The pound found itself under pressure today, reacting to the release of inflation growth data in the United Kingdom. To the disappointment of GBP/USD buyers, almost all components of today's report turned out to be in the "red zone." Hopes for a strengthening hawkish stance regarding further actions by the Bank of England collapsed – now the pair's rise is possible only through the weakening of the American currency. Although, just last week, the British currency enjoyed the support of the English regulator, whose members voiced unexpectedly harsh formulations, allowing for an additional interest rate hike in the foreseeable future. But after today's release, the overall discussion will inevitably shift to a different set of coordinates: now the market will discuss the timing of the first rate cut. The question of additional tightening of monetary policy (in the foreseeable future) is definitively off the agenda.

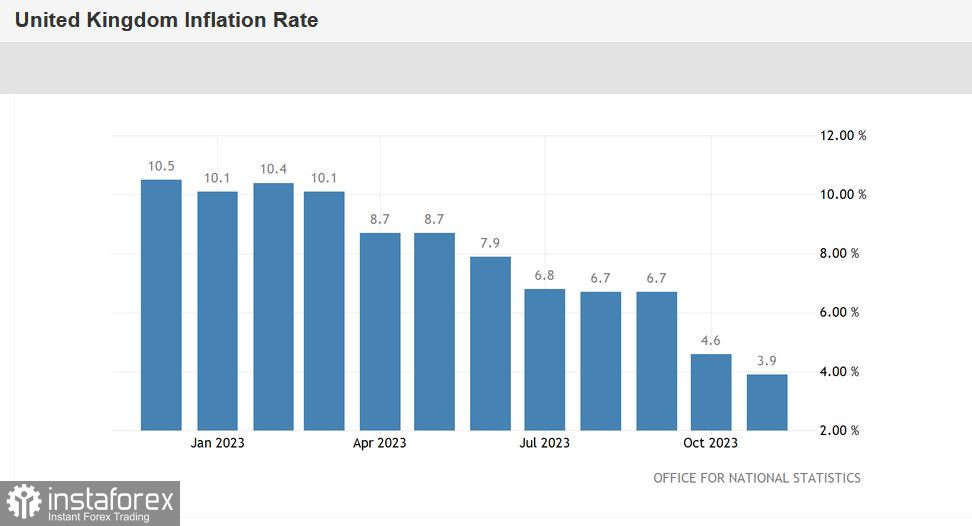

So, according to the disclosed data, the overall Consumer Price Index (CPI) on a monthly basis fell into the negative territory (-0.2%), while most experts predicted minimal growth (0.1%). In annual terms, the overall CPI dropped to 3.9%, with a forecast of a decline to 4.3%. This is the weakest growth rate since September 2021.

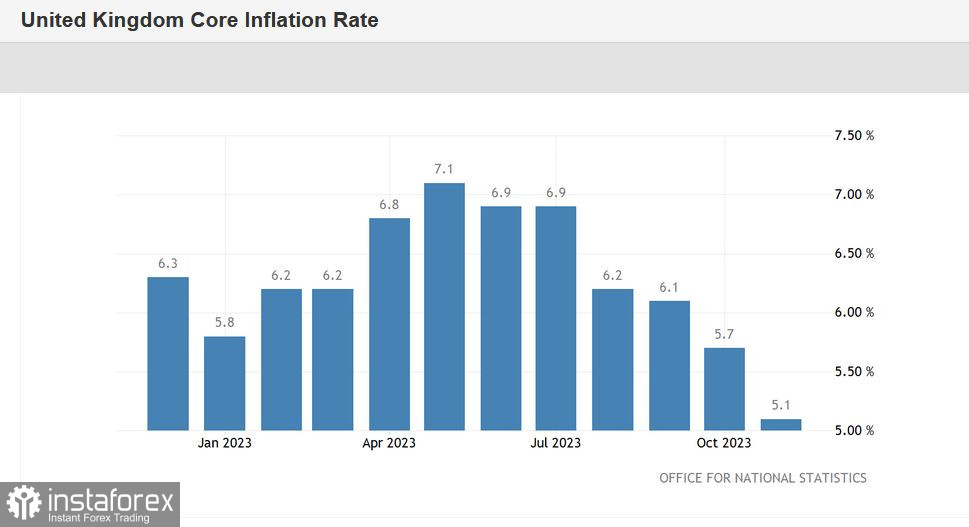

The core Consumer Price Index, excluding volatile energy and food prices, also dropped quite sharply. The indicator came in at 5.1% YoY, while most analysts expected to see it at 5.6%. The result for November is the weakest since January 2022. It's also worth noting that the core CPI has been consistently declining for the fourth consecutive month.

The Retail Price Index (RPI), which British employers use in wage discussions, dropped to 5.3% YoY (the forecast was 5.6%). Here, too, we can talk about a multi-month record – the last time the indicator was at this level was in September 2021.

The Producer Purchasing Price Index remained in the negative territory (-2.6%) – in annual terms, this indicator has been below zero for the sixth consecutive month. A similar situation has developed with the Producer Selling Price Index: in November, it was at -0.2% YoY.

What do the November results say? Primarily, that hawkish hints from the Bank of England, essentially, have lost their relevance. GBP/USD buyers were inspired by the tone of the accompanying statement from the central bank following the December meeting, according to which the central bank may resort to an additional round of tightening the monetary policy "in case of sustained inflation growth." At the moment, we can talk about a sustained downward trend, which has been observed for the fourth consecutive month.

It's also worth recalling the position voiced by Bank of England Governor Andrew Bailey in early December. He noted that the current rate, in his opinion, is effective, and in determining the bank's further prospects, it will take into account the cumulative volume of monetary policy tightening and the lag effects of monetary policy. In addition, the head of the Bank of England reminded about the side effects of tight monetary policy and the risks to financial stability that may arise in the foreseeable future.

In other words, Bailey unmistakably indicated that the central bank would adhere to the well-known principle of "do no harm" when making further decisions regarding monetary policy tightening. The published inflation report today eloquently testifies to the fact that the current rate is indeed effective.

Reacting to this turn of events, the GBP/USD pair has again turned downward and is currently testing the support level of 1.2650 (the Tenkan-sen line on the daily chart). Although just yesterday, buyers of the pair were aiming for the 1.28 level, which remained an unreachable height. Over the past seven weeks, GBP/USD bulls have repeatedly stormed this price barrier, but in vain – sellers have taken the initiative each time. The same happened this time.

However, it's still too early to write off the upward prospects of the pair. GBP/USD buyers can very well play on the weakening of the American currency if the core PCE index disappoints the dollar bulls. According to forecasts, this crucial inflation indicator for the Fed will decrease to 3.4%, the lowest level since May 2021. If the index ends up in the "red zone," the dollar will face additional pressure amid the strengthening of "dovish" sentiments in the market. Buyers of GBP/USD will surely take advantage of this circumstance, even despite the passivity of the British currency. Therefore, at the moment, it is advisable to take a wait-and-see position on the pair – at least until sellers break through two support levels – 1.2650 (the Tenkan-sen line on the daily chart) and 1.2620 (the middle line of the Bollinger Bands on the same timeframe).