Despite the central banks' interest rate topic becoming less significant in recent months, markets continue to closely monitor any possible changes. Interest rates have remained unchanged for several months in the EU, the US, and the UK. Nevertheless, the market still pays attention to this topic. While markets used to closely watch every statement from representatives of Monetary Policy Committees to gather information about possible rate hikes, the focus has now shifted. Everyone is anticipating policy easing in 2024, and the question of which central bank will move first is of great interest.

If we only look at inflation (which is logical), the European Central Bank should be the first to adopt a rate cut. Eurozone inflation has already fallen to 2.4%, while in the United States, it is 3.1%, and in the UK, it is 3.9%. However, there is every reason to believe that the Consumer Price Index will slightly accelerate in winter, so the ECB will certainly not rush to lower the interest rate and will wait at least until spring. As for the Federal Reserve and Bank of England, they currently have no grounds to reduce rates, as inflation is still too far from the target. In the US, there was a recent spike in consumer prices to 3.7%, so the FOMC will not take risks. Moreover, the BoE has no reason to cut rates in the near future. BoE Governor Andrew Bailey spoke about the possibility of another rate hike just a week ago, so the question of a rate cut is not on the agenda.

Rating agency Fitch has released a report stating that next year all three central banks may lower rates by 75 basis points. The agency believes that the rate cuts will be more gradual and smooth than what the markets are currently expecting. The sharp rise in the cost of loans has led to a decline in household and business lending volumes, so the economy will be "cooling down" next year. This applies to the EU, the UK, and the US.

In my opinion, the key phrase in the release was about a 75 bps cut by all three central banks. It implies that central banks will be moving in step with each other in the process of easing policy. Therefore, the dollar, euro, and pound will not be able to benefit individually from changes in the monetary policy of one central bank.

