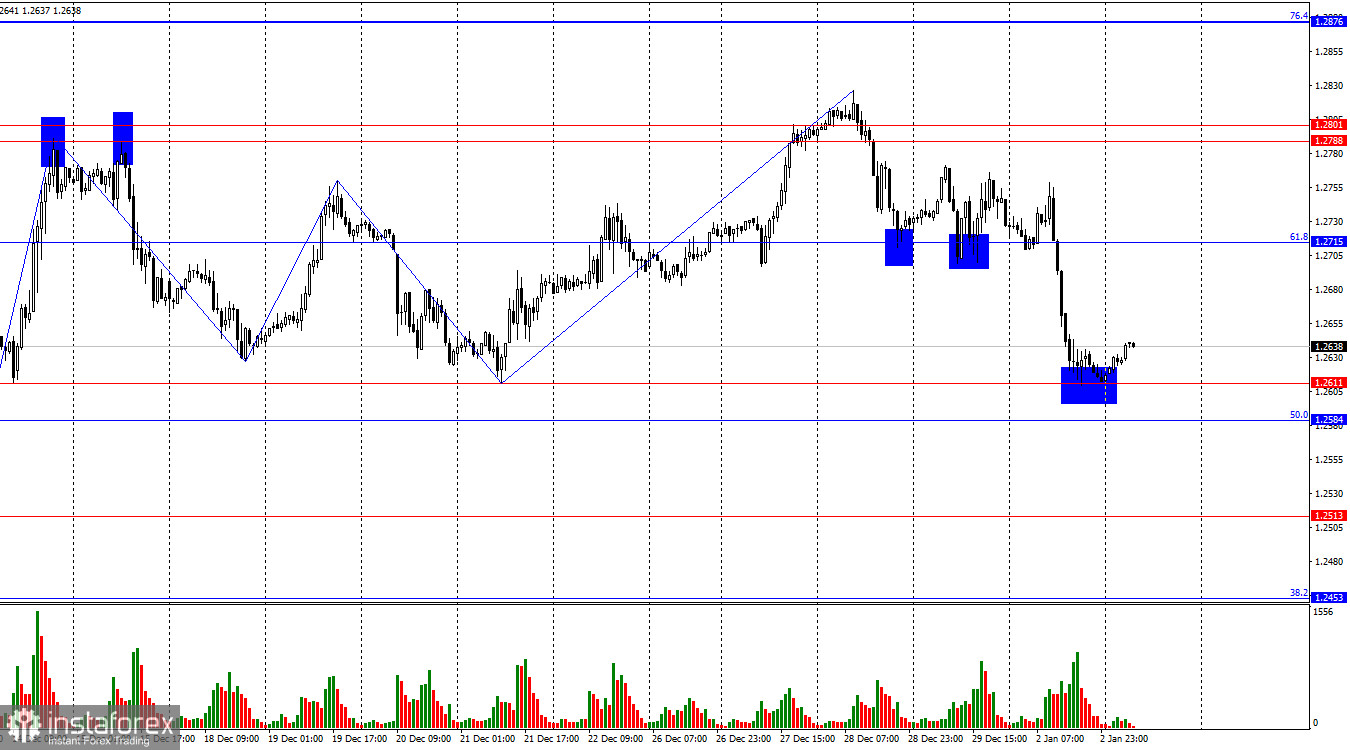

On the hourly chart, GBP/USD, on its third attempt, managed to consolidate below the 61.8% retracement level of 1.2715 and fall to the level of 1.2611. A rebound from this will likely lead to a reversal and growth towards 1.2715, while a consolidation below the support zone of 1.2584 - 1.2611 could result in a further decline towards the levels of 1.2513 and 1.2453.

The situation with the waves remains ambiguous. The last upward wave broke through previous peaks, while the new downward wave struggles with the level of 1.2611, near which lies two previous lows.

