"Markets have a strong aversion to uncertainty, and with the polls close to 50-50, it's as uncertain as it gets," said Ross Yarrow, managing director of U.S. equities at investment bank Baird.

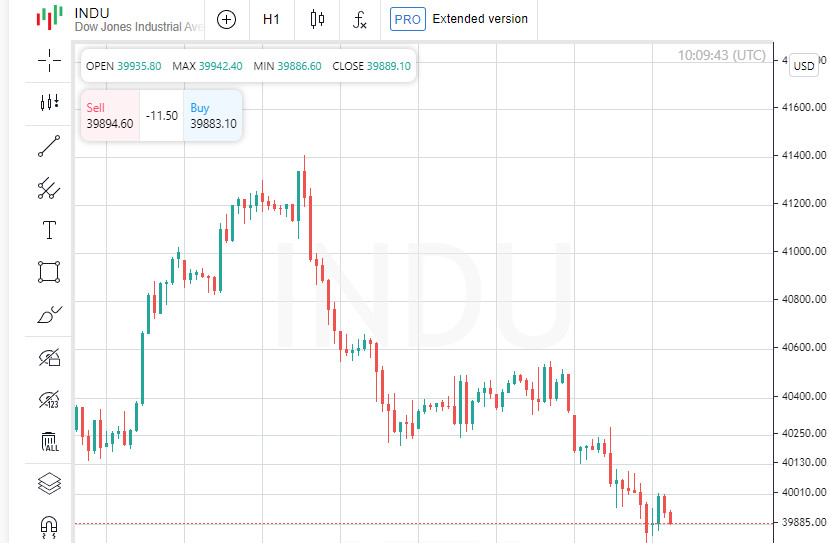

Wall Street's S&P 500 (.SPX) fell 2.3% on Wednesday, its biggest one-day loss since December 2022, as Big Tech, which accounts for a significant portion of U.S. and global indexes, fell. The decline continued Thursday morning, spreading to European markets.

Investors, wary of further selling, have turned to small-cap stocks, UK assets and gold as possible safe havens.

Of particular concern to global markets is the possibility that competition for votes on big spending plans could lead to potential turmoil in the US debt market, weighing on global stocks and bonds whose value depends on long-term Treasury yields.

The 30-year US Treasury yield rose above the two-year yield last week as big investors began to shy away from long-term US credit risk as the budget deficit widened to nearly $2 trillion.

Emerging market stocks and bonds have come under pressure from President Trump's proposed tariff hikes, said Adam Norris, a multi-manager at Columbia Threadneedle. Higher tariffs are having a negative impact on the economies and currencies of exporting countries.

Stock market volatility (.VIX) has started to rise from its lows as traders shift between stock sectors based on the changing election odds.

Tech stocks from the U.S. to Amsterdam have felt the pressure after Trump proposed earlier this month to cut U.S. support for Taiwan, a key link in the chip supply chain.

Meanwhile, the Russell 2000 index of U.S. small-caps (.RUT) has risen on expectations that Trump's growth policies will favor domestically focused companies over global tech giants.

The rotation could end, however, if tech or consumer stocks heavily dependent on Chinese supply chains rise as Trump falls in the polls.

Benjamin Mehlman, chief investment officer at Edmond de Rothschild Asset Management, expressed caution on European exporters due to potential tariff risks if Trump wins, preferring to invest in smaller, less global European companies.

Now on to global financial news.

More than $3 trillion has been pulled out of global equities in recent days.

Stock markets plunged into a multi-trillion-dollar slump on Thursday as a slide in global tech stocks sent investors seeking refuge in traditionally safe havens like bonds, the yen and the Swiss franc.

Europe's biggest bourses opened the day down more than 1% as traders in Europe and Asia reacted to the Nasdaq's worst day since 2022 (.IXIC) on Wednesday following disappointing earnings reports from giants Alphabet and Tesla.

Chinese stocks, iron ore and oil prices also extended their losses after a surprise move by China's central bank to cut long-term interest rates added to concerns about the world's second-largest economy.

The sell-off in stocks has increased bets on interest rate cuts around the world, with futures pointing to a 100% chance of Federal Reserve easing in September. A sharp rise in market volatility (.VIX) added pressure on carry trades, sending the U.S. dollar down 0.7% to 152.78 yen on Thursday.

MSCI's broadest index of global shares (.MIWD00000PUS) fell 1%, while Japan's Nikkei (.N225) fell 3.3%, partly due to an 11% plunge in Nissan Motor (7201.T) after the company reported a 99% drop in quarterly profit.

Taiwan (.TWII) markets remained closed for a second day due to a typhoon.

Chinese blue-chip stocks (.CSI300) fell 0.9%, while the Shanghai Composite Index (.SSEC) also fell 0.9%, hitting a five-month low.

Hong Kong's Hang Seng (.HSI) fell 1.7%, unhelped by Beijing's latest round of economic easing.

On Wall Street, the Nasdaq (.IXIC) lost nearly 4% as weak earnings results from Alphabet and Tesla dented investor confidence in the already lofty valuations of Big Tech stocks.

The decline added to recent market volatility, with the Wall Street Fear Index (.VIX) hitting a three-month high. Investors sought safety in cash and highly liquid short-term debt as two-year U.S. Treasury yields fell to their lowest in nearly six months on Wednesday.

"There are a lot of factors weighing on equity markets right now," said Jeff Yu, senior currency and macro strategist at BNY Mellon in London.

He also pointed to declining auto sales in the US, Europe and Japan, as well as recent interest rate moves in China, as clear signs of weakening global consumer demand.

Another big factor was the strengthening of the yen, which rose more than 1% to its highest in 2 1/2 months, ahead of a Bank of Japan meeting next week to discuss whether to raise interest rates.

The Swiss franc also strengthened 0.5% to 0.88 per dollar, adding 0.7% overnight.

Shorter-term bonds extended gains, helped by comments from former New York Federal Reserve President Bill Dudley that the central bank should cut rates, preferably at its policy meeting next week.

The yield on two-year Treasury notes fell another 3 basis points to 4.3894%, after falling 4 basis points on Wednesday. Ten-year Treasury yields also fell 2 basis points to 4.2622% on Thursday.

In commodities, iron ore prices fell nearly 1% on lingering concerns about China's economy. Copper futures fell 1.2%, while oil prices remained near six-week lows.

Brent crude futures fell 0.5% to just over $81 a barrel, while U.S. West Texas Intermediate (WTI) crude also fell 0.5% to $77.23 a barrel. Gold prices fell 1% to $2,373.62 an ounce.