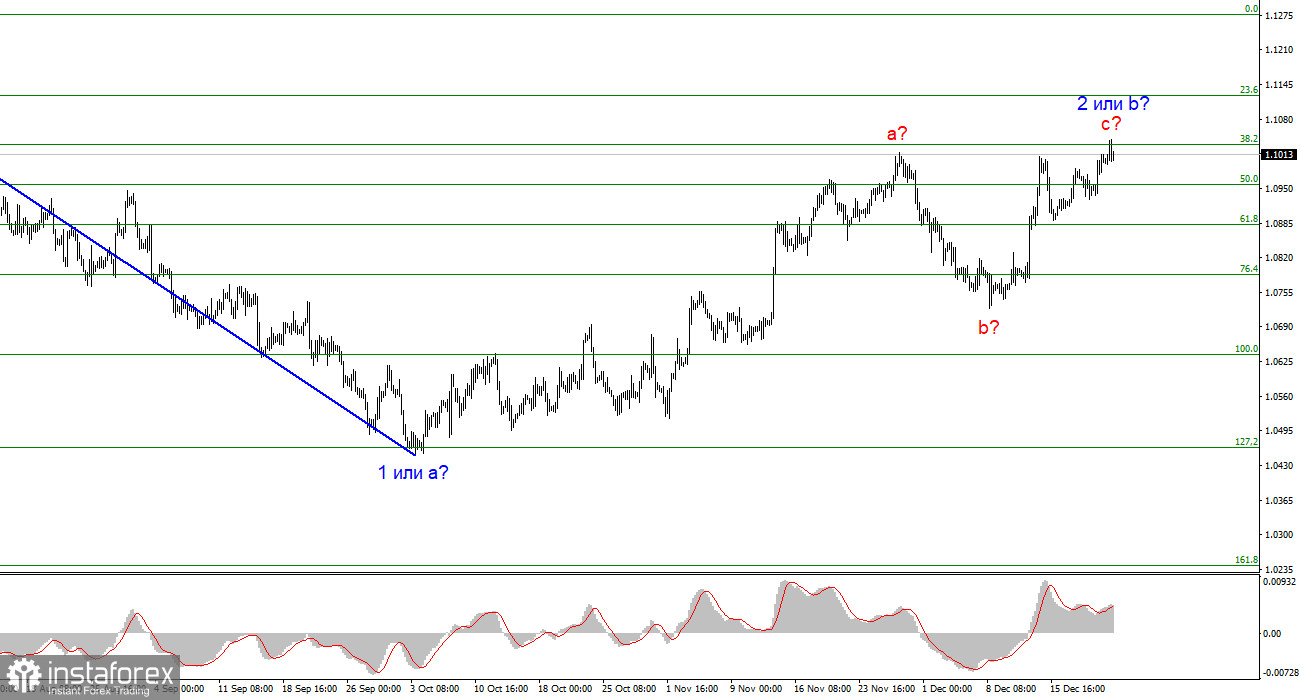

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. I still expect the pair to fall with targets below the low of wave 1 or a. An unsuccessful attempt to break the 38.2% level may indicate that the market is prepared to sell.

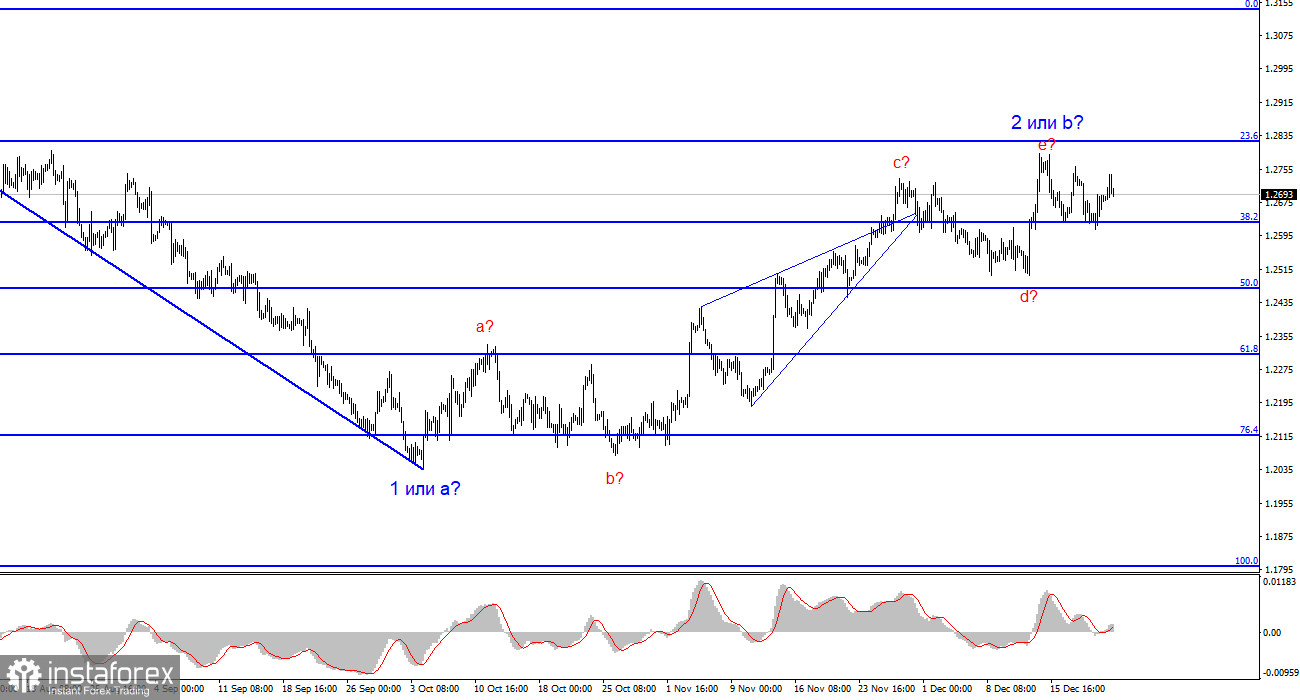

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b should end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave e in 2 or b can be used for short positions, and an order limiting potential losses on transactions can be placed above it.