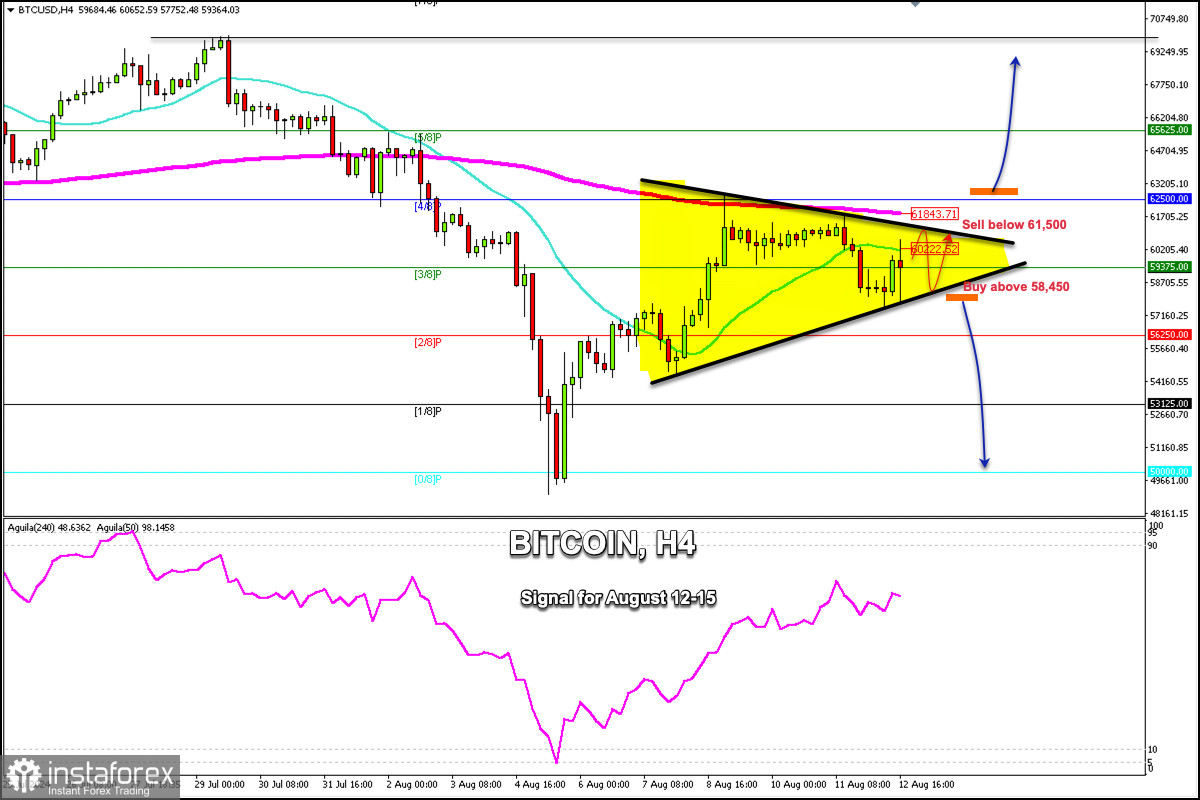

Bitcoin is trading at about 59,375 within a symmetrical triangle pattern forming since August 7. The crypto is likely to consolidate below the 200 EMA and above $58,000.

The BTC price is expected to trade above or around the psychological level of $60,000 in the next few days. Therefore, Bitcoin could be preparing for a bullish or bearish scenario.

The symmetrical triangle pattern could confirm the sideways movement of Bitcoin for the next few days. So, we could look for opportunities to buy in case Bitcoin consolidates above the 200 EMA located at 61,843 and above 4/8 Murray located at 62,500. Then, it could reach the psychological level of $70,000.

In case Bitcoin falls below the pattern, we could expect a trend reversal. The key for the BTC price is to consolidate below $58,000 and even below 6/8 Murray. There is a strong probability that BTC could fall below 56,250. Then, it could reach 0/8 Murray located at $50,000.

Our strategy for the next few days could be to buy and sell Bitcoin within the channel within the symmetrical triangle pattern. On the other hand, whenever BTC trades below 62,500, the outlook will remain negative and we could look for opportunities to sell.