As for economic data, the UK Manufacturing PMI for December dropped from 47.2 to 46.2, continuing the negative trend. Although this indicator usually does not affect market sentiment, traders took action because of the empty macroeconomic calendar.

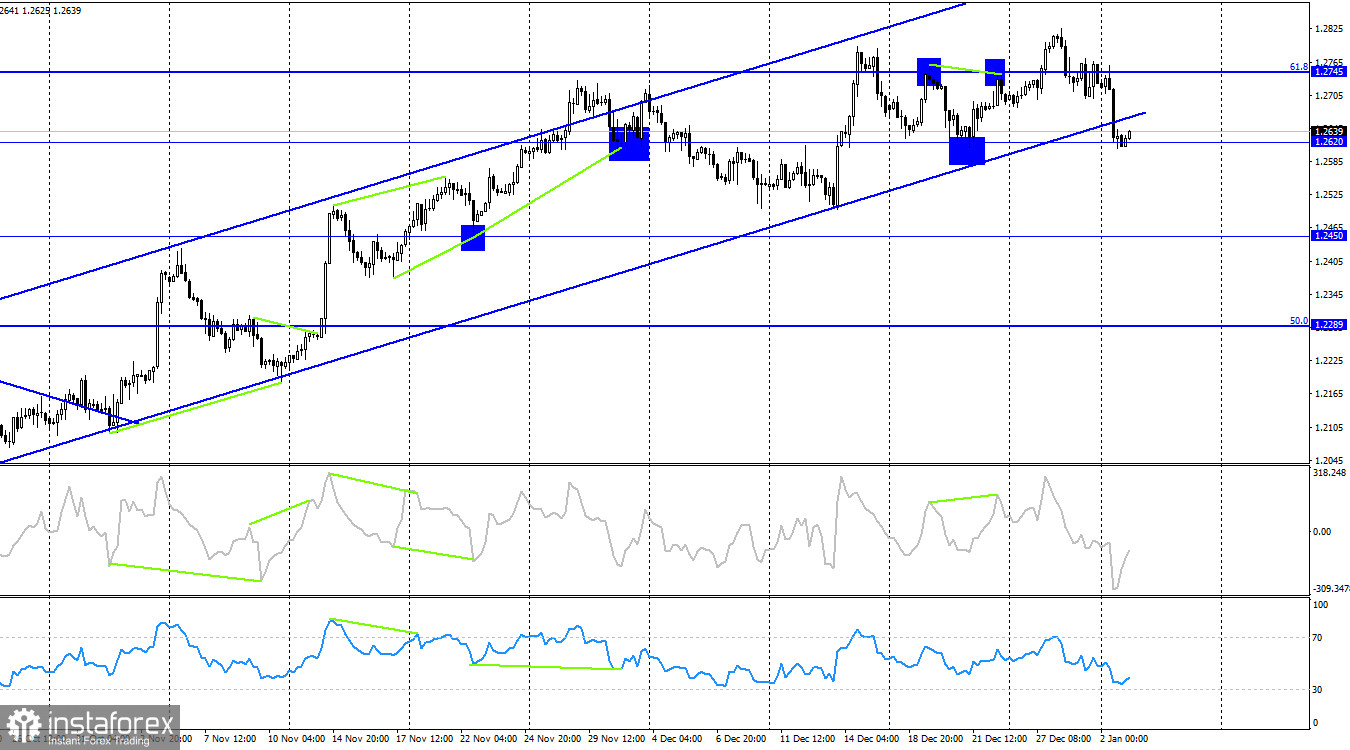

Consequently, pound fell, so the picture on the 4-hour chart started to change. A reversal in favor of dollar could be seen, as well as a consolidation below the upward channel, and a fall to the level of 1.2620.

Now, the bears need to consolidate below the level of 1.2620 for pound to decline to 1.2450.

