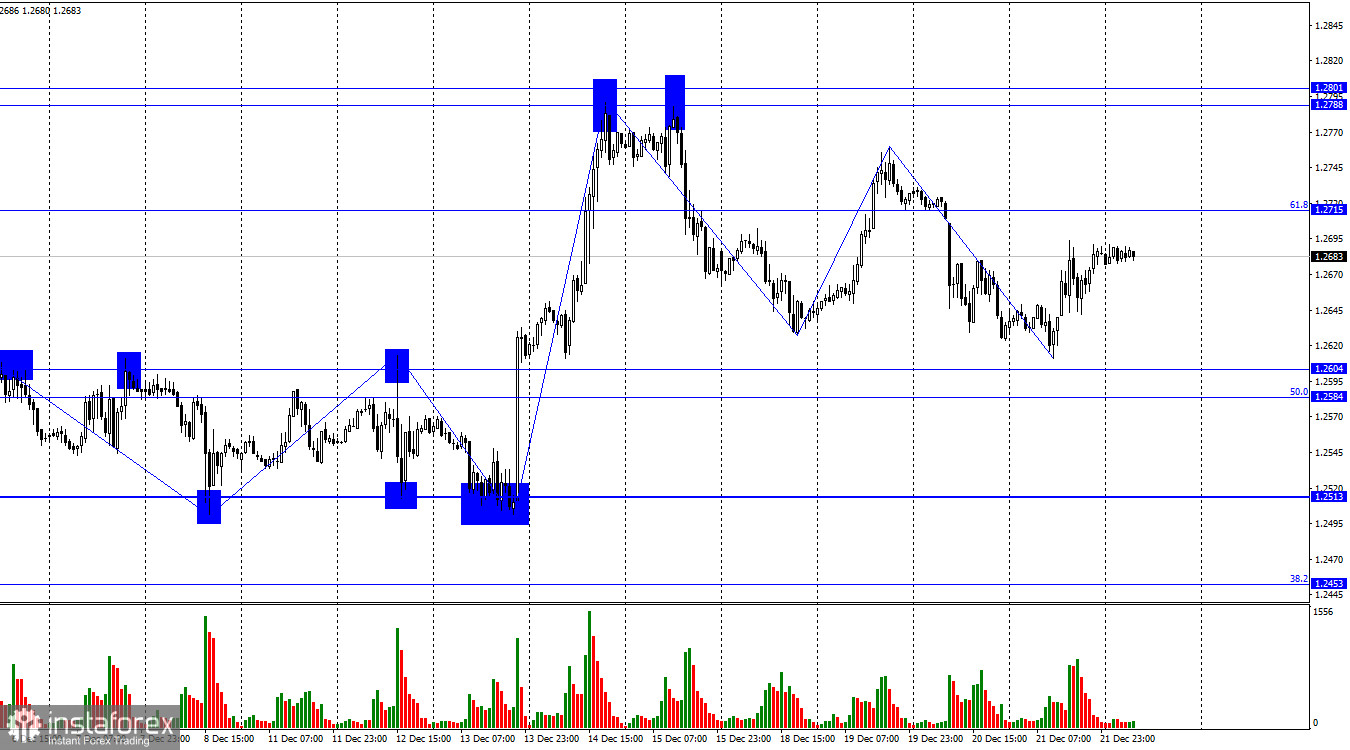

On the hourly chart, the GBP/USD pair reversed around the 1.2584-1.2604 zone in favor of the British pound yesterday and started a new upward process towards the corrective level of 61.8% (1.2715). A rebound of quotes from this level will favor the US currency and a new decline toward the 1.2584-1.2604 zone. Fixing the pair's rate above 1.2715 increases the likelihood of continued growth towards the 1.2788-1.2801 zone.

