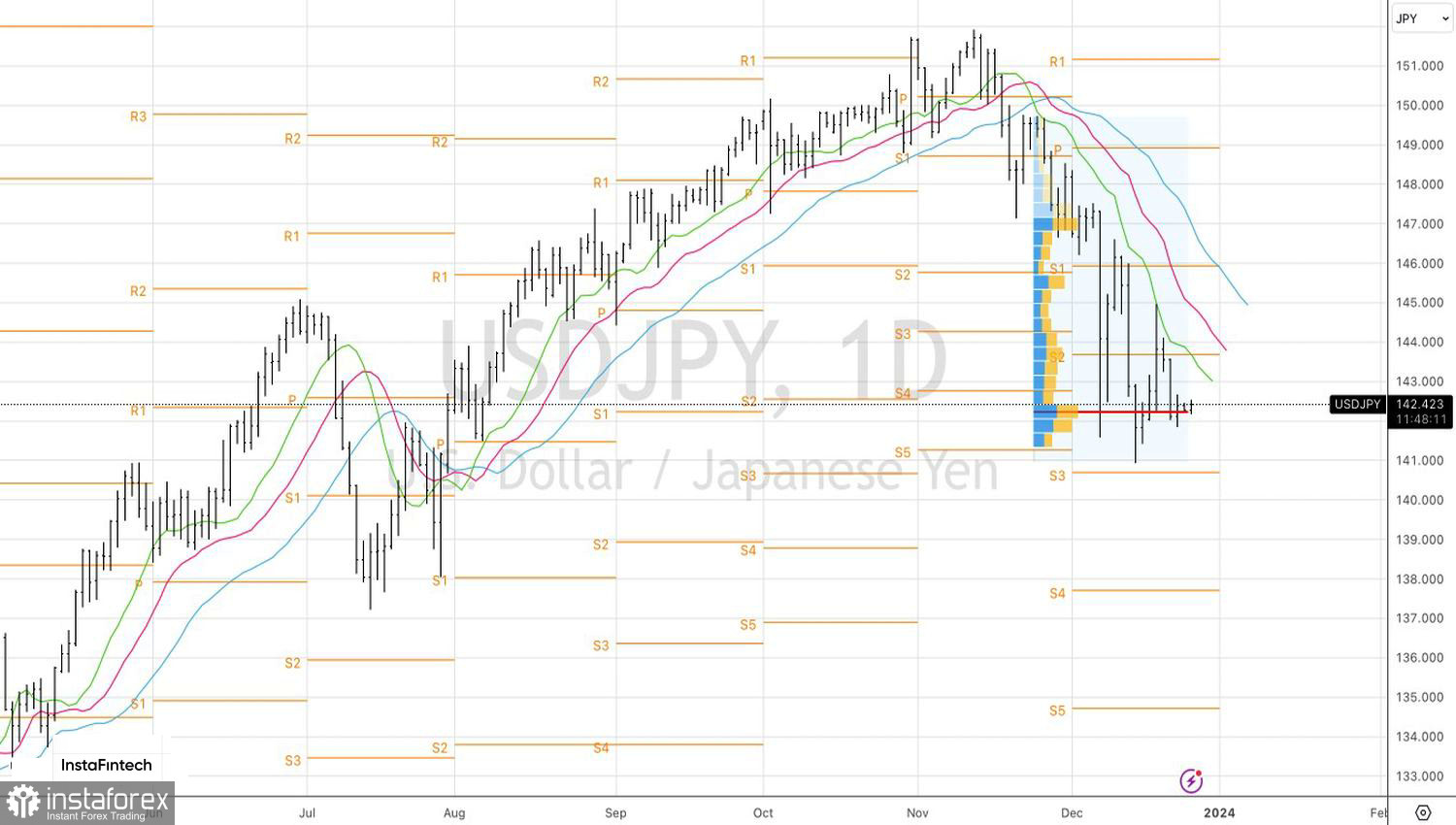

And the last shall be first. In 2023, the Japanese yen emerged as the main underperformer among the Big 10 currencies. It weakened against the US dollar by more than 8%. However, if we compare the bearish positions on USD/JPY with those in mid-autumn, the yen has emerged strong. Moreover, it is one of the main favorites on the Forex market in 2024.

