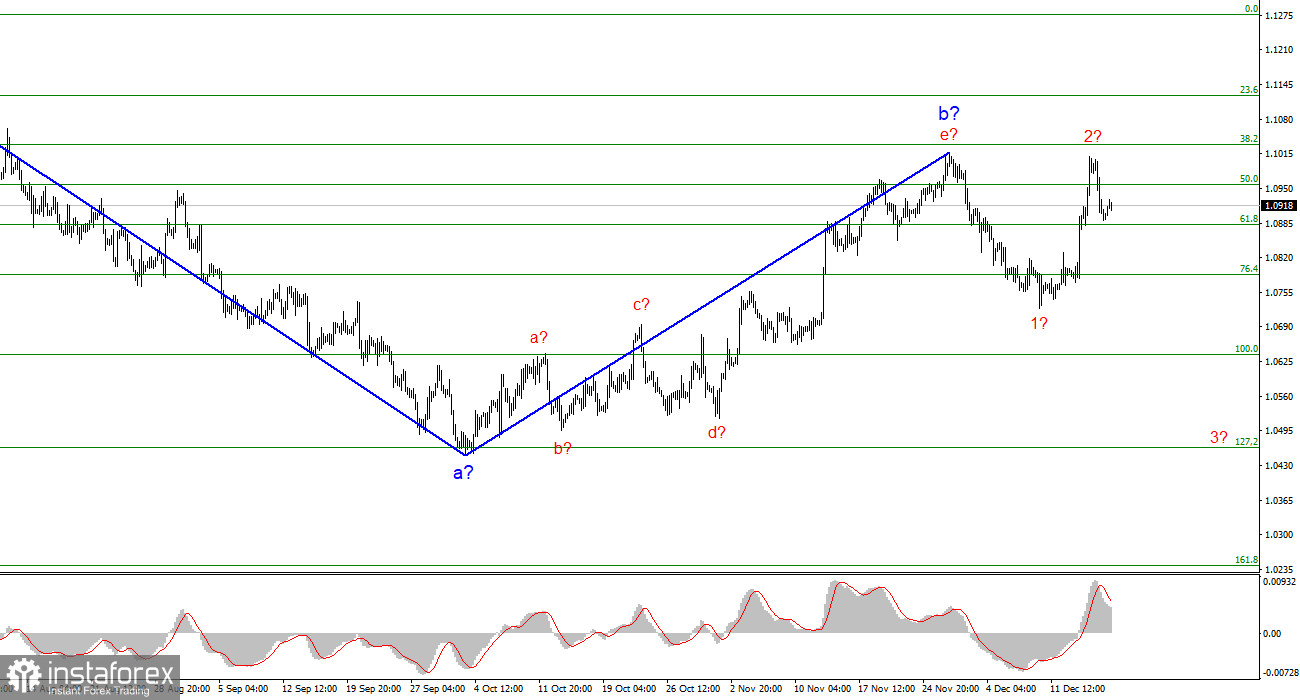

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. The construction of another three-wave structure, a downtrend, is ongoing. The presumed waves 1 and 2 are possibly complete, suggesting that the pair has moved on to building the third wave, which should lead to a decline in the pair towards the 4th figure and below. There is a risk of complicating the presumed wave 2 or b since the market is unstable, and the news background can be interpreted in favor of any currency. Nevertheless, I expect a resumption of the decline in euro quotes.

Regardless of the eventual form of wave 2 or b (it may take an even more prolonged form), the overall decline in the European currency will still need to be completed, as the construction of the third wave of the downward trend still requires. The only option is to complicate the entire wave structure of recent months into an unrecognizable state.

The euro exchange rate may drop to the 7th figure in the near future.

The euro/dollar pair experienced a slight increase on Monday. This increase is too small and does not affect the current wave pattern. There was virtually no news background on Monday, so the market was at rest. Activity may increase slightly during the American session, but we will not see strong movements today. So, what can we expect later this week?

