EUR/USD

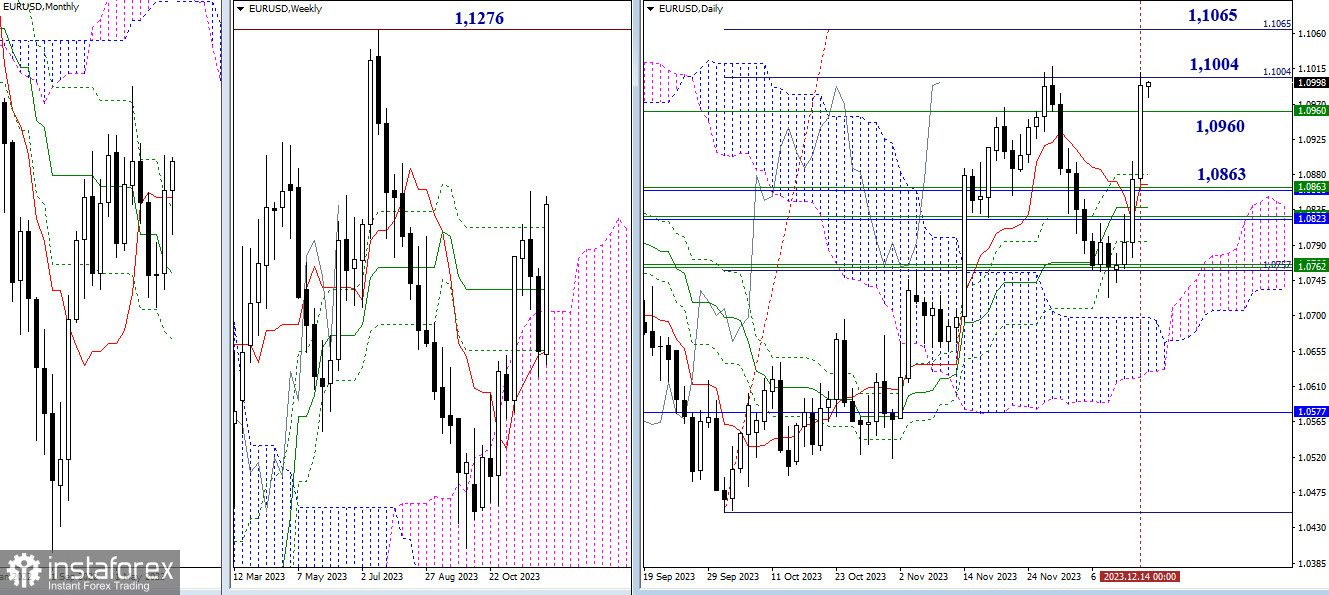

Higher Timeframes

Bulls were again active yesterday, allowing them to test the previous target levels of 1.0960 – 1.1004. The next significant milestone in the upward movement is the 100% completion of the target on the breaktout of the daily Ichimoku cloud (1.1065). After eliminating the weekly death cross and achieving the daily target, attention will be on forming new highs in this direction; for this, bulls must update their old achievements. The nearest previous high is currently located at 1.1276. The levels reached yesterday are now transformed into supports, which, in the event of a decline, will meet the pair at the levels of 1.0863 – 1.0823 – 1.0762.

