EUR/USD

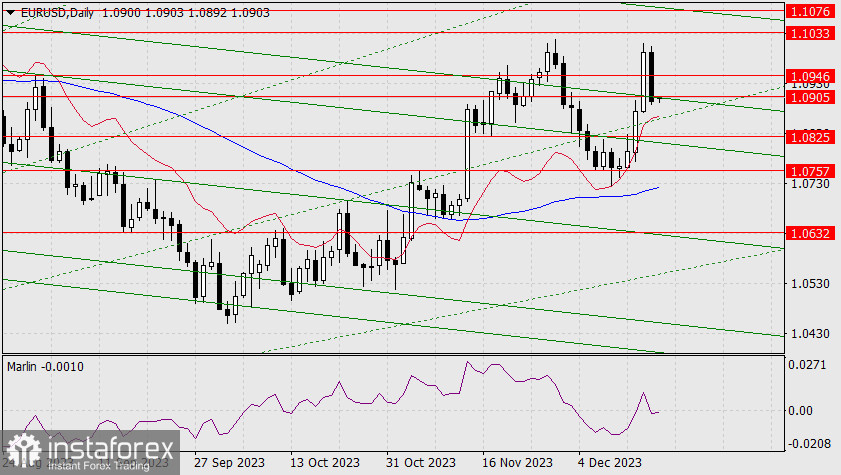

Friday's correction turned out to be quite intense and balancing on the verge of a change in trend, as the price managed to overcome the strong support at 1.0905, while the Marlin oscillator returned to negative territory. Now, if the current day closes below the price channel line, below the level of 1.0905, the price could attack the lower Fibonacci ray and support at 1.0825.

However, the euro still has a chance to rise. In order to do so, the current daily candle should stay above the level of 1.0905, which will lead the Marlin oscillator to rise in the positive territory. Surpassing the 1.0946 mark will reopen the target of 1.1033 and then 1.1076.

On the 4-hour chart, we can see that the corrective phase was just over 38.2%. The Marlin oscillator has not left the bullish territory. There is a good chance that the price will turn from these levels. The uptrend remains intact, and in order to change it, the price needs to consolidate below 1.0825 and below the MACD line.

Take note that such a deep correction only occurred with the euro. The Canadian dollar strengthened on Friday, Asia-Pacific currencies spent the day in consolidation, and this morning, the New Zealand dollar continues to rise. This means that on Friday, the euro qualitatively reacted to the weak eurozone PMI data. But today, German IFO indices for December will be released, and they are expected to increase. In particular, the value is expected to rise from 89.4 to 89.5. This supports the main scenario.