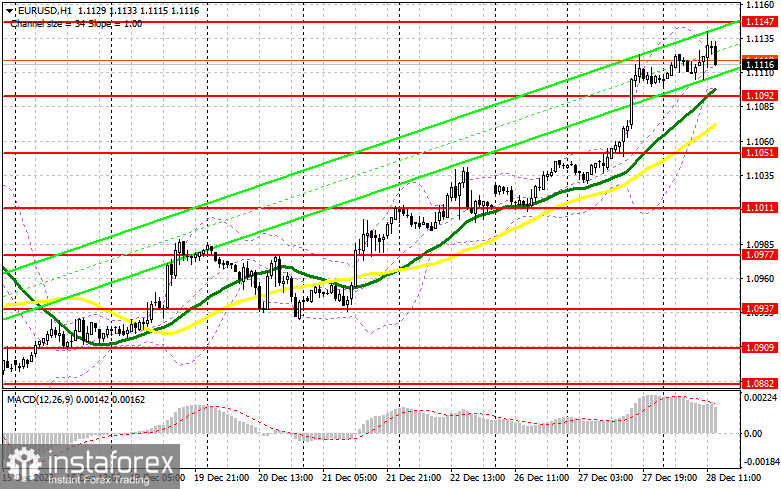

In my morning forecast, I pointed out the level of 1.1147 and planned to decide whether to enter the market based on it. Let's look at the 5-minute chart and analyze what happened there. The rise occurred but didn't reach the test of 1.1147, so I never got the selling signals from this level. Low volatility on pre-holiday days forces me to stay out of the market. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, it is required:

Considering that we have upcoming data on the U.S. labor market if the initial jobless claims data are worse than economists' forecasts, the bulls will make another attempt to rise. If the data turn out to be better than expected, pressure on the euro will persist, and that's what I plan to take advantage of. The strategy for the second half of the day remains unchanged. The optimal scenario for me is still a decline and the formation of a false breakout in the support area of 1.1092, just below which the moving averages are located, supporting the bulls. Only this will allow us to enter the market and continue the bullish trend with a target of 1.1147, which we still need to reach. A breakout and an update from top to bottom of this range, which is unlikely to happen by the end of the year, will provide an opportunity for a buy position with further development of the uptrend and the prospect of reaching 1.1188. The ultimate target will be a new annual high at 1.1226, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.1092 in the second half of the day, which is more likely, one can expect a larger pair movement downwards. In such a case, I plan to enter the market only after forming a false breakout around 1.1051. I will consider opening long positions on a rebound from 1.1011 with the target of an upward correction within the day in the range of 30-35 points.

To open short positions on EUR/USD, it is required:

Buyers are expected to appear after the U.S. data release. If the pair shows an increase, they will have to act actively around the resistance level of 1.1147, which I highly anticipate. The formation of a false breakout there may lead to a sell signal with the target of a pair's decline and an update of the nearest support at 1.1092, formed after yesterday's trading. After breaking and consolidating below this range and a retest from bottom to top, I expect a sweep of bulls' stop orders and another entry point for sale with a decline to 1.1051. The test of this level will keep the pair in a sideways channel until the end of the year. The ultimate target will be a minimum of 1.1011, where I will take profit. If EUR/USD moves up in the second half of the day and there are no bears at 1.1147, the bullish market will continue. In such a case, I will postpone selling until the test of the next resistance at 1.1188. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1226 with the goal of a downward correction within 30-35 points.

Indicator signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating further growth for the euro.

Note: The author on the H1 chart determines the period and prices of moving averages and differs from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 1.1092 will act as support.

Indicator Descriptions:

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

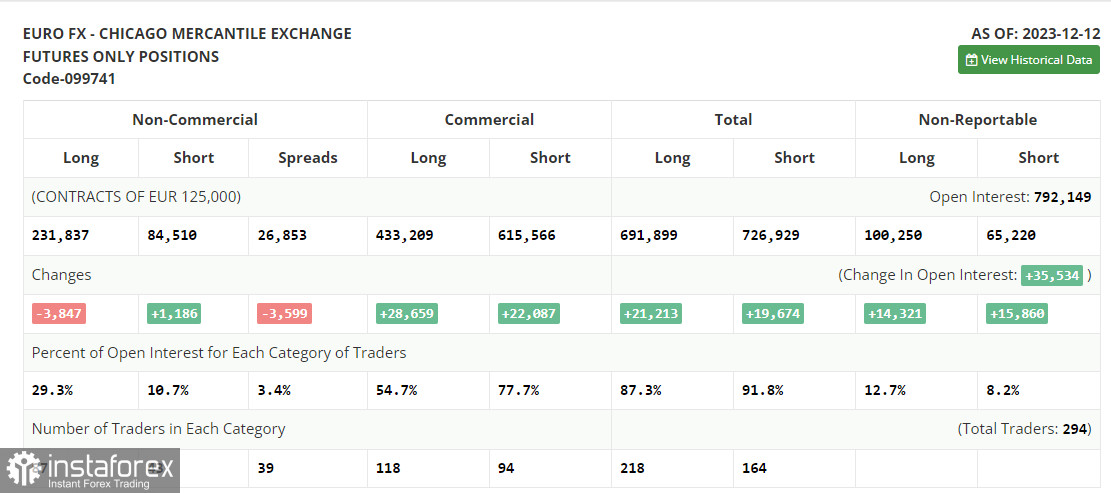

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' long and short positions.