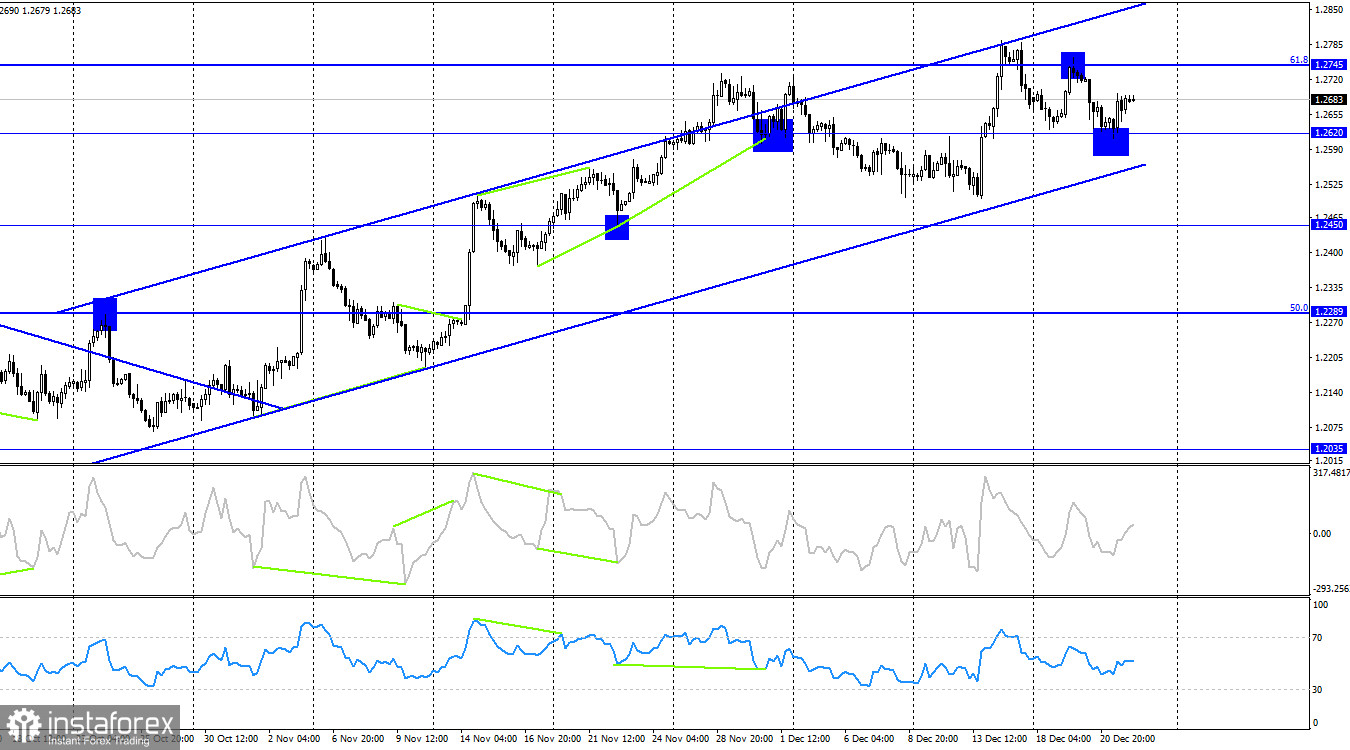

The wave situation needs to be clarified. Trends change too often and become shorter and shorter. The last "bullish" trend is one wave. The last downward wave barely broke the low of the previous wave. Thus, the trend has now changed to "bearish," but a breakthrough of the peak from December 19 will indicate a reversal of the trend to "bullish."

Yesterday, as I mentioned, the GDP report again helped the competitors of the US currency. Today, in the UK, a similar GDP report for the third quarter will be released, from which it is also very difficult to expect a positive value. However, market expectations can play a role here. Yesterday, the market expected US economic growth of 5.2% but saw 4.9%. Today, the market expects 0%, and if it sees +0.1%, it will be enough for bullish traders to become active again. Despite the much higher pace of US economic growth, it does not provide any support for the US currency. And the British economy, with its lack of growth, can quite support the British currency today. Such is the paradox.

On the 4-hour chart, the pair experienced a decline to 1.2620 and a rebound from it. Thus, the growth process can be resumed, and the pair is still inside the ascending trend corridor, supporting the British pound's rise. I expect a strong decline in the pound no earlier than consolidation below the corridor. In this case, the pair's rate may fall to 1.2289. No imminent divergences are observed in any indicator today.

