We can, of course, make a surprise. But it is unlikely that the Bank of Japan will raise rates without warning in advance. The vague rhetoric of BoJ Governor Kazuo Ueda at the press conference following the December meeting of the bank prompted speculators to buy USD/JPY. They still did not receive a signal about the normalization of monetary policy in the future, which negatively affected the yen.

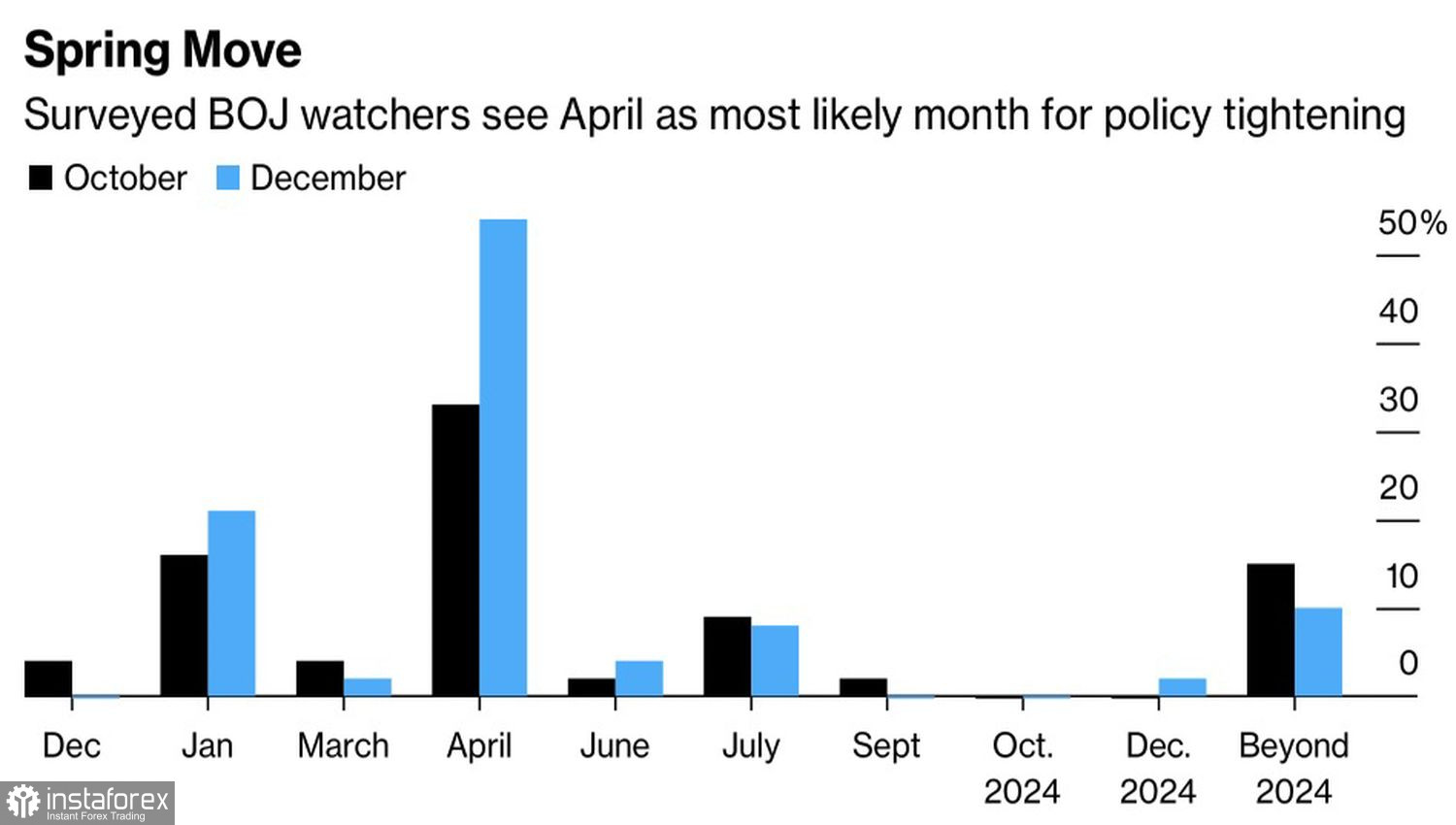

Despite the fact that almost all of the 52 Bloomberg experts did not expect a change in the Bank of Japan's monetary policy in December, the stake was on hints from Ueda about adjustments in the future. Two-thirds of economists expect a departure from negative interest rate policy by April. 80% of Reuters respondents predict that this will happen in 2024. The markets needed a signal, they didn't get it, and USD/JPY moved upward.

