EUR/USD

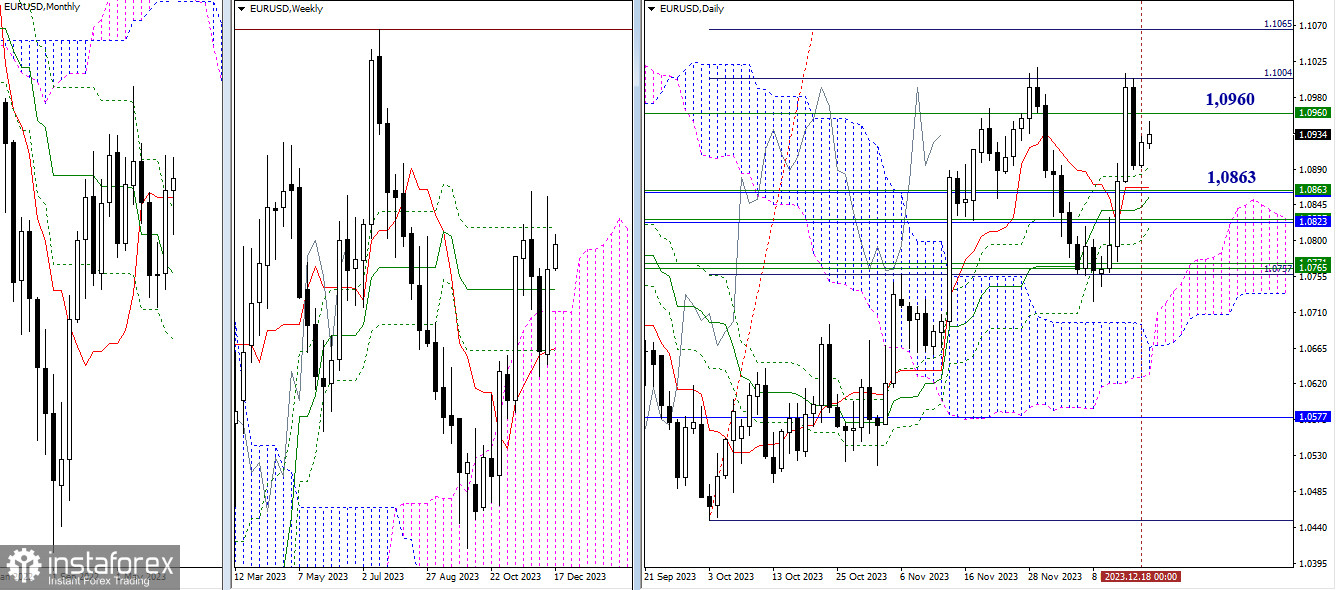

Higher Timeframes

The bearish players yesterday failed to continue the sentiments outlined at the end of last week, so we observed a slowdown and some recovery of bullish positions. There have been no changes in the situation. The targets indicated earlier maintain their significance and location today. For the bullish players, the key resistances are 1.0960 – 1.1004 – 1.1065 (the final level of the weekly Ichimoku cross), while for the bearish players, accumulations of various daily, weekly, and monthly levels 1.0863 – 1.0823 – 1.0765 will be of interest in case of a decline.