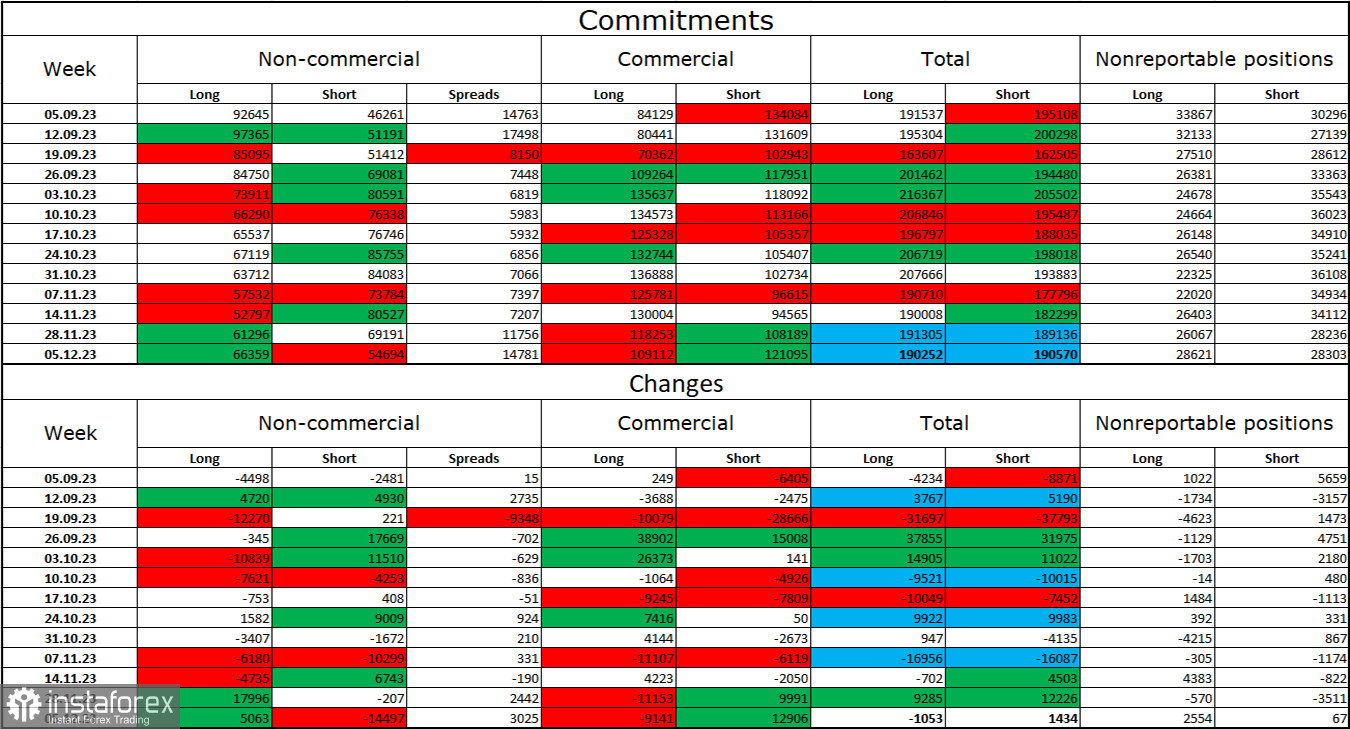

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category over the past reporting week has become more "bullish." The number of long contracts in the hands of speculators increased by 5063 units, while the number of short contracts decreased by 14497 units. The overall sentiment of major players changed to "bearish" several months ago, but at this time, bulls are attacking again. The gap between long and short contracts is increasing in favor of the bulls: 66 thousand against 55 thousand. Excellent prospects for continuing the decline persist for the British pound. I still do not expect a strong rise in the pound soon. Over time, bulls will continue to get rid of buy positions as the information background currently plays more in favor of the dollar. The growth we have seen in the last month and a half is corrective.

News Calendar for the US and the UK:

UK – Retail Sales Volume Change (07:00 UTC).

UK – GDP for the third quarter (07:00 UTC).

US – Core Personal Consumption Expenditures Price Index (13:30 UTC).

US – Durable Goods Orders (13:30 UTC).

US – Personal Income and Outlays (13:30 UTC).

US – University of Michigan Consumer Sentiment Index (15:00 UTC).

On Friday, the economic events calendar contains many important entries. The impact of the information background on market sentiment today can be significant.

GBP/USD Forecast and Trader Tips:

Buying the pound was possible yesterday around the 1.2604 level, but there was no clear rebound; accordingly, the signal needed to be formed. Today, you can consider selling options from the 1.2715 level on the hourly chart with a target of 1.2584-1.2604. Purchases today are possible when closing above the 1.2715 level with a target of 1.2788-1.2801.