Analysis of EUR/USD 5M

EUR/USD practically stood still on Tuesday. There is nothing surprising or extraordinary about this since the holiday week has begun. There is no macroeconomic and fundamental background, but that is only half the problem. Traders lack the desire to trade. Many have gone on vacation, leading to a significant decline in the number of market participants. When there are no participants and trading volumes are significantly low, there are no movements. Therefore, we may observe a similar picture until the new year. Yesterday, volatility was about 30 pips, which practically shows the absence of movements. If there are no movements, what trends or trading signals can we find on the charts?

There were no trading signals on Tuesday. During the US trading session, the price fell short of reaching the level of 1.1006. Traders could open a long position around this level, and in this case, they could have gained a small profit (around 15-20 pips). There were no more trading signals or even hints of it after that.

COT report:

The latest COT report is dated December 19. In the first half of 2023, the net position of commercial traders hardly increased, but the euro remained relatively high during this period. Then, the euro and the net position both decreased for several months, as we anticipated. However, in the last few weeks, both the euro and the net position have been rising. Therefore, we can conclude that the pair is correcting higher, but the correction cannot last long because it is still a correction.

We have previously noted that the red and green lines have moved significantly apart from each other, which often precedes the end of a trend. Currently, these lines are diverging again. Therefore, we support the scenario where the euro should fall and the upward trend must end. During the last reporting week, the number of long positions for the non-commercial group decreased by 23,800, while the number of short positions increased by 8,900. Consequently, the net position decreased by 32,700. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 115,000. The gap is significant, and even without COT reports, it is evident that the euro should continue to fall.

Analysis of EUR/USD 1H

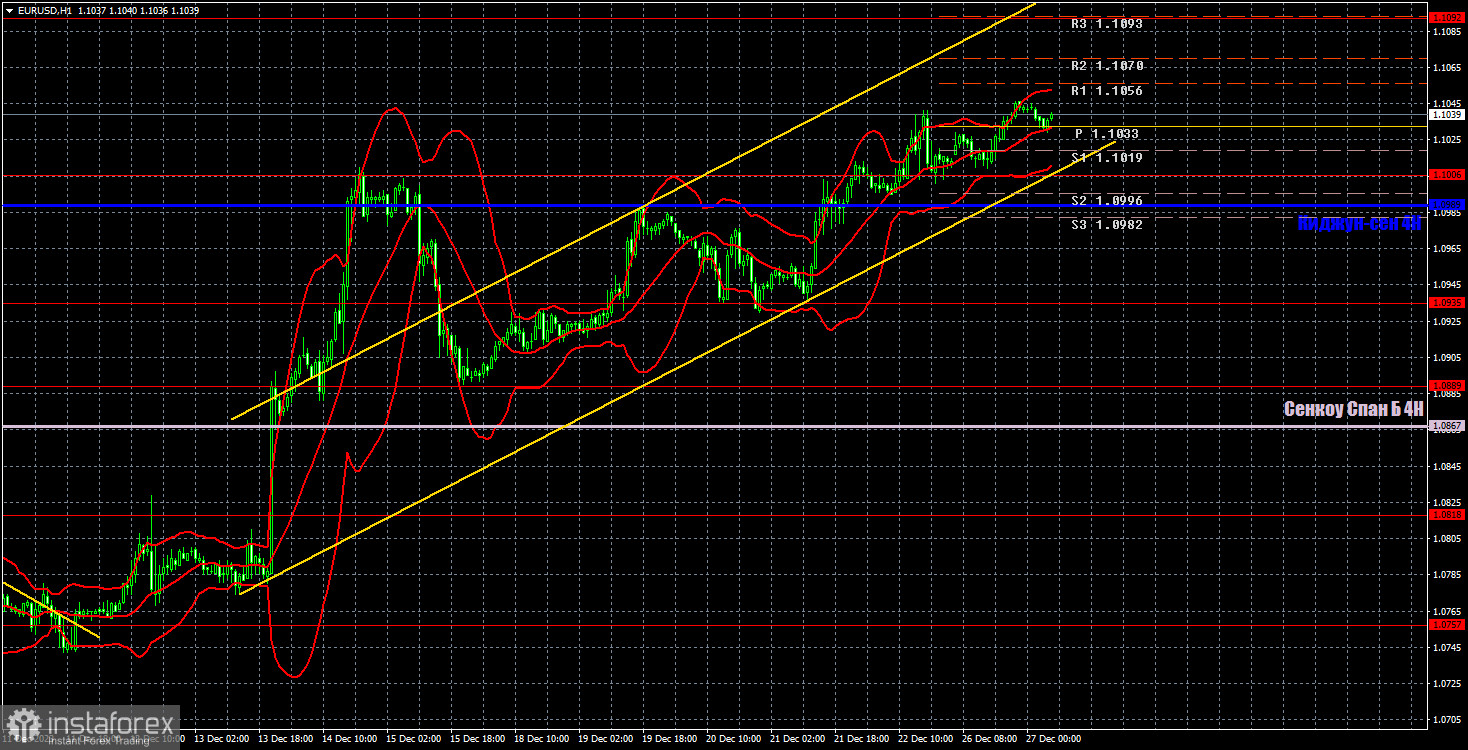

On the 1-hour chart, EUR/USD gradually rose to the level of 1.1000 and also overcame it. We believe that the euro has risen very high already, and it continues to rise more often than it falls, although there are no serious reasons to support this. Therefore, the only thing we can do now is to follow the trend. The ascending channel currently visualizes what is happening in the market.

Today, we consider it reasonable to remain in long positions with 1.1092 as the target since the price bounced off the level of 1.1006 last Friday. Tuesday showed us that even though there is no volatility, the euro can still edge up. So buying is still relevant if there is a desire to trade. You can consider short positions after the price settles below the Kijun-sen line and below the ascending channel with targets at 1.0935 and 1,0889. This week, volatility can be very weak, which you should consider when opening a position.

On December 27, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0818, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, as well as the Senkou Span B (1.0867) and Kijun-sen (1.0989). The Ichimoku indicator lines can shift during the day, so this should be taken into account when identifying trading signals. There are also auxiliary support and resistance levels, but signals are not formed near them. Signals can be "bounces" and "breakouts" of extreme levels and lines. Don't forget to set a breakeven Stop Loss if the price has moved in the right direction by 15 pips. This will protect against potential losses if the signal turns out to be false.

On Wednesday, like the entire current week, there will be no significant events or reports. Therefore, we expect a flat phase and low volatility.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.