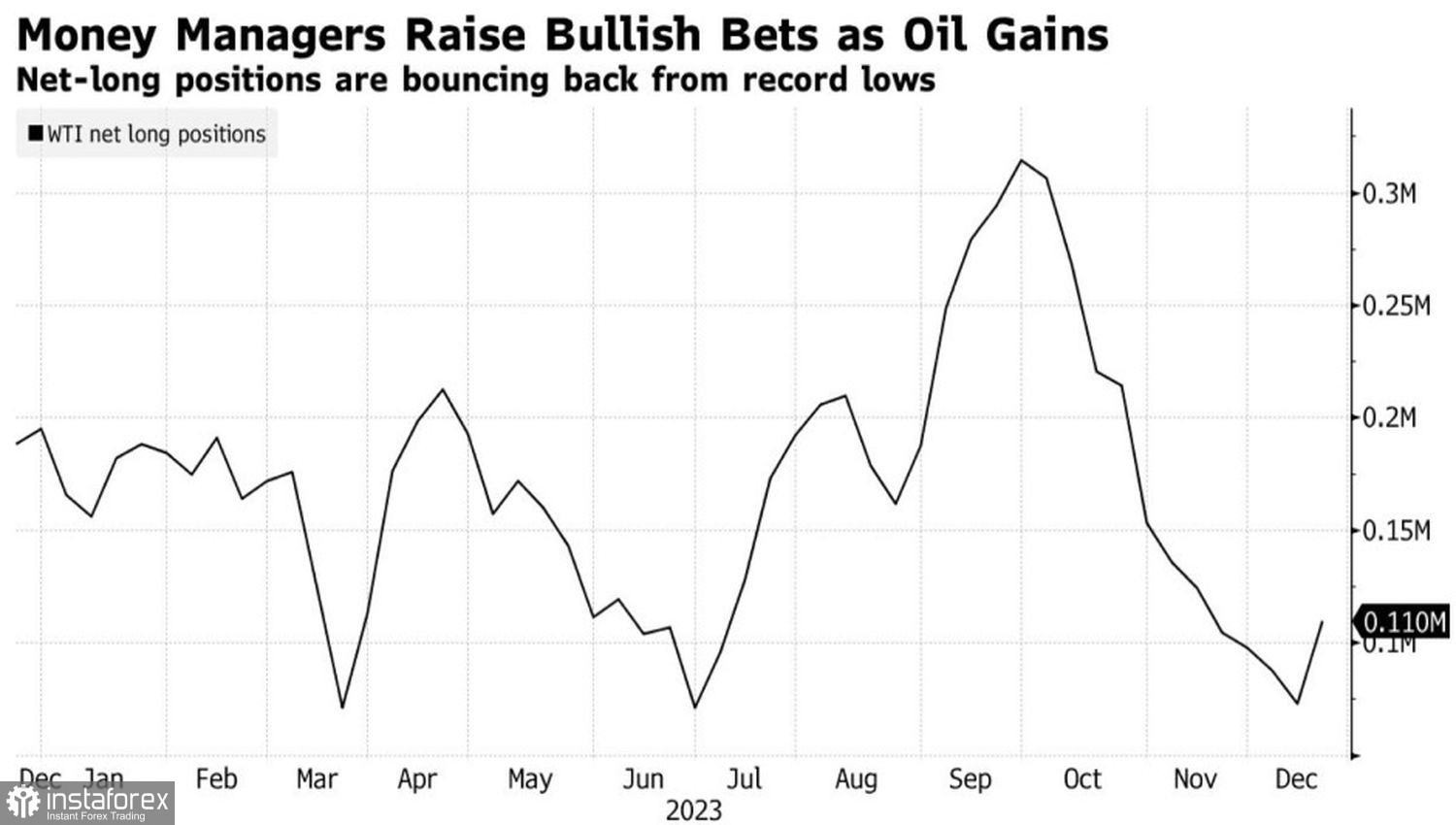

Central banks move in flocks. They collectively tighten monetary policy first, as was the case in 2022-2023, and then they loosen it. The Bank of Japan has moved differently for the past few years. While the Federal Reserve and other central banks raised rates, trying to slow down inflation, the BOJ remained committed to monetary stimulus. Divergence turned the USD/JPY bulls into punching bags. But by the end of the year, asset managers reconsidered their views and, for the first time since May, became net buyers of the yen.

Asset managers' position on the yen

The reasons for such abrupt changes in investors' view stem from the fact that in 2024, divergence in monetary policy is likely to work in favor of the USD/JPY bears. The futures market predicts a 150 basis point cut in the federal funds rate next year, while two-thirds of Bloomberg experts believe that in April, the BOJ will abandon its negative interest rate policy. About 15% expect this to happen as early as January.