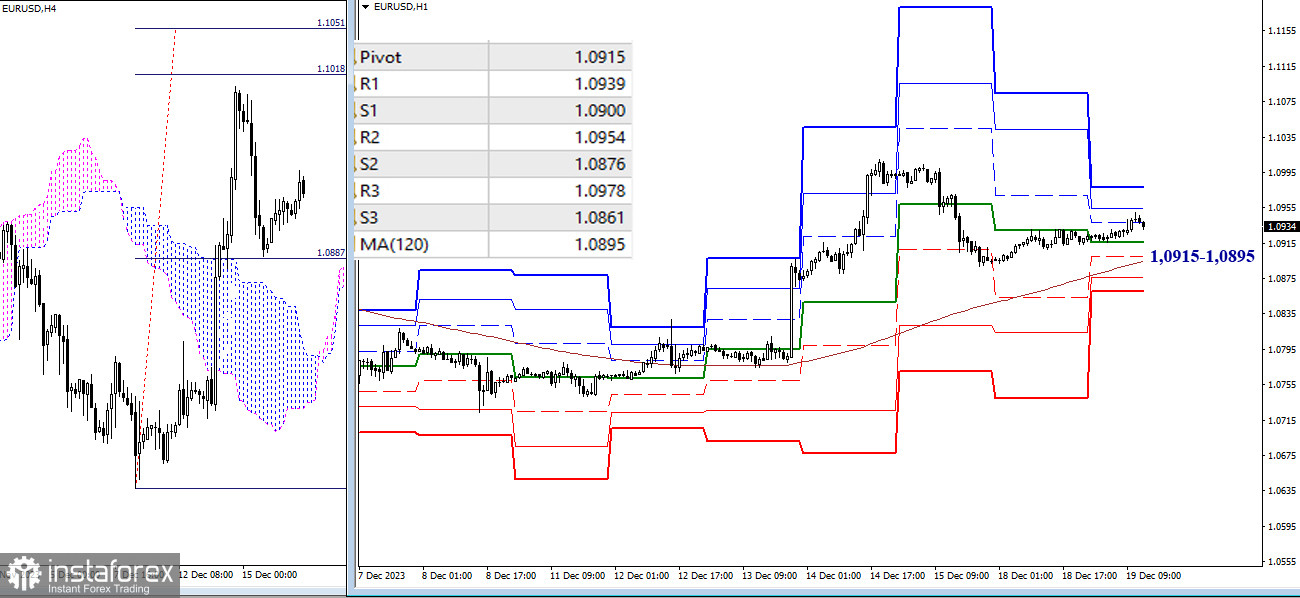

H4 – H1

On the lower timeframes, the pair continues to operate in the correction zone. The key levels still form the main boundary of support, converging today around 1.0915 – 1.0895 (central pivot point + weekly long-term trend). Additional supports in case of strengthening bearish sentiments could be 1.0876 – 1.0861 (classic pivot points). The path for the bullish players today is blocked by the resistances of classic pivot points (1.0954 – 1.0978), but the most important task in this direction is to update the high (1.1010).

