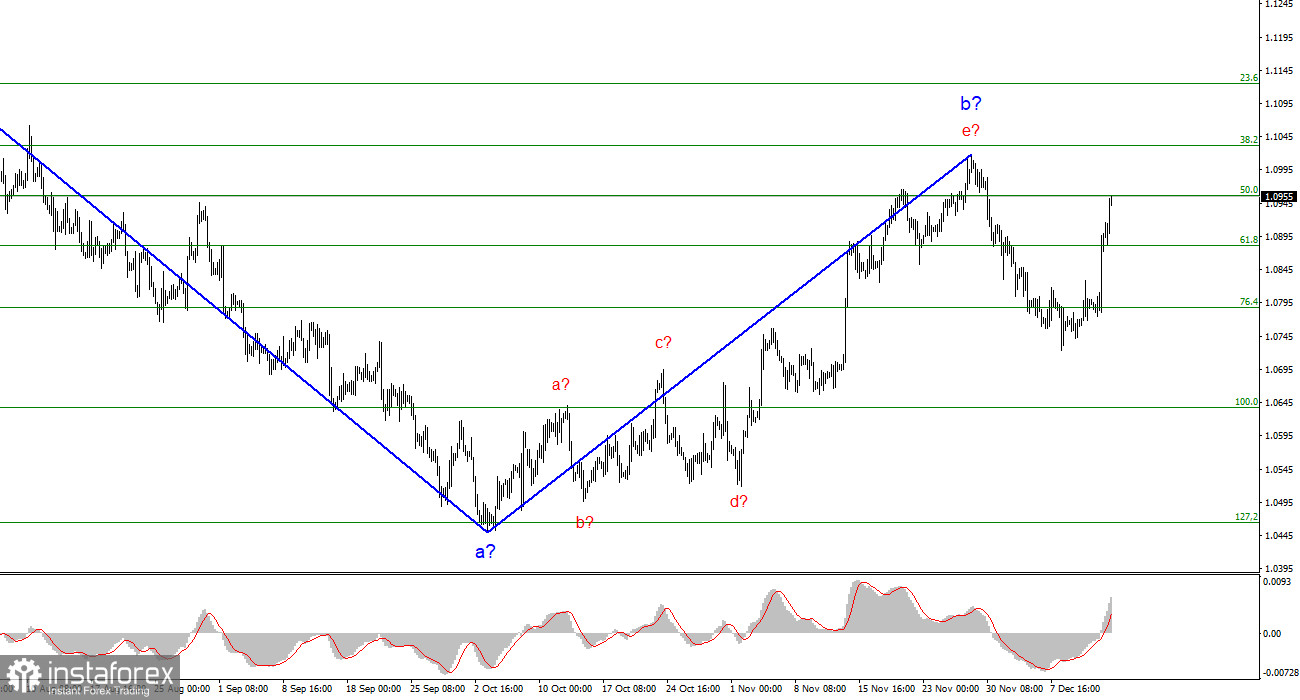

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave c in 2 or b can be used for short positions, and the order limiting possible losses on transactions can be placed above it.