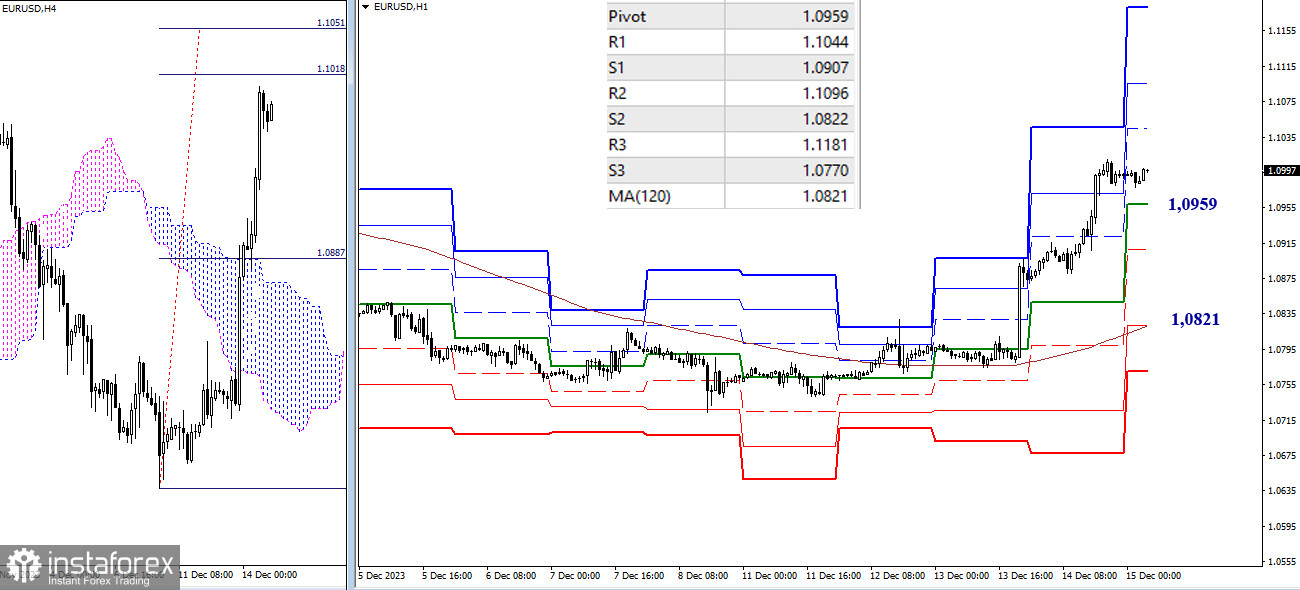

H4 – H1

On the lower timeframes, bulls are close to testing the target for breaking the H4 cloud (1.1018 – 1.1051). In addition, resistance benchmarks of classic pivot points are prepared for them within the day (1.1044 – 1.1096 – 1.1181). In the event of a shift in priorities and the development of a downward correction movement, key supports today are located at significant distances: 1.0959 (central pivot point of the day) and 1.0821 (weekly long-term trend), with intermediate support on this path possibly provided by S1 (1.0907).

