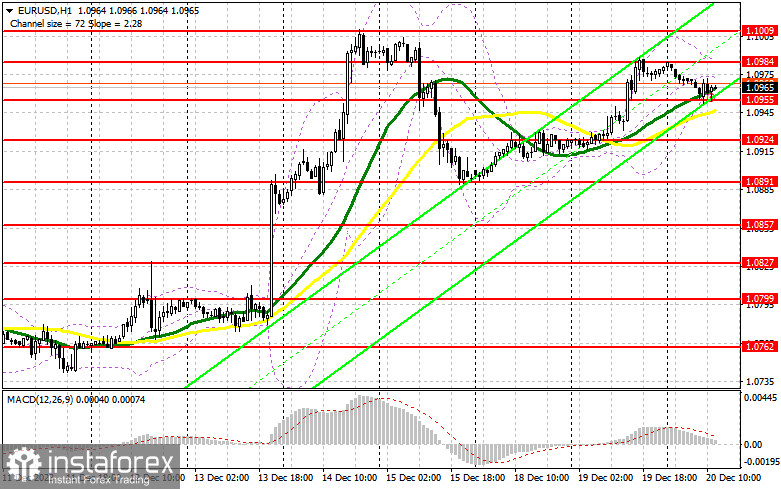

In my morning forecast, I highlighted the level of 1.0955 and recommended making decisions based on it for market entry. Let's look at the 5-minute chart and analyze what happened there. The drop and the formation of a false breakout at 1.0955 led to a buy signal for the euro. However, after the pair rose by 15 points, the activity from major players sharply decreased. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

The morning statistics from the eurozone did not significantly help the euro continue its ascent. However, there were few eager sellers at the current levels either. Much depends on the US Consumer Confidence Index and existing home sales volume. An increase in these indicators will lead to a return of demand for the dollar, ultimately undermining the support at 1.0955, which has been tested several times today. However, the speech of FOMC member Austan D. Goolsbee and his dovish stance could harm the dollar and restore balance to the market. I will act similarly to the morning strategy: a false breakout around 1.0955, similar to what I discussed earlier, will provide another buy signal with a target of 1.0984 – a resistance level tested several times in the last 24 hours. Breaking and updating this range from top to bottom will lead to another entry point for buying and a chance to update the maximum around 1.1009. The ultimate target will be the area at 1.1041, where I will take profits. Trading will take on a sideways character in the scenario of a decline in EUR/USD and the absence of activity at 1.0955 in the second half of the day. In this case, entering the market will be possible after a false breakout around the next support at 1.0924. I will consider entering long positions from the rebound at 1.0891 with a target of an upward correction within the day, ranging from 30 to 35 points.

To open short positions on EUR/USD, the following is required:

Sellers attempted, but so far, nothing has worked out. In case of weak US statistics, bulls will try to continue the pair's rise. In this case, they expect bears to show up only after a false breakout around 1.0984, signaling a sell-off with EUR/USD dropping to the morning support at 1.0955, where trading is currently taking place. Only after breaking and consolidating below this range and a reverse test from bottom to top do I expect to get another sell signal with an exit at 1.0924, where I anticipate the appearance of more significant euro buyers. The ultimate target will be the minimum at 1.0891, where I will take profits. A test of this level will keep the pair in a wide sideways channel. In case of an upward movement of EUR/USD during the American session, as well as the absence of bears at 1.0984, which is more likely, buyers will aim to update monthly highs. In this case, I will postpone selling until the test of 1.1009, but acting against the bullish market will only be possible with a false breakout. I will consider entering short positions immediately on the rebound from 1.1041 with a target of a downward correction within 30-35 points.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating the likelihood of further euro growth.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0955, will act as support.

Indicator Descriptions:

- Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

- Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands - Period 20.

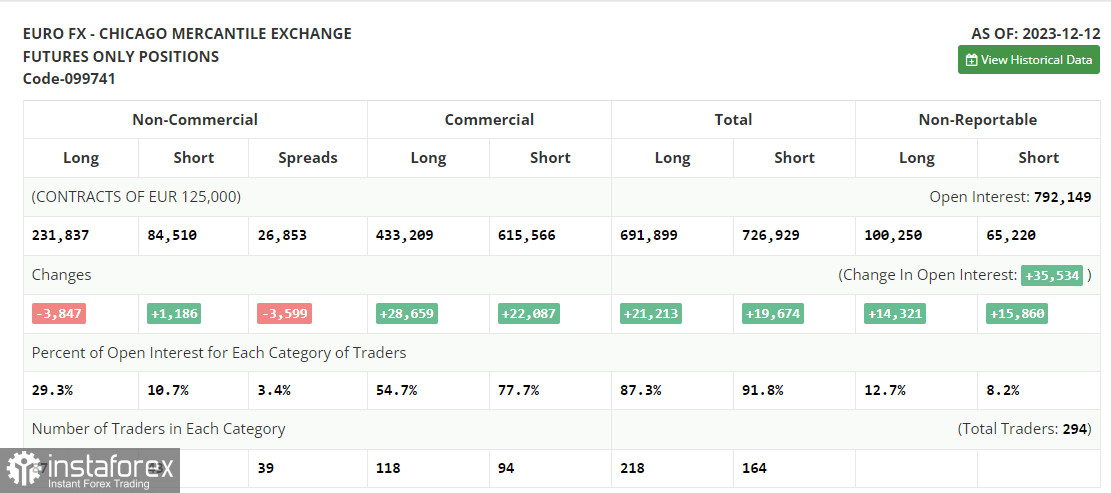

- Non-Commercial Traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long Non-Commercial Positions represent the total long open positions of non-commercial traders.

- Short Non-Commercial Positions represent the total short open positions of non-commercial traders.

- The Total Non-Commercial Net Position is the difference between non-commercial short and long positions.