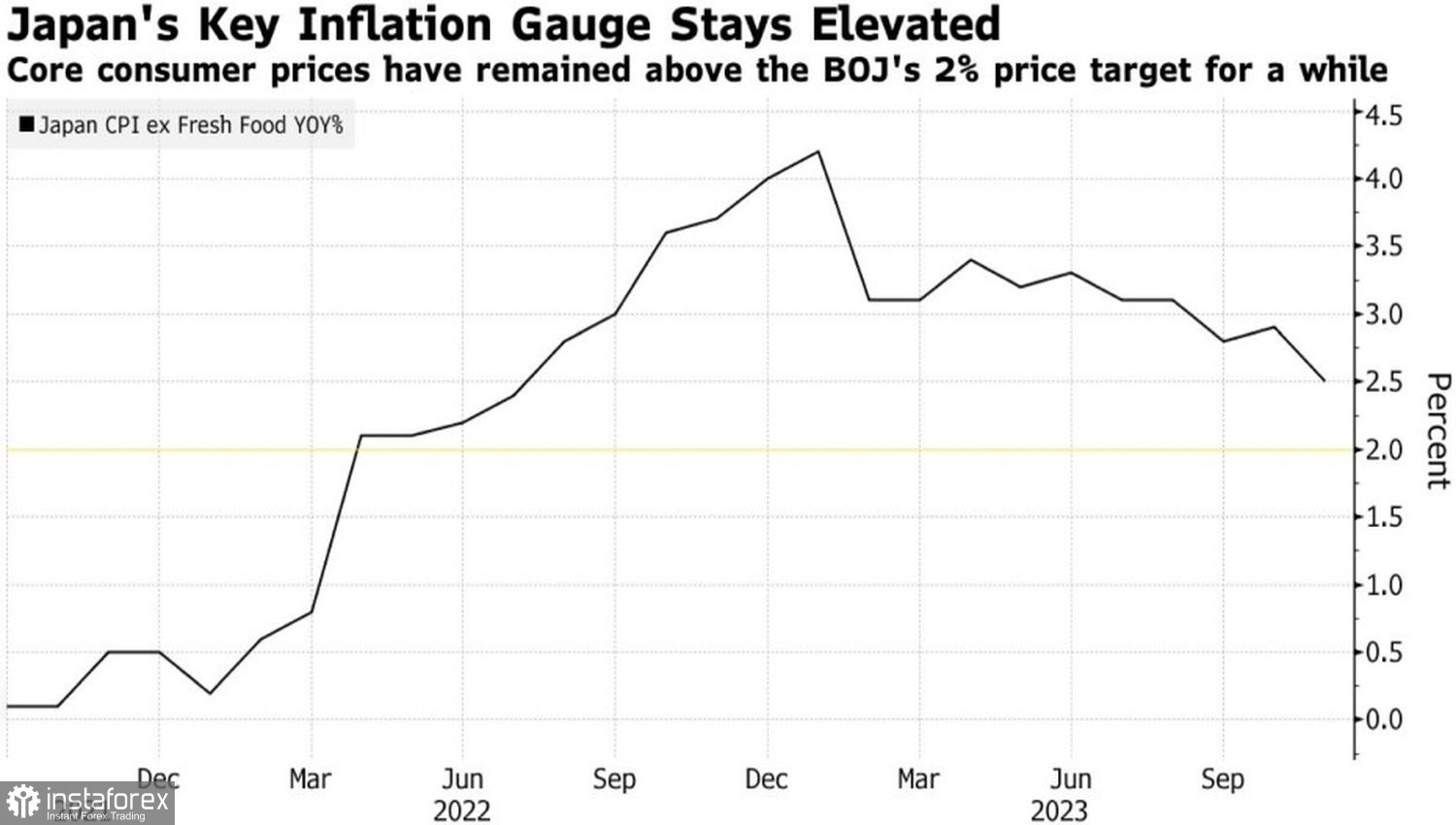

Inflation in Japan has been above the 2% target for 19 consecutive months, and in their recent comments, members of the Board of Governors speak about the benefits of normalizing monetary policy. In particular, Kazuo Ueda noted that higher rates allow the central bank to effectively respond to an economic recession.

The BOJ is not concerned that consumer prices slowed to 2.5% in November, fueling rumors of the temporary nature of high inflation and theoretically allowing the central bank to continue sitting on the sidelines. However, service inflation has surged to its highest level since 1993. Its dynamics add another argument in favor of a gradual withdrawal from monetary stimulus.

Inflation dynamics in Japan

The bulls believe that the BOJ will not raise interest rates when the Fed and other leading central banks in the world are lowering them. In response to this, Ueda said that Japan's monetary policy does not align and will not align with the US. Each country has its own path.

Overall, the strategy based on divergence in monetary policy has yielded and will continue to yield results. Therefore, it is advisable to closely monitor the yen in 2024.

Technically, on the daily chart, a downtrend is forming after breaking the uptrend. If the bears manage to pull the pair's quotes below the fair value at 142.1, there will be an opportunity to increase the short positions formed from the level of 144.3.