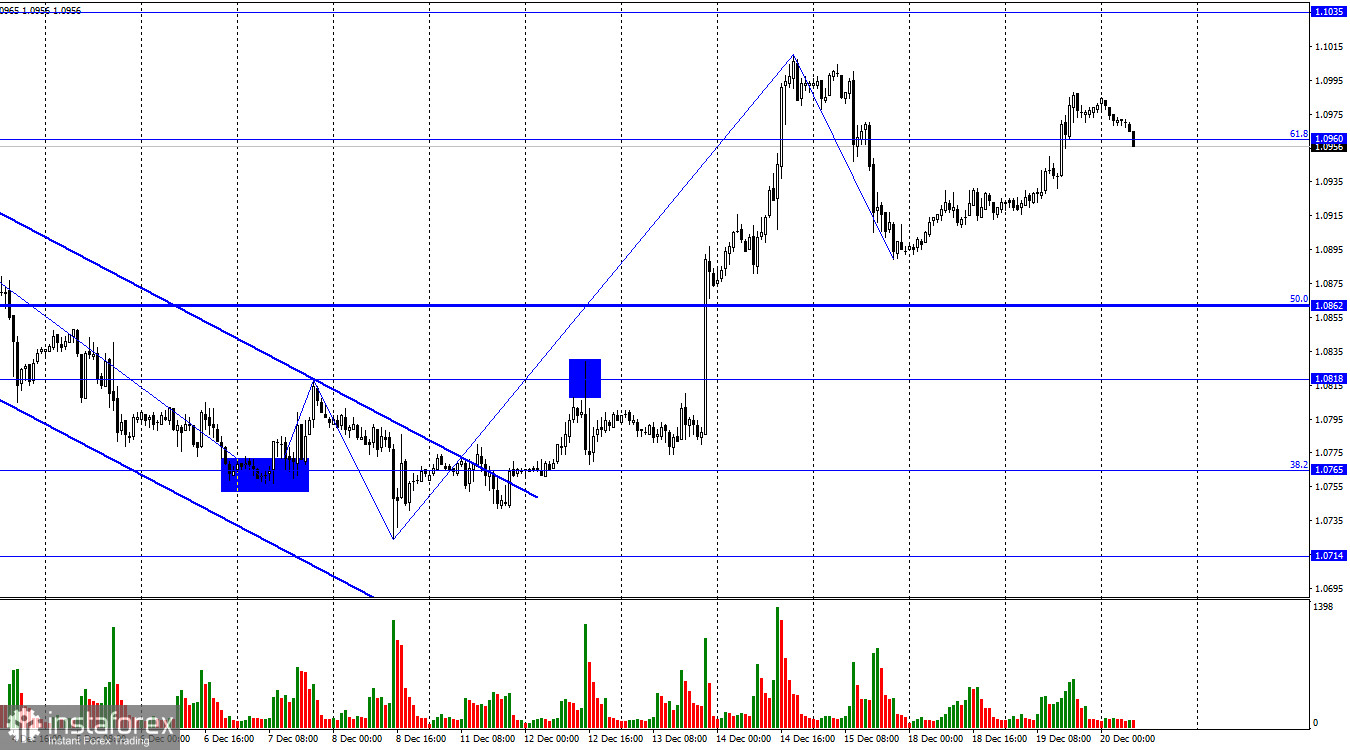

The EUR/USD pair continued its upward momentum on Tuesday and, by the end of the day, found itself above the corrective level of 61.8% (1.0960). Consolidation above this level allows counting on further growth towards the next level at 1.1035. If the pair consolidates below 1.0960, it will favor the US dollar and the resumption of the decline towards the corrective level of 50.0% (1.0862).

The wave situation is gradually becoming clearer. The last downward wave turned out to be quite weak (compared to the previous upward wave), and the current upward wave has every chance of not breaking the peak of the previous wave. If this happens, we will get the first sign of completing the "bullish" trend. In this case, a decline to 1.0862 may begin today, which may only begin a prolonged "bearish" trend. At the beginning of this week, bulls wished to continue the trend of the previous one, but the information background does not support them. It is absent. Monday and Tuesday favored the bulls, but bears may dominate after that.

On Tuesday, among the interesting reports, I can highlight the inflation report in the eurozone. It showed that the Consumer Price Index dropped to 2.4% y/y in November 2024. I want to remind you that the ECB continues to monitor inflation indicators closely and uses them to make decisions on interest rates. Inflation has decreased significantly, so we can only expect interest rate cuts from the European regulator. If so, euro buyers may step back. Lately, they have felt a positive information background, as Jerome Powell announced last week about the readiness to move to a more dovish monetary policy.