Predictions about the timing of BoJ abandoning negative interest rate policy

The BoJ left the overnight rate at 0.1%, emphasized the flexible nature of the target range for the yield of 10-year bonds at 1%, and repeated the well-known phrase about maintaining an ultra-easy monetary policy for as long as necessary. Ueda noted that he still doubts the sustainability of inflation. According to the regulator's head, it would be naive to think that the Bank of Japan will decide to raise borrowing costs just because the Federal Reserve will begin to loosen monetary policy in 2024.

In fact, despite the jump in USD/JPY in response to the lack of signals from BoJ about normalization, the pair remains in the hands of the bears. Speculations about exiting negative interest rate policy have not disappeared. They will intensify as the January meeting of the Board of Governors approaches. Moreover, it is necessary to understand that the potential divergence in monetary policy between the Federal Reserve and the Bank of Japan in 2024 is not the only trump card of the yen.

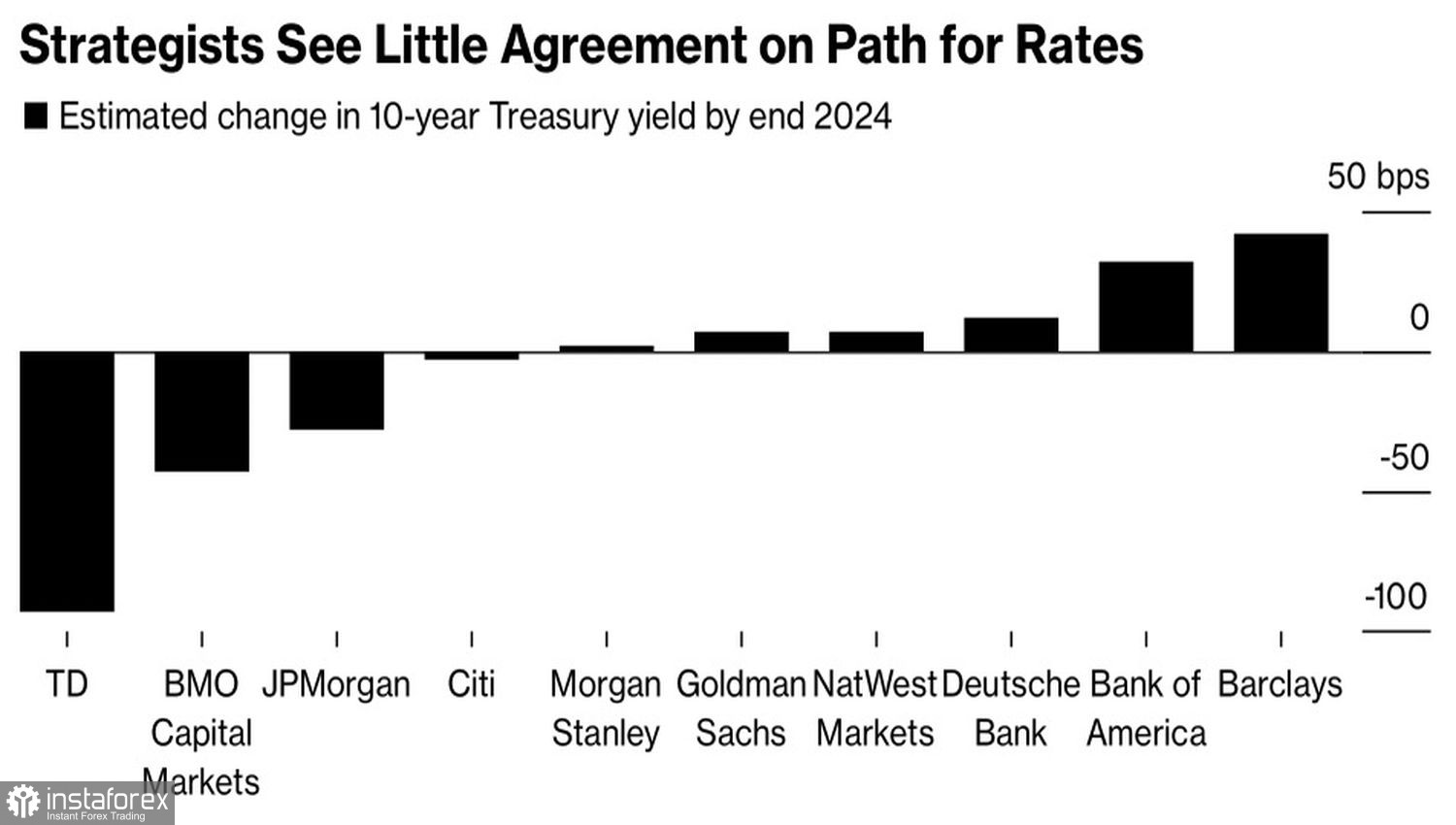

The downward dynamics of USD/JPY is also associated with the decline in the yield of 10-year U.S. Treasury bonds from 5% in October to less than 4%. At the same time, the consensus forecast of Bloomberg banks and investment companies indicates that rates on ten-year bonds in 12 months will be 3.98%. That is, they will remain approximately where they are now. TD Securities believes that the indicator will drop to 3%. Barclays, on the contrary, expects it to rise to 4.35%.