As always, it is very difficult to answer this question. Over the next four days, interesting events will take place in the European Union and the United States. In addition to economic events, speeches by FOMC members and ECB Governing Council members will begin since central bank meetings are a thing of the past, and officials can now be interviewed again. All ECB and Fed members will only adjust the information Christine Lagarde and Jerome Powell provided last week. Recall that Powell stated there is no need to expect a new tightening of monetary policy, and Lagarde did not provide any information about raising or lowering interest rates. However, the market understands well that next year cannot do without a policy easing.

Therefore, attention will now be focused on the comments of officials who may hint at when the interest rate of this or that bank will start to decrease. Depending on which bank will be the first to provide such information, the currency of that bank may come under pressure. However, it is unlikely to be strong pressure, and the wave analysis still suggests a decline in European currency quotes.

General conclusions.

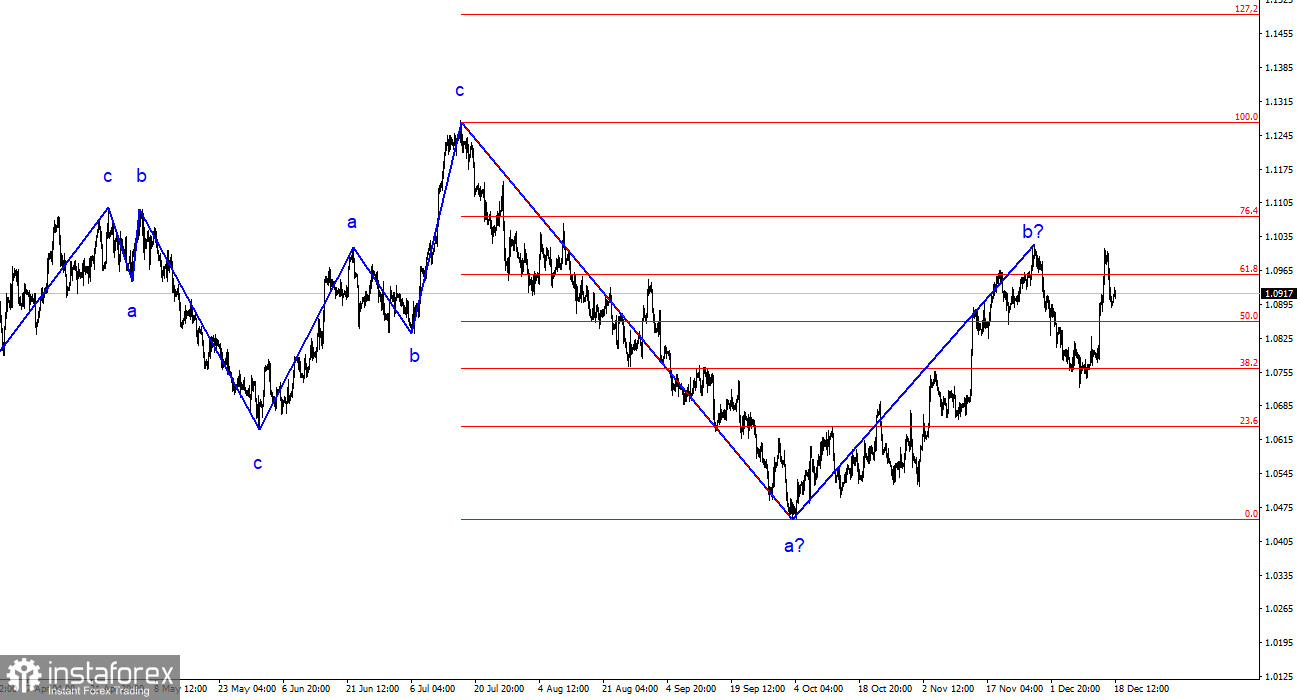

Based on the analysis, the construction of a downward set of waves continues. Targets around the 1.0463 mark have been ideally worked out, and an unsuccessful attempt to break through this mark indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. I still recommend sales with targets located below the low of wave 1 or a. At this time, wave 2 or b can be considered complete.

On a larger wave scale, it can be seen that the construction of a corrective wave 2 or b continues, which is already more than 61.8% in length from the first wave, according to Fibonacci. As I mentioned before, this is not critical, and the scenario of building wave 3 or c and lowering the pair below the 4th figure remains valid.