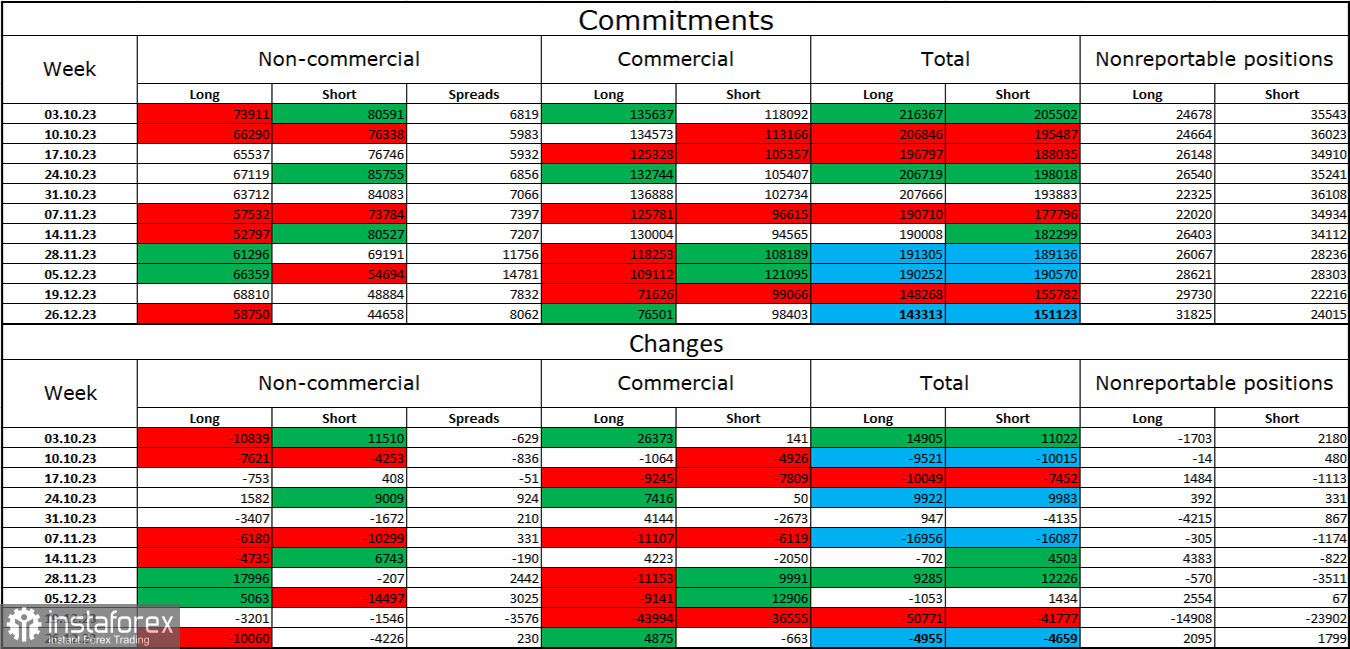

Commitments of Traders (COT) Report:

The mood changed in favor of the bears as the number of long contracts in the hands of speculators decreased by 10,060 units, while the number of short contracts decreased by 4,226 units. But even though sentiment shifted a few months ago, bulls have a slight advantage again, thanks to the gap between the number of long and short contracts: 59,000 against 45,000.

Pound may continue to fall as bulls will continue to get rid of buy positions. The growth in the last three months may just be corrections.

News calendar for the US and the UK:

US - ISM Manufacturing PMI (15-00 UTC).

US - JOLTS Job Openings (15-00 UTC).

US - FOMC Meeting Minutes (19-00 UTC).

The economic calendar for Wednesday contains several important entries in the US. The impact of the news on market sentiment today will be medium in strength.

GBP/USD forecast and tips for traders:

Sell-offs occurred in the pair after the consolidation below the level of 1.2715. The quote headed towards 1.2604, almost reaching it. Another consolidation below 1.2584 - 1.2611 today will lead to a further decline to 1.2513 and 1.2453, while growth will occur only after a rebound from 1.2611 to 1.27151 on the hourly chart. Pound will unlikely show strong growth, so purchases should be small and cautious.