The Bank of England summarized the results of its last meeting of the year on the same day as the European Central Bank. It's hard to say which of the two meetings had a greater impact on the upward movement of the euro and the pound, but there is no doubt that both central banks to some extent influenced the currencies' movements. The ECB took a slightly more hawkish position compared to market expectations, as many expected a dovish shift in rhetoric after inflation fell to 2.4%. But what about the BoE, which is forced to continue fighting high inflation?

If we look at the results of the BoE meeting with an impartial eye, it turns out that they are quite logical. The BoE left the interest rate unchanged, but BoE Governor Andrew Bailey, made some quite important statements. In particular, he assured that there would be no rate cuts in the near future and did not deny the possibility of further tightening of monetary policy. Therefore, the BoE remains, for the time being, the only one among the three central banks that can still raise the interest rate.

A couple of months ago, inflation in the US rose to 3.7%, which turned out to be insufficient for a new rate hike. But in the UK, inflation is at 4.6%, and if it stops falling towards the target, the BoE could resort to the last available tool – raising the rate by another 25 basis points. This is good news for the pound, but based on the current wave analysis, it has exhausted its growth potential.

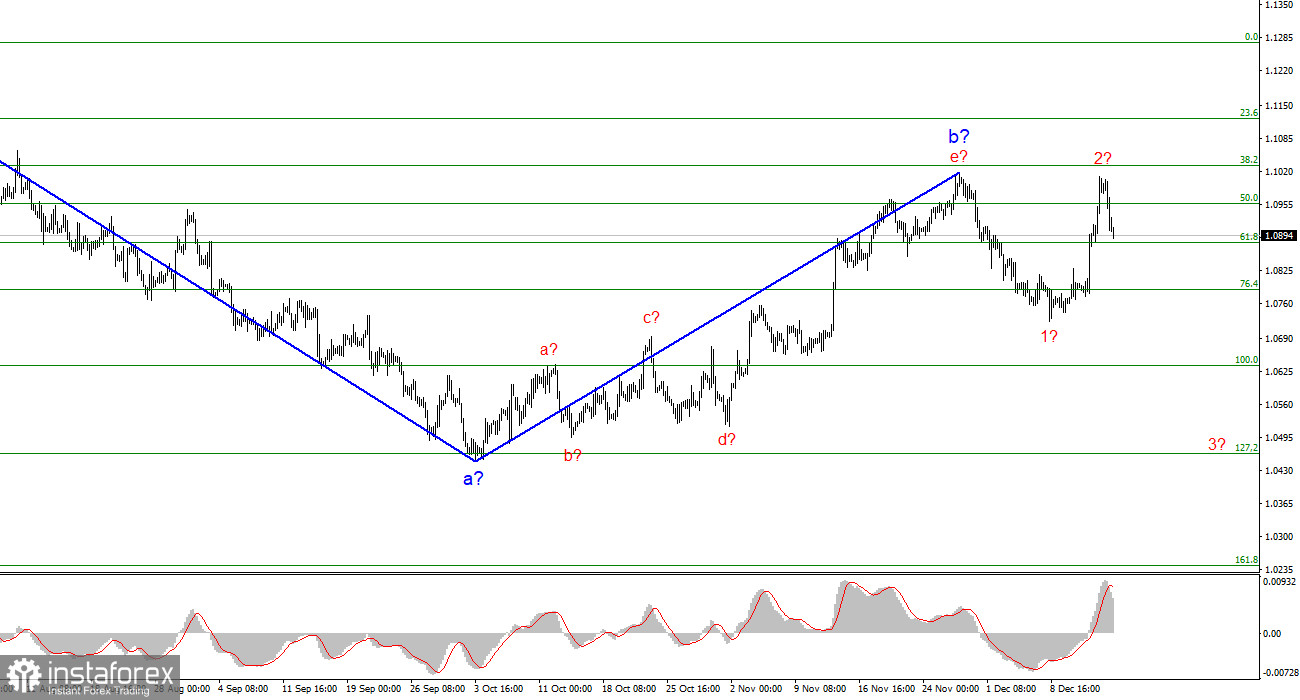

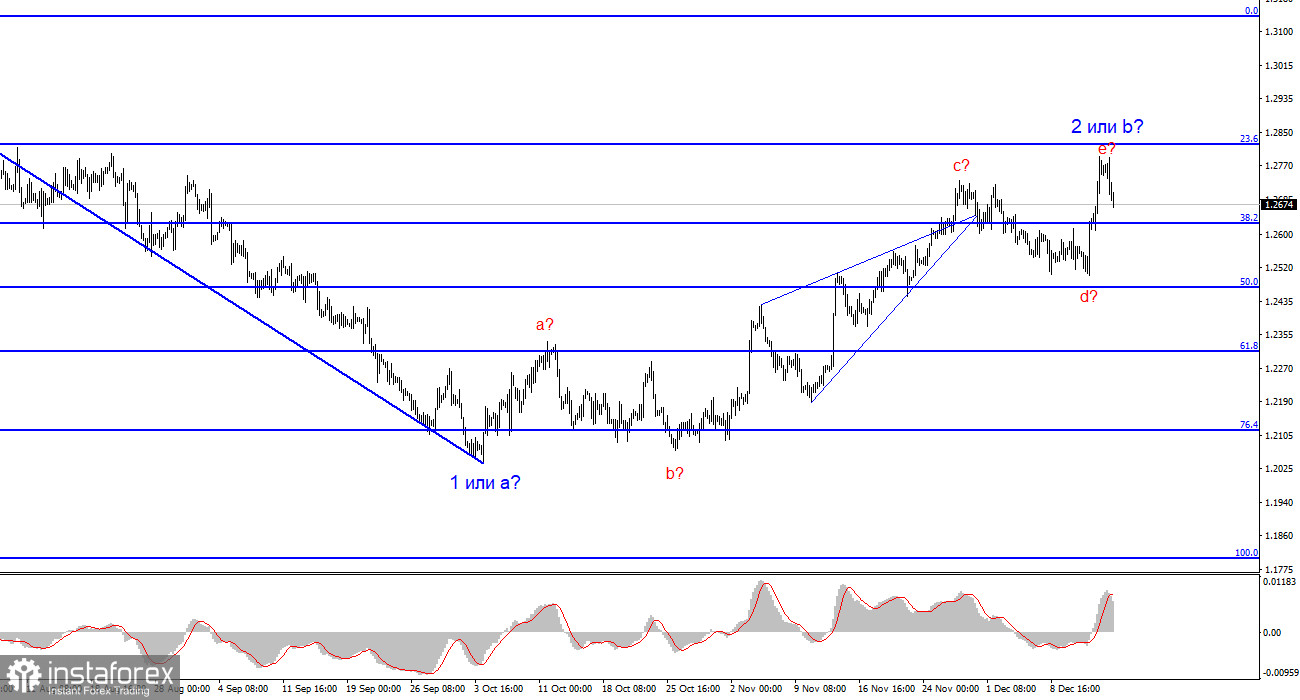

As I mentioned earlier, any wave analysis can always take on a more extensive and complex form, but I try to start from simple and clear markings. At this time, the corrective wave 2 or b has taken on a five-wave form. Therefore, it can and should be considered complete. Now the instrument should fall to the low of wave d and surpass it. If this happens, we can come to the conclusion that the market has moved on to building the presumed wave 3 or c, which is what I expect.

Also, Bailey said that inflation at the end of the year will remain at about the same level as it is now, and the economy will continue to hover around zero growth. I believe that the hawkish factor of the BoE's policy has already been absorbed, so I still expect the instrument to fall.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave c in 2 or b can be used for short positions, and the order limiting possible losses on transactions can be placed above it.