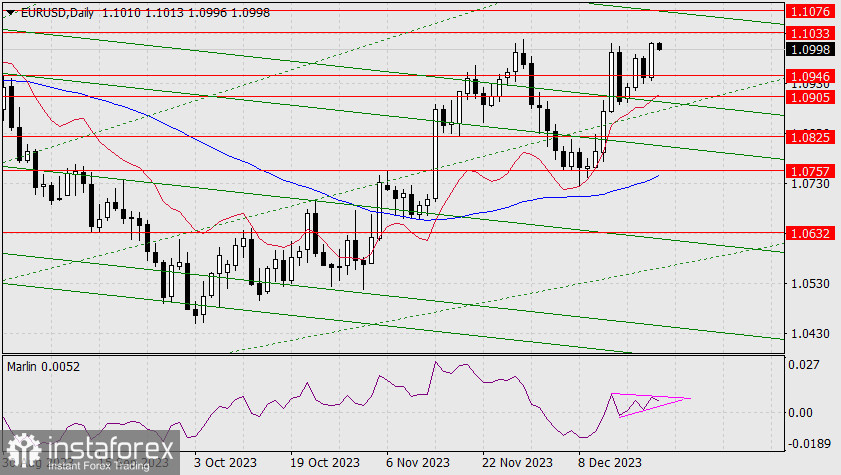

EUR/USD

The stock market closed higher. Yesterday, the S&P 500 added 1.2%, and the euro gained 69 pips. The 1.1076 target is even closer now, but first, the price needs to overcome the level of 1.1033 – the high of February 2. The Marlin oscillator broke out of its triangle and moved to the upside, changing its shape.

Today, the U.S. will release important economic indicators: personal spending and Durable Goods Orders. Personal spending in November is expected to increase by 0.2%, and incomes by 0.4%. Durable Goods may show an increase of 1.7% for November. November new home sales are also expected to be 695,000, compared to 679,000 in October. These indicators can contribute to the growth of risk appetite and help the euro rise as a risk instrument.

On the 4-hour chart, the price has settled above the balance and MACD indicator lines, and the Marlin oscillator has returned to the uptrend territory. Overall, the technical picture is bullish.