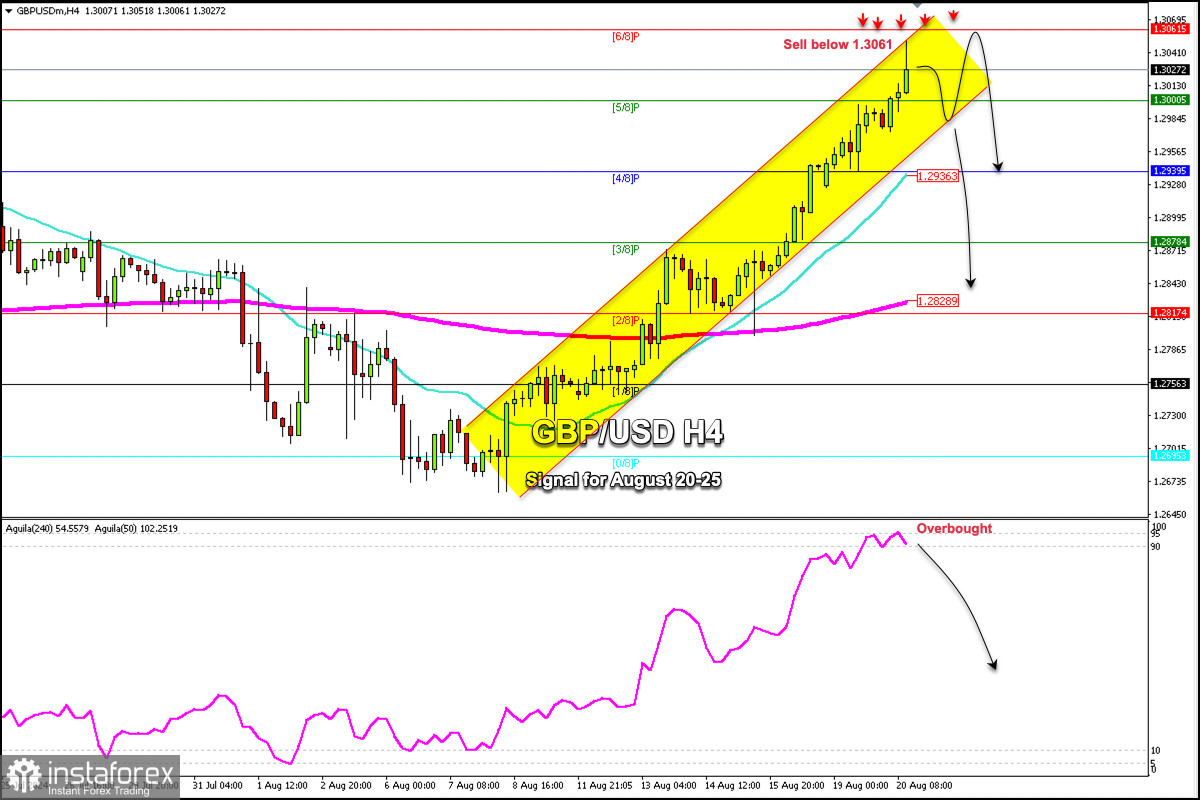

The British pound (GBP/USD) is trading around 1.3027, retreating after the strong rally that touched 1.3051 and almost the 6/8 Murray area which represents strong resistance.

Since August 16th, the British pound has been in an overbought zone and since then we have seen a downward correction. A strong technical correction is expected to unfold in the next few days. If the GBP/USD fluctuates below 6/8 Murray (1.3061), the price could reach the psychological level of 1.3000.

We believe that the British pound could correct in the next few hours if it consolidates below 1.3061. So, we will look for opportunities to sell at the current price levels with targets at 1.3000 and finally, at the bottom of the uptrend channel around 1.2984.

If the GBP/USD pair bounces around 1.2990, it could resume the bullish cycle and reach 1.3061 or even surpass and reach 8/8 Murray around 1.3183.

On the other hand, if the British pound breaks the bullish trend channel in the next few days and consolidates below 1.2980, the outlook would be revised and we could expect a strong technical correction with targets at 4/8 Murray at 1.2939 and finally, at the 200 EMA at 1.2828.

Our strategy is to sell the British pound at current levels because the eagle indicator is warning about an imminent technical correction for the next few hours.