Now, the ECB may also come to this. It was not announced at the last meeting, but on Monday, one of the members of the Governing Council, Francois de Galhau, stated that next year, interest rates would start to decline as inflation confidently moves towards the target level.

Thus, the scenario with further euro depreciation is a logical development of events. Before the New Year, the pair may return to 1.0765.

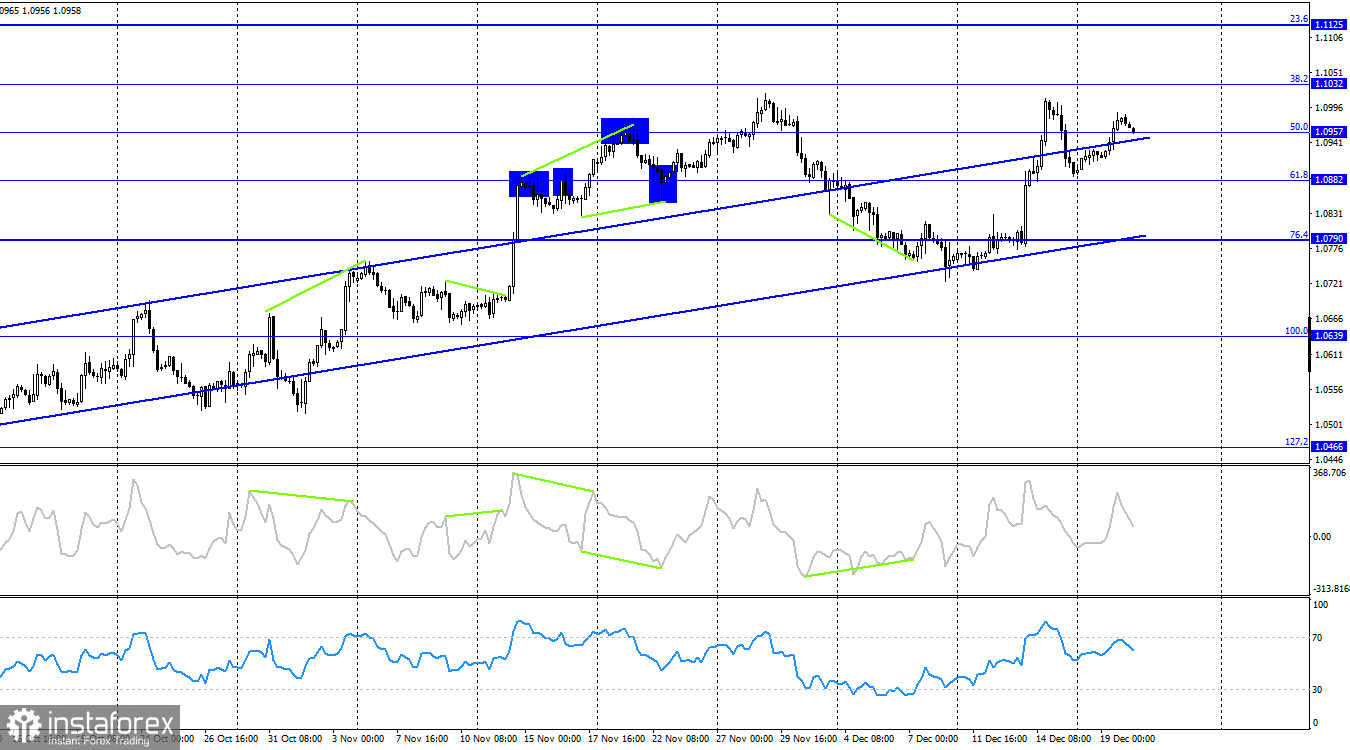

On the 4-hour chart, the pair rose to the corrective level of 50.0% (1.0957). Consolidation above this level allows for further growth towards the next Fibonacci level of 38.2% (1.1032). A re-consolidation below 1.0957 will work in favor of the US currency and a decline to the lower line of the ascending trend corridor, which still characterizes traders' sentiment as "bullish." I expect a significant decline in the euro only after closing below the corridor. There are no emerging divergences with any of the indicators today.

Forecast for EUR/USD and trader recommendations:

What can be advised to traders today? The rise of the European currency is unlikely today. The continuation of the "bullish" trend is also unlikely. Today's information background could be stronger; the EU and the US economic calendar is almost empty, and traders will find it difficult to find new reasons for purchases. Thus, the resumption of the decline towards the level of 1.0862 is more likely. I recommend using consolidation below the level of 1.0960 for selling. Purchases are impractical and too risky today.