***

GBP/USD

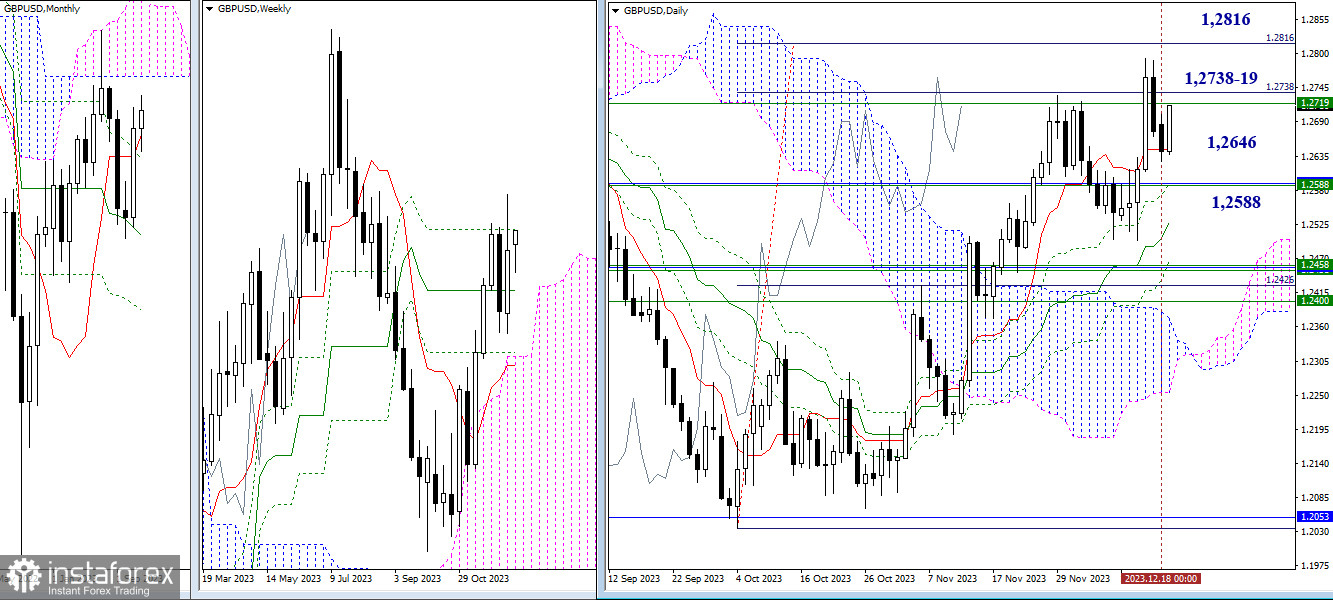

Higher timeframes

The support of the daily short-term trend (1.2646) encountered yesterday is holding back bearish pressure today. As a result, the bullish players are using this for recovery, approaching the testing of the boundaries 1.2719-38 (the final level of the weekly Ichimoku cross + the first target reference of the daily target for breaking through the cloud), followed by a possible 100% execution of the daily target (1.2816).

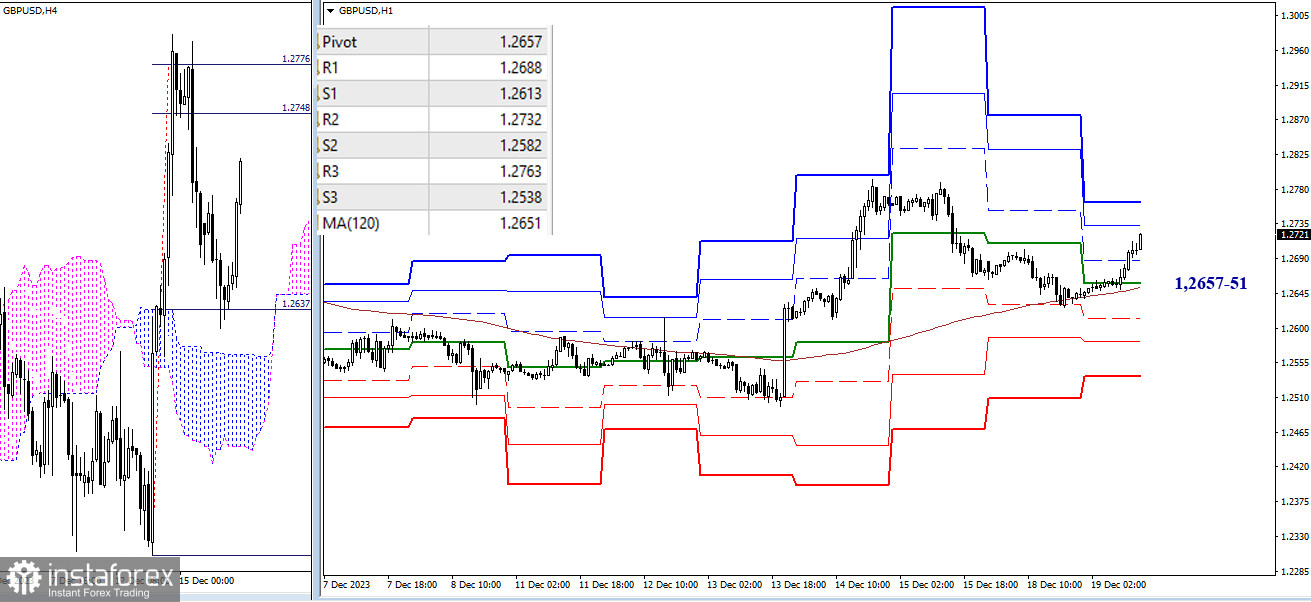

H4 – H1

Key levels managed to defend bulls' interests yesterday, maintaining the main advantage on their side. Thanks to this, there is now an ascent and a recovery of bullish positions. The first resistance of classic pivot points R1 (1.2688) has been overcome, with R2 (1.2732) and R3 (1.2763) ahead. To change the current balance of power, it is necessary to overcome and consolidate below key supports 1.2657-51 (central pivot point + weekly long-term trend), and only after that, the supports of classic pivot points (1.2613 – 1.2582 – 1.2538) may come into play.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)