***

GBP/USD

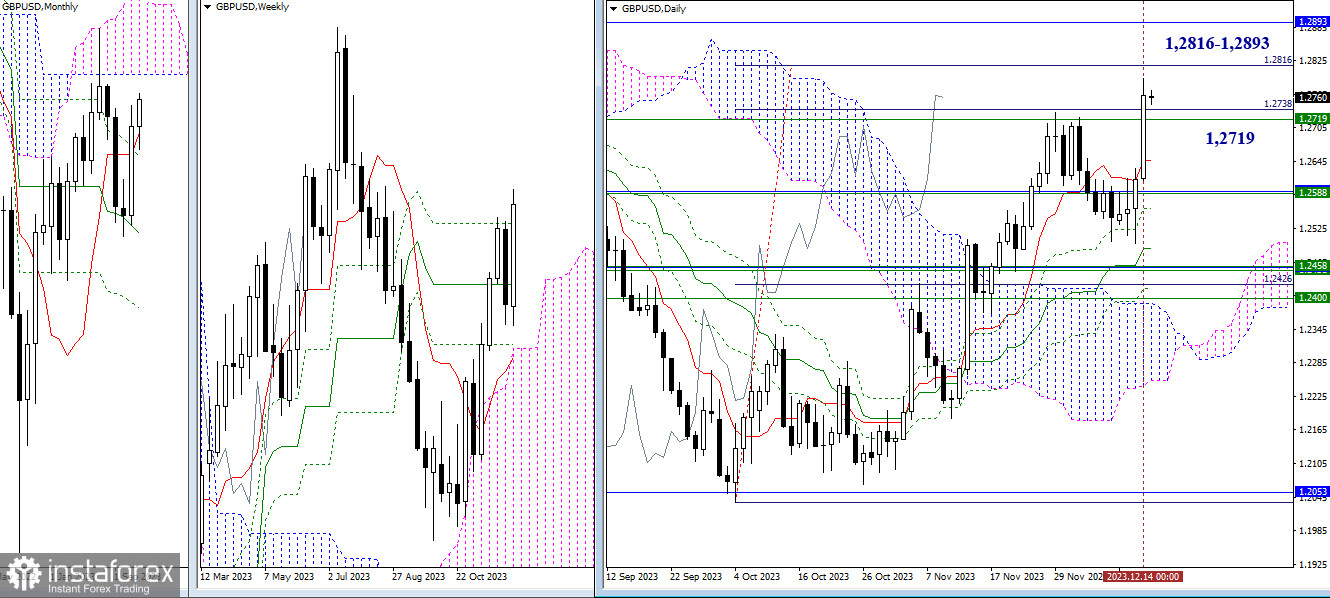

Higher timeframes

The pound is close to fully working out the daily target for breaking the cloud (1.2816). After completing this task, attention will be directed to testing the lower boundary of the monthly cloud (1.2893). Entry and consolidation in the monthly Ichimoku cloud will open up new horizons for bullish players. If bulls fail to accomplish the set task, the loss of the weekly level of 1.2719 will bring relevance back to the support area of 1.2589, currently uniting the weekly medium-term and monthly short-term trends. Intermediate support can be provided by the daily short-term trend (1.2646).

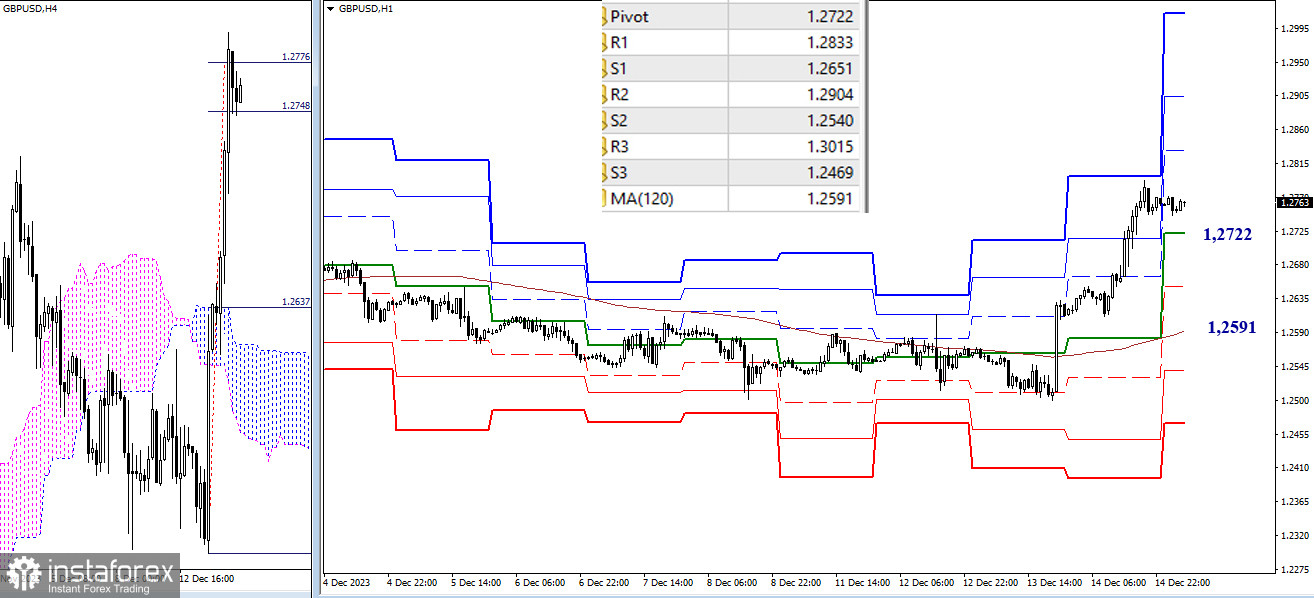

H4 – H1

On the lower timeframes, the target for breaking the H4 cloud has been worked out (1.2748-76). The continuation of the rise will allow testing intraday resistance of classic pivot points: 1.2833 – 1.2904 – 1.3015. If the emerging corrective slowdown develops, supports on the path to restoring bearish positions may be 1.2722 (central pivot point of the day) – 1.2651 (S1) – 1.2591 (weekly long-term trend).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)