Banks' forecasts for U.S. bond yields

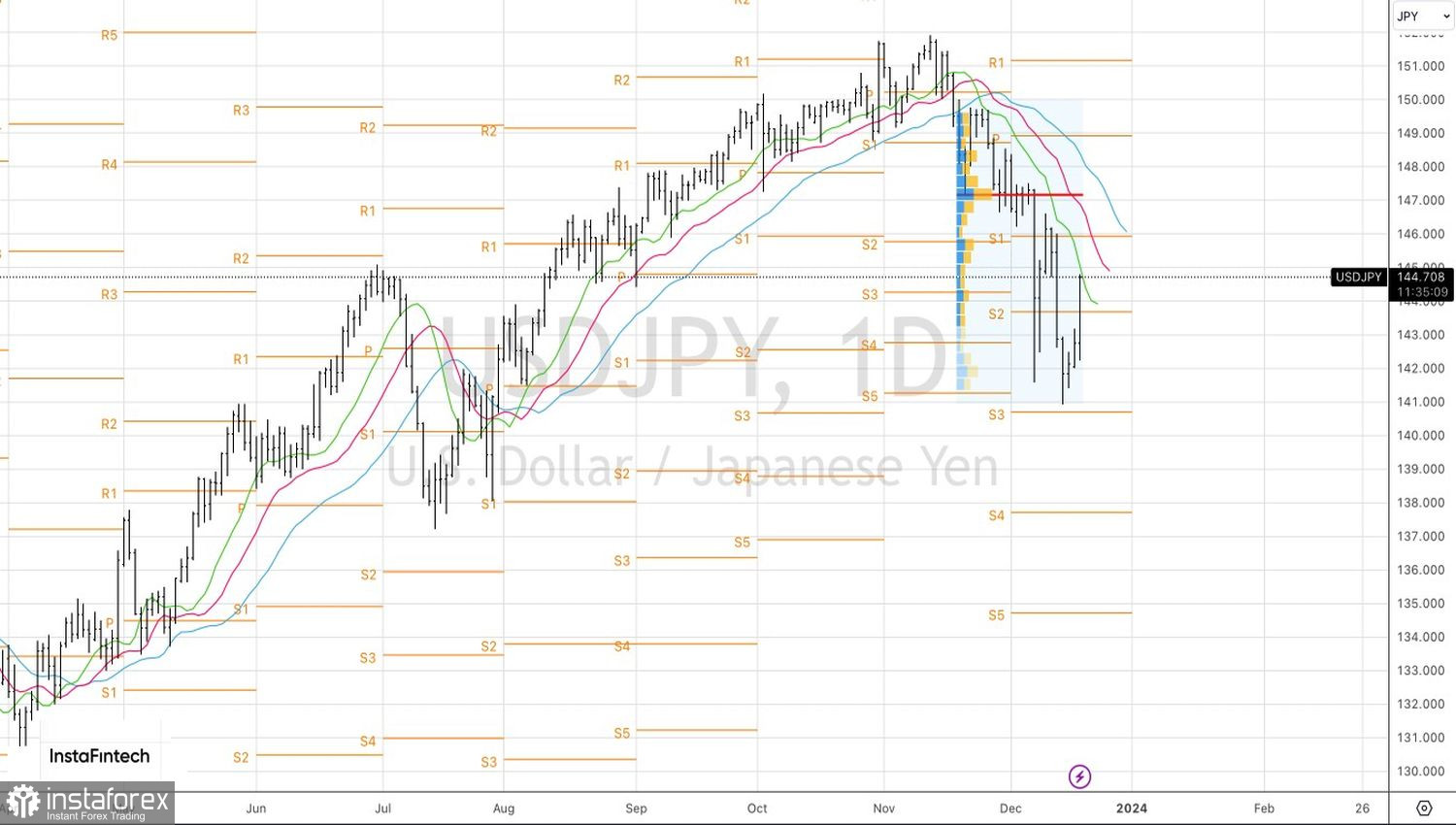

Thus, the further fate of USD/JPY will depend on the divergence in the monetary policy of the Federal Reserve and the Bank of Japan and on the dynamics of U.S. Treasury bond yields. Assuming that Ueda and his colleagues will eventually abandon negative interest rate policy, the Bloomberg expert consensus forecast of the pair falling to 135 by the end of 2024 may materialize.

Technically, on the daily chart of USD/JPY, after reaching the target at 142.5 for previously formed shorts, a pullback followed. A rebound from the 145.85 pivot level or a return of the pair below support at 144.3 should be used for selling.