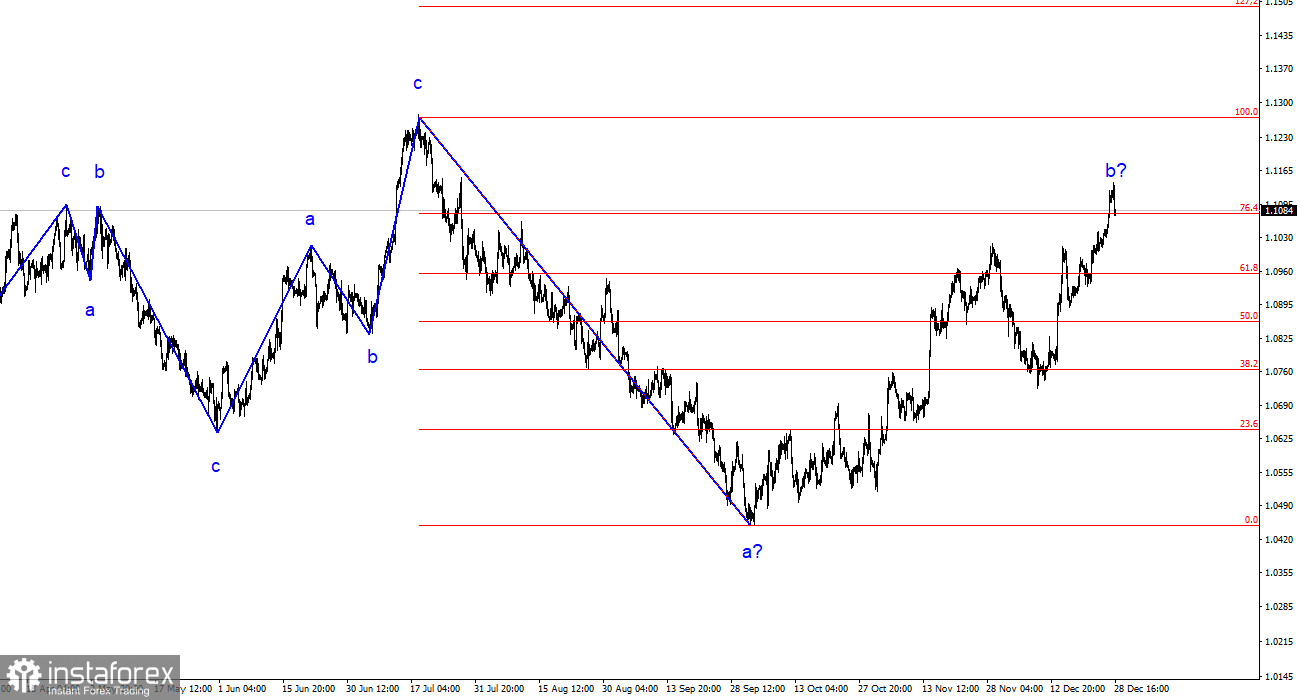

The wave structure of the 4-hour chart for the euro/dollar pair has become more complex once again. Over the past year, we have seen only three wave structures that constantly alternate with each other. Currently, the construction of another three-wave structure, a bearish one, is continuing. The presumed wave 1 is complete, but wave 2 or b is becoming more complex for the third or fourth time. Although the news background cannot be considered "supportive of the European currency," the market keeps finding new reasons to increase demand for the pair. Such a situation is not normal. Even if the bullish trend resumes, its internal structure will be unreadable.

The internal wave structure of the presumed wave 2 or b has changed. Since the last bearish wave turned out to be disproportionately large, I now interpret it as wave b. If this is indeed the case, wave c is currently being built, and the entire wave 2 or b can still end.

The euro is overbought, but buyers are not backing down.

The euro/dollar pair decreased ten basis points on Thursday. The main decline occurred a few hours ago, but on the charts, it is evident that this is just a retracement. The bullish sentiment in the market persists, and the pair's upward movement can resume at any moment. An unsuccessful attempt to break through the 23.6% Fibonacci level pushed the quotes slightly down, but buyers continue to exert pressure, which could lead to a very rapid return of the pair to this level and its breakthrough.

There still needs to be something to say about the news background. There are no news, reports, or speeches. Notwithstanding this scenario, the market maintains its faith in the euro, the postponed commencement of the ECB's monetary policy easing program, a less substantial rate cut in 2024, optimistic expectations, and other factors contributing to its ongoing euro purchases. I believe even the news background is not needed by market participants right now. The New Year week is turning out to be not boring but rather strange. Even Eren Sengezer, one of the well-known currency analysts, acknowledges the overbought condition of the RSI indicator, forgetting that this indicator has been overbought not for the first time in recent months. Finding reasons for increased demand for the euro is becoming more and more challenging.

General conclusions.

Based on the analysis conducted, the construction of a bearish wave set continues. The targets near the 1.0463 level have been ideally worked out, and the unsuccessful attempt to break this level indicates a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decline in the pair. I still anticipate a decline with targets below the low of wave 1 or a. The unsuccessful attempt to break the 23.6% level may indicate the market's readiness for sales.

On a larger wave scale, it can be seen that the construction of corrective wave 2 or b is continuing, which in length is already more than 61.8% of Fibonacci from the first wave. As I have already mentioned, this is not critical, and the scenario of building wave 3 or c with a decline in the pair below the 1.4 figure remains in force.