As soon as representatives of the Bank of England expressed that they are unwilling to lower interest rates due to high inflation, we learned that the pace of consumer price growth slowed from 4.6% to 3.9%. This goes against the expected decrease to only 4.3%. As a result, the pound immediately fell. Just yesterday morning, everyone was confident that among the key central banks, the BoE would be the last to embark on monetary policy easing. However, after the latest inflation data, the situation has changed somewhat, at least in terms of the extremely unlikely scenario of an interest rate disparity shift in favor of the pound.

The only thing we can highlight for today is the jobless claims data in the United States. However, the data is expected to have a limited impact on the pair's movement, as any changes may be purely symbolic. For instance, the number of initial claims is expected to increase by 7,000, while the number of continuing claims is projected to decrease by 1,000. There is no sense in considering the US GDP data for the third quarter, as these are final figures meant to confirm the previous estimates, which are already priced in by the market.

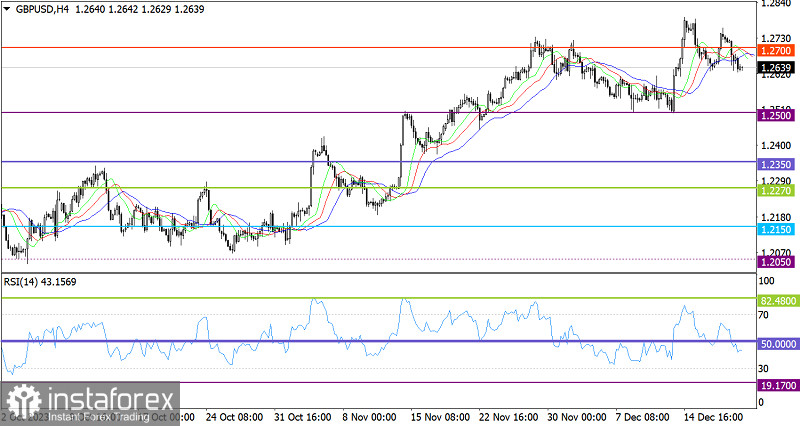

The GBP/USD pair is pursuing a downtrend, and the quote managed to update the local low of the corrective cycle.

On the four-hour chart, the RSI downwardly crossed the 50 middle line, indicating an increase in the volume of short positions in the corrective phase.

Meanwhile, the Alligator's MAs are intertwined in the 4-hour chart. This technical factor indicates a slowdown in the upward cycle.

Outlook

Keeping the price below 1.2600 suggests that the British pound could fall towards the level of 1.2500.

The bullish scenario will come into play if the price returns above the level of 1.2700 with confirmation on the daily time frame.

The comprehensive indicator analysis in the short-term and intraday periods indicates a corrective phase. Indicators signal